Rio Tinto Group's (LSE:RIO) Dividend may be Threatened by the Fall of Iron Ore Prices

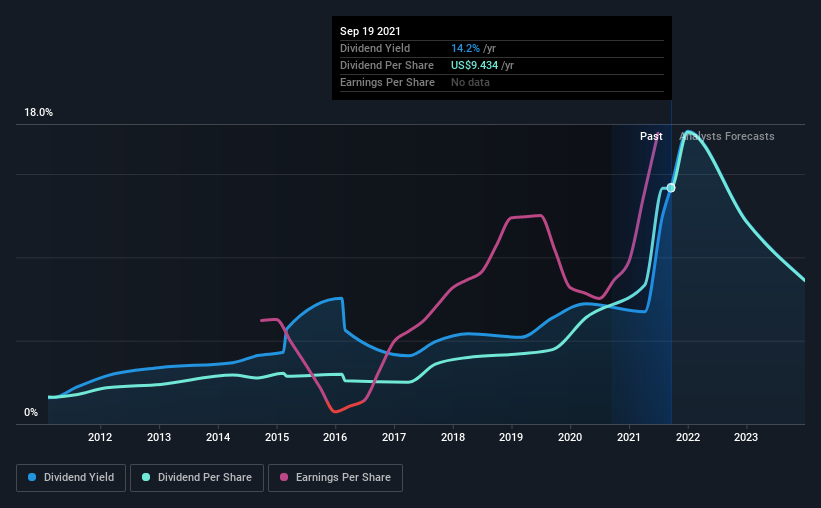

Rio Tinto Group (LSE:RIO) investors are taken on a rollercoaster ride with the high success in the last 12 months, followed by the recent downfall of Iron Ore prices. Dividend yields for investors reached some 14%, however, the seemingly attractive yield may not be sustainable in light of the changing macro situation. We are going to overview the dividend policy and earnings potential for Rio Tinto, in order to see if the recent market volatility represents an opportunity or a convergence to true value.

Rio Tinto Group likely looks attractive to investors for the dividends, given its high dividend yield and a payment history of over ten years.

Some simple analysis can reduce the risk of holding Rio Tinto Group for its dividend, and we'll focus on the most important aspects below.

Explore this interactive chart for our latest analysis on Rio Tinto Group!

Payout ratios

Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable.

Rio Tinto Group paid out 60% of its profit as dividends, over the trailing twelve month period. This is a healthy payout ratio, and also gives the company some earnings to fund sustainable growth.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend.

Rio Tinto Group paid out a conservative 44% of its free cash flow as dividends last year. It's positive to see that Rio Tinto Group's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable.

While the above analysis focuses on dividends relative to a company's earnings, we do note Rio Tinto Group's strong net cash position, which will let it pay larger dividends for a time, should it choose.

Remember, you can always get a snapshot of Rio Tinto Group's latest financial position, by checking our visualisation of its financial health.

Dividend Sustainability Factors

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. With recent, rapid earnings per share growth and a payout ratio of 60%, this business looks like an interesting prospect if earnings are reinvested effectively.

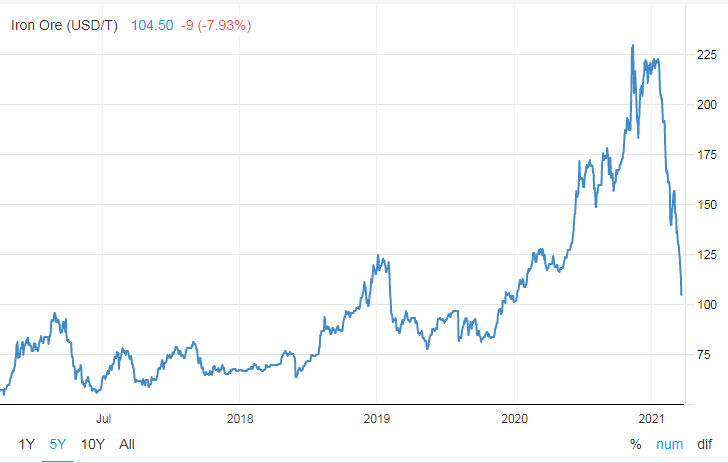

However, the company is massively dependent on iron ore prices, and their spike in the recent year has accounted for a large portion of their profit growth.

This scenario is unlikely to repeat, as Iron Ore prices are plummeting because of reduced demand in China. In the graph below, you can see the extent of the fall.

In their risk-factor outline (page 6), the company outlines "Credit conditions, cooling exports and softer housing market in China main risks to demand", which unfortunately seems to be currently materializing with the decline in demand from China, and the slowdown of the Chinese housing market stemming from Evergrande's financial distress.

With all that in mind, Rio Tinto is a great stock to watch and look for recovery points, since the company is using last year's great performance to stabilize debt and invest in growth projects with US$3.3b in CapEx.

Conclusion

To summarize, shareholders should always check that Rio Tinto Group's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. While the last 12 months were immensely successful to the point of the company declaring a special dividend, we see trouble on the horizon and Rio Tinto will have to cut back in order to stabilize.

The company is in great shape, working down its debt, financing new growth projects and finding sustainable replacements for expiring excavation sites.

Considering the dividends, Rio Tinto Group has an acceptable payout ratio and its dividend is well covered by cashflow, and while current investors were positively surprised, future investors will need to keep an eye out for any potential changes in the dividend payout.

Additionally, we've come across 3 warning signs for Rio Tinto Group you should be aware of, and 1 of them is a bit unpleasant.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance