Rollins Inc (ROL) Achieves Solid First Quarter Growth, Aligns with Analyst EPS Projections

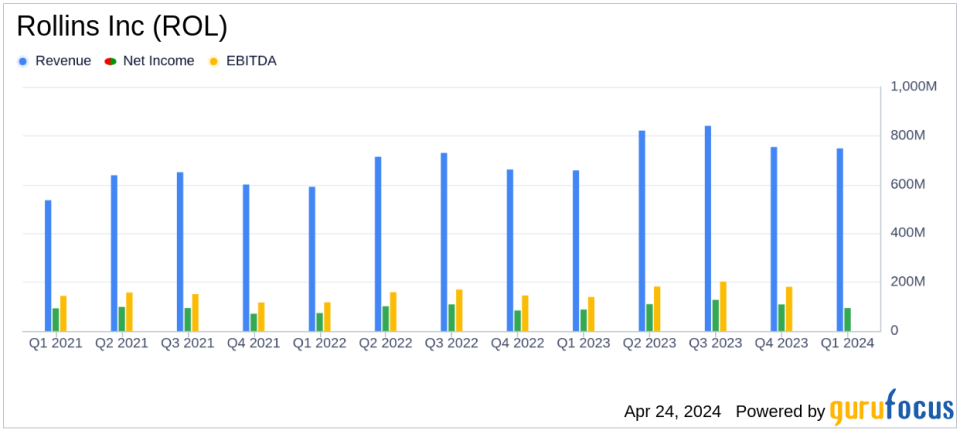

Revenue: Reported at $748 million, marking a 13.7% increase year-over-year, surpassing the estimated $739.10 million.

Net Income: Achieved $94 million, up 7.0% from the previous year, falling slightly short of the estimated $95.90 million.

Earnings Per Share (EPS): Recorded at $0.19 per diluted share, up 5.6% year-over-year, below the estimated $0.20.

Operating Income: Grew to $132 million, an 18.0% increase from last year, with an operating margin improvement to 17.7%.

Adjusted EBITDA: Increased by 19.3% to $161 million, with the EBITDA margin expanding by 100 basis points to 21.5%.

Free Cash Flow: Rose by 29.1% to $120 million, demonstrating strong cash generation capabilities.

Dividends: Paid out $73 million in dividends, underlining a commitment to shareholder returns.

On April 24, 2024, Rollins Inc (NYSE:ROL), a leading global provider of consumer and commercial services, disclosed its financial results for the first quarter of 2024, demonstrating significant growth and operational success. The company announced these results in its 8-K filing, revealing a robust increase in both revenue and earnings, supported by strategic acquisitions and organic growth.

Financial Highlights and Performance

Rollins Inc reported a remarkable revenue of $748 million for the first quarter, up 13.7% from $658 million in the same period last year. This increase was driven by a 7.5% rise in organic revenues and further supported by recent acquisitions. The company's operating income saw an 18% increase to $132 million, with the operating margin expanding by 60 basis points to 17.7%. Adjusted earnings per share (EPS) stood at $0.20, perfectly aligning with analyst estimates and marking a 17.6% increase from the prior year's $0.17.

The company's net income rose to $94 million, a 7% increase year-over-year, while adjusted net income improved by 16.1% to $98 million. These results reflect Rollins' effective management and strategic initiatives which have enhanced profitability and operational efficiency.

Operational Insights and Strategic Developments

Rollins' growth is not just a result of expanding market reach but also due to the deepening penetration of its core markets, particularly in residential, commercial, and termite and ancillary services. The company's focus on continuous improvement and robust acquisition strategy has been pivotal. During the quarter, Rollins invested $47 million in acquisitions, which have contributed to its revenue streams and geographical expansion.

Management highlighted the unpredictable weather conditions that slightly impacted the business earlier in the year but praised the strong recovery and acceleration in growth as the quarter progressed. The company's ability to maintain high service standards and client retention rates underlines its industry-leading position.

Financial Position and Future Outlook

As of March 31, 2024, Rollins' balance sheet remains strong with total assets of $2.66 billion. The company's strategic investments and focus on generating robust free cash flow, which saw a 29.1% increase to $120 million this quarter, underscore its financial health and operational success.

Looking ahead, Rollins is well-positioned for continued growth in 2024, with a strong pipeline for acquisitions and ongoing initiatives aimed at enhancing profitability. The company's commitment to a balanced capital allocation and robust operational strategies are expected to drive further financial and operational success.

Conclusion

Rollins Inc's first quarter of 2024 reflects a company that is not only growing through strategic acquisitions but also improving its core operations. The alignment of its adjusted EPS with analyst expectations and the double-digit growth in key financial metrics demonstrate Rollins' ability to execute its strategic plans effectively. With a solid foundation and a clear strategic direction, Rollins Inc is poised for continued success in the competitive pest control industry.

For more detailed financial analysis and future updates on Rollins Inc, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Rollins Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance