Restaurant Brands International Inc. (QSR) Q1 2024 Earnings: Aligns with EPS Projections, ...

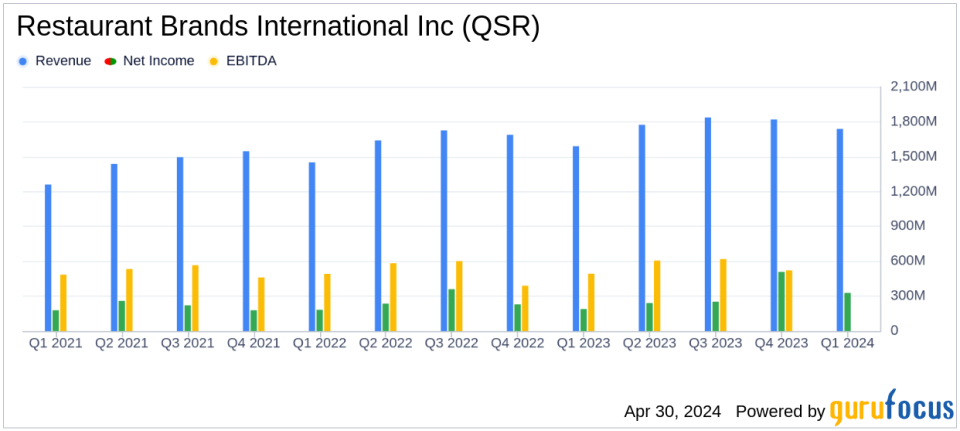

Revenue: Reported at $1.739 billion for the quarter, surpassing the estimated $1.702 billion.

Net Income: Achieved $328 million, exceeding the forecast of $323.89 million.

Earnings Per Share (EPS): Recorded at $0.72, meeting the analyst estimate.

Global Comparable Sales: Increased by 4.6%, with notable growth across major segments including 7.5% at TH Canada and 6.2% at PLK US.

System-wide Sales Growth: Rose by 8.1% year-over-year, driven by strong performance across all brands.

Net Restaurant Growth: Expanded by 3.9% compared to the previous year, contributing to a total count of 31,113 restaurants globally.

Free Cash Flow: Improved to $122 million, up from $77 million in the previous year, reflecting stronger operational efficiency.

On April 30, 2024, Restaurant Brands International Inc. (NYSE:QSR) released its 8-K filing, detailing the financial outcomes for the first quarter ended March 31, 2024. The company reported a net income of $328 million and earnings per share (EPS) of $0.72, aligning closely with analyst expectations of $0.72 EPS and slightly surpassing the estimated net income of $323.89 million. Total revenue for the quarter reached $1,739 million, exceeding the forecast of $1,702.85 million.

Restaurant Brands International, a major player in the global quick-service restaurant sector, operates iconic brands like Tim Hortons, Burger King, Popeyes Louisiana Kitchen, and Firehouse Subs. With a strategy deeply rooted in franchisee profitability and system-wide sales growth, the company continues to expand its global footprint, which now encompasses over 31,000 restaurants in more than 100 countries.

Operational and Financial Highlights

The first quarter of 2024 saw a robust 8.1% increase in system-wide sales year-over-year, driven by significant growth across all brands. Notably, Tim Hortons in Canada experienced a 7.5% rise in comparable sales, contributing to a total system-wide sales of $1,725 million for the brand. Burger King, Popeyes, and Firehouse Subs also reported solid sales and operational growth, with Burger King planning further investments to modernize its U.S. locations by 2028.

Adjusted operating income rose to $540 million, reflecting a 7.7% organic increase. Despite a slight organic decrease in adjusted diluted EPS by 0.9%, the company's strategic investments in marketing and remodels under the "Reclaim the Flame" initiative are setting the stage for sustained long-term growth.

Strategic Developments and Future Outlook

Significant capital is being allocated towards enhancing the customer experience and operational efficiency. The $300 million expansion in Burger King's remodel program is a testament to the company's commitment to revitalizing its brand image and driving franchisee success. Furthermore, the acquisition of Carrols Restaurant Group, set to close in Q2 2024, marks a strategic expansion that will likely bolster the company's market presence in key regions.

For 2024, Restaurant Brands International anticipates continued growth with a focus on comparable sales and net restaurant growth, projecting a system-wide sales growth of over 8% and adjusted operating income growth in line with or exceeding system-wide sales growth.

Investor and Analyst Confidence

The alignment of Q1 earnings with analyst expectations and the strategic steps the company is taking to enhance shareholder value through growth and efficiency initiatives provide a positive outlook for investors. The planned investor conference call is expected to further detail the strategies and financial health of the company.

As Restaurant Brands International continues to navigate a complex global market, its focus on operational excellence, strategic investments, and robust financial management positions it well for sustainable growth. Investors and stakeholders are likely to keep a close watch on the company's execution of its long-term strategies and its impact on future financial performance.

Explore the complete 8-K earnings release (here) from Restaurant Brands International Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance