Rockwell Automation (ROK) to Post Q2 Earnings: What's in Store?

Rockwell Automation Inc. ROK is expected to report a decline in both revenues and earnings when it reports second-quarter fiscal 2024 results later this month.

The Zacks Consensus Estimate for ROK’s fiscal second-quarter revenues is pegged at $2.09 billion, indicating a 8.4% decline from the year-ago quarter’s actual. The same for earnings is pinned at $2.15 per share, suggesting a 28.6% plunge from the year-ago quarter’s reported figure.

Q1 Performance

In the last reported quarter, the company reported lower earnings despite an increase in revenues. Both the top and bottom lines missed the respective Zacks Consensus Estimate.

The company’s earnings surpassed estimates twice in the trailing four quarters and missed on the remaining two occasions, the average surprise being a negative 2.15%.

Rockwell Automation, Inc. Price and EPS Surprise

Rockwell Automation, Inc. price-eps-surprise | Rockwell Automation, Inc. Quote

Factors to Note

Industrial production rose 0.4% in March but declined at an annual rate of 1.8% in the first quarter, per the Federal Reserve. In March 2024, the Institute for Supply Management’s manufacturing index was 50.3%, the first expansion in 16 months. The index reading was 49.1% in January 2024 and 47.8% in February. Overall, the index averaged 49% in January-March. This is likely to have been reflected in Rockwell Automation’s second-quarter top-line performance. This is expected to have been offset by favorable pricing in the quarter. Our model predicts an organic sales decline of 12.2% for the quarter. This will be offset by a 1.5% contribution from acquisitions and a 0.9% gain from favorable currency impact.

ROK’s performance has been impacted by ongoing material shortages and production delays in the earlier quarters. The company expects this to normalize in the back half of fiscal 2024. This is also expected to have impacted the company’s fiscal second-quarter performance. Also, higher logistics costs and increased spending on product development are expected to have dented ROK’s margin performance.

Segment Expectations

We expect the Intelligent Devices segment’s second-quarter fiscal 2024 revenues to be down 8.5% year over year to $936 million. Our prediction for the segment’s operating profit is pinned at $145 million, indicating a year-over-year decrease of 30%.

Our model predicts the Software & Control segment’s sales to be $668 million, suggesting an increase of 9.9% from the prior year’s actual. The segment’s operating profit, which is pinned at $181 million, indicates a decrease of 27.6% from the year-ago quarter’s reported figure.

We expect the Lifecycle Services segment’s sales to be $448 million, indicating a decline of 12.5% from the prior-year period’s actual. The estimate for the segment’s operating profit is $29.5 million. The figure indicates a 5.7% increase from the year-ago quarter’s reported figure.

What the Zacks Model Indicates

Our proven model does not conclusively predict an earnings beat for Rockwell Automation this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat.

Earnings ESP: Rockwell Automation has an Earnings ESP of -2.84%. You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #4 (Sell).

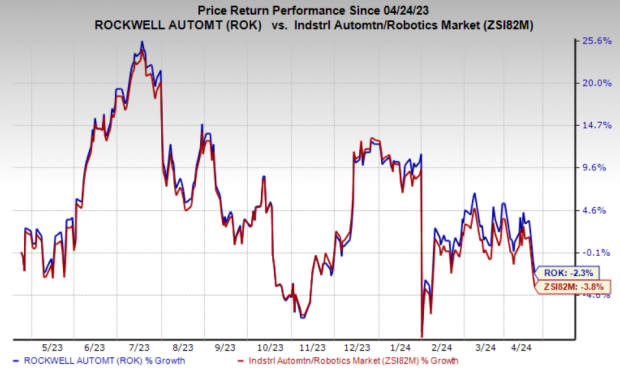

Price Performance

In the past year, Rockwell Automation’s shares have lost 2.3% compared with the industry’s 3.8% decline.

Image Source: Zacks Investment Research

Stocks to Consider

Here are some stocks with the right combination of elements to post an earnings beat in their upcoming releases.

Applied Industrial Technologies AIT, scheduled to release its first-quarter 2024 results on Apr 25, currently has an Earnings ESP of +0.63% and a Zacks Rank of 1. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Applied Industrial Technologies’ first-quarter 2024 earnings is pegged at $2.40 per share, which indicates year-over-year growth of 0.8%. AIT has a trailing four-quarter average surprise of 10.4%.

Eaton Corporation plc ETN, expected to release earnings soon, currently has an Earnings ESP of +1.95% and a Zacks Rank of 2.

The Zacks Consensus Estimate for Eaton’s earnings for the first quarter of 2024 is pegged at $2.28 per share. The estimate projects a 21.3% increase from the year-ago quarter. ETN has a trailing four-quarter average surprise of 4.8%.

Chart Industries GTLS, scheduled to release its first-quarter 2024 on May 3, currently has an Earnings ESP of +9.86% and a Zacks Rank of 2.

The Zacks Consensus Estimate for Chart Industries’ first-quarter 2024 earnings is pegged at $1.88 per share, indicating 33.3% year-over-year growth. GTLS has a trailing four-quarter average surprise of 75.8%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

Rockwell Automation, Inc. (ROK) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Chart Industries, Inc. (GTLS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance