Regis Healthcare (ASX:REG) Use Of Debt Could Be Considered Risky

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Regis Healthcare Limited (ASX:REG) does use debt in its business. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Regis Healthcare

How Much Debt Does Regis Healthcare Carry?

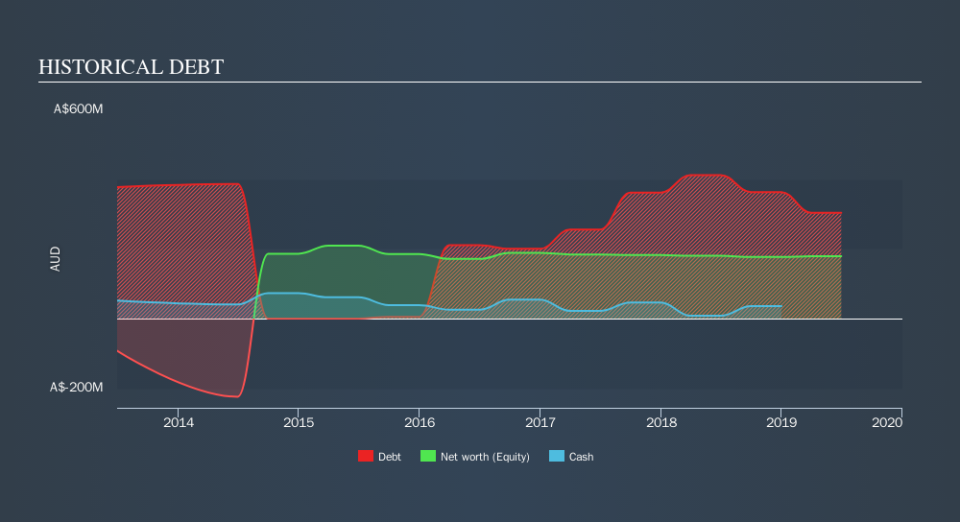

You can click the graphic below for the historical numbers, but it shows that Regis Healthcare had AU$303.3m of debt in June 2019, down from AU$411.6m, one year before. However, because it has a cash reserve of AU$35.7m, its net debt is less, at about AU$267.6m.

How Healthy Is Regis Healthcare's Balance Sheet?

The latest balance sheet data shows that Regis Healthcare had liabilities of AU$1.24b due within a year, and liabilities of AU$371.4m falling due after that. Offsetting these obligations, it had cash of AU$35.7m as well as receivables valued at AU$17.7m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by AU$1.56b.

The deficiency here weighs heavily on the AU$833.1m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet." So we definitely think shareholders need to watch this one closely. At the end of the day, Regis Healthcare would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Regis Healthcare's net debt is sitting at a very reasonable 2.5 times its EBITDA, while its EBIT covered its interest expense just 6.2 times last year. While these numbers do not alarm us, it's worth noting that the cost of the company's debt is having a real impact. The bad news is that Regis Healthcare saw its EBIT decline by 17% over the last year. If that sort of decline is not arrested, then the managing its debt will be harder than selling broccoli flavoured ice-cream for a premium. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Regis Healthcare's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Looking at the most recent three years, Regis Healthcare recorded free cash flow of 32% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

To be frank both Regis Healthcare's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. Having said that, its ability to cover its interest expense with its EBIT isn't such a worry. We should also note that Healthcare industry companies like Regis Healthcare commonly do use debt without problems. We're quite clear that we consider Regis Healthcare to be really rather risky, as a result of its balance sheet health. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. Given our concerns about Regis Healthcare's debt levels, it seems only prudent to check if insiders have been ditching the stock.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance