Riley Exploration Permian, Inc. Reports Q1 2024 Earnings: A Comprehensive Review

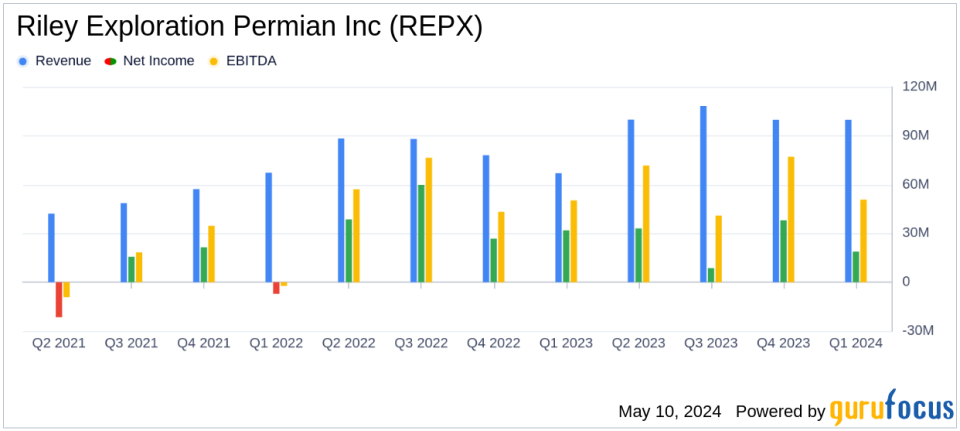

Revenue: Reported at $100 million, falling short of estimates of $105.85 million.

Net Income: Achieved $19 million, below the estimated $34.63 million.

Earnings Per Share (EPS): Recorded at $0.94 per diluted share, significantly below the expected $1.64.

Free Cash Flow: Generated $23 million, indicating strong financial health and operational efficiency.

Debt Reduction: Reduced total debt by $15 million, enhancing the company's financial stability.

Oil Production: Increased to 14.2 MBbls/d, up by 4% from the previous quarter, reflecting improved operational performance.

Dividends: Paid $0.36 per share, totaling $7 million, demonstrating commitment to returning value to shareholders.

Riley Exploration Permian, Inc. (REPX) unveiled its financial and operational results for the first quarter ended March 31, 2024, through its recent 8-K filing. The company, a prominent player in the oil and natural gas sector with operations primarily in New Mexico and surrounding areas, reported a mix of achievements and challenges during the period.

Company Overview

Riley Exploration Permian, Inc. is engaged in the exploration, development, and production of oil, natural gas, and natural gas liquids. The company's strategic operations focus on leveraging advanced extraction and production technologies to maximize its output in the Permian Basin, one of the most prolific hydrocarbon-producing regions in the United States.

Q1 2024 Performance Highlights

The company reported a net income of $19 million, or $0.94 per diluted share, for Q1 2024. This performance marks a decrease compared to the previous year's same quarter but shows resilience in a fluctuating market environment. The total revenue for the quarter stood at $100 million, driven by an average oil production of 14.2 MBbls/d and total equivalent production of 20.4 MBoe/d.

Riley Permian also highlighted its operational efficiency improvements, which have led to reduced cycle times and cost savings. Notably, the company generated $56 million in operating cash flow and achieved a free cash flow of $23 million. These financial metrics are crucial as they reflect the company's ability to generate surplus cash that can be used for debt reduction, dividends, or reinvestment into core business activities.

Strategic Acquisitions and Debt Management

During the quarter, Riley Permian continued to execute its growth strategy through strategic acquisitions, including the purchase of oil and natural gas properties in Eddy County, New Mexico. This acquisition enhances the company's development inventory and is expected to contribute positively to future production volumes. Additionally, the company reduced its total debt by $15 million, strengthening its balance sheet and enhancing financial flexibility.

Financial Health and Future Outlook

The balance sheet of Riley Permian remains robust with total assets amounting to $956 million as of March 31, 2024. The company's efforts to manage its debt levels were evident, with a notable reduction in total debt to $342 million from the previous quarter.

Looking ahead, Riley Permian has provided guidance for the second quarter of 2024, expecting to maintain production levels and manage capital expenditures effectively. The company's focus on operational efficiencies and cost management is likely to support its financial performance in the upcoming quarters.

Management Commentary

Our Company had a strong start to the year with both operational and financial performance during the first quarter, said Bobby D. Riley, Chief Executive Officer and Chairman of the Board. Were experiencing improved cycle times and efficiencies in our development activities, leading to measurable cost savings. We continue to prioritize free cash flow generation which allows for debt reduction and direct shareholder return through dividends. Finally, we recently closed on the previously announced acquisition in New Mexico, contiguous to our existing New Mexico assets, which adds valuable development inventory in the region.

In conclusion, Riley Exploration Permian, Inc.'s first quarter of 2024 reflects a strategic blend of operational excellence and prudent financial management. Despite some challenges, the company's focus on enhancing efficiencies and strengthening its asset base bodes well for its long-term growth trajectory. Investors and stakeholders may look forward to continued progress as the company navigates the dynamic energy landscape.

For detailed financial figures and further information, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Riley Exploration Permian Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance