Rekor Systems Inc (REKR) Earnings: A Year of Substantial Growth Despite Analysts' Net Income ...

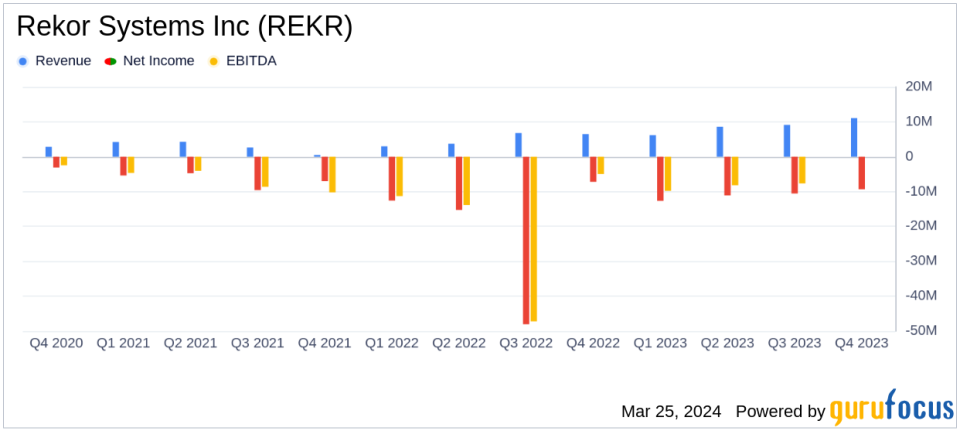

Revenue: Surged to $34.9 million in 2023, a 75% increase from 2022, with Q4 hitting an all-time high of $11.1 million.

Performance Obligations: Grew to $26.4 million, up 23% year-over-year.

Total Contract Value: Soared by 124% to $49.1 million in 2023, indicating strong future revenue potential.

Adjusted EBITDA: Loss reduced from $37.4 million in 2022 to $28.7 million in 2023, reflecting improved operational efficiency.

Net Income: Estimated at -$6.321 million, actual figures not disclosed, potentially missing the analyst's expectations.

On March 25, 2024, Rekor Systems Inc (NASDAQ:REKR) unveiled its 8-K filing, announcing a year filled with strategic milestones and exceptional growth for the fiscal year ending December 31, 2023. The company, known for its AI-driven roadway intelligence technology, achieved a record gross revenue of $34.9 million, marking a significant 75% increase from the previous year's $19.9 million.

Rekor Systems Inc is a leader in providing real-time roadway intelligence through AI-driven decisions. With a focus on transforming video streams into actionable data, Rekor's technology is used across commercial and government sectors to enhance safety, operations, and logistics. The majority of its revenue is generated within the United States, although it operates in Canada and other regions as well.

The company's financial achievements are particularly noteworthy given the complex and competitive landscape of the software industry. The 71% year-over-year increase in Q4 gross revenue, which reached $11.1 million, underscores Rekor's ability to scale and capture market share. Additionally, the 23% growth in performance obligations to $26.4 million and the 124% surge in total contract value to $49.1 million reflect the company's success in securing long-term revenue streams.

Rekor's leadership has expressed confidence in the company's strategic execution. CFO Eyal Hen highlighted the significant revenue growth and the reduction in operating cash burn as evidence of strong strategic execution. CEO Robert A. Berman emphasized the company's impressive 162% CAGR in revenue from 2018 to 2023 and the avoidance of toxic debt, positioning Rekor for sustained innovation and financial health.

The financial results reveal that the increase in revenue for both the twelve and three-month periods ended December 31, 2023, was primarily driven by the Urban Mobility product line and increased sales of software and hardware products. The cost of revenue, excluding depreciation and amortization, rose by 52% for the year, but at a lower rate than revenue, indicating improved operational efficiency. The operating loss decreased by 17% for the year, due to revenue growth and steady operating expenses.

Adjusted EBITDA, a key metric for assessing a company's operating performance, showed improvement as the loss narrowed from $37.4 million in 2022 to $28.7 million in 2023. This improvement is a positive indicator of Rekor's ability to manage its expenses and move towards profitability.

Despite the positive trends in revenue and operational metrics, the company's estimated net income of -$6.321 million suggests a potential miss compared to analyst expectations. This discrepancy highlights the challenges Rekor faces in achieving bottom-line profitability, an important factor for value investors.

Rekor has scheduled a conference call to discuss the 2023 results, providing an opportunity for investors to gain further insights into the company's performance and future outlook.

In conclusion, Rekor Systems Inc's fiscal year 2023 results demonstrate robust top-line growth and strategic advancements. While the company appears to have missed analyst net income estimates, its record revenue and improved operational efficiency point to a strong foundation for future growth. Investors will be watching closely to see if these trends continue and translate into sustained profitability.

For more detailed information on Rekor Systems Inc's financial performance and future prospects, investors and analysts are encouraged to review the full earnings report and join the upcoming conference call.

Explore the complete 8-K earnings release (here) from Rekor Systems Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance