Reasons to Add WEC Energy (WEC) to Your Portfolio Right Now

WEC Energy Group’s WEC ongoing investments in infrastructure projects, focus on clean energy and development of LNG facilities will continue to drive its bottom line. The company plans to invest $7.3 billion in renewable assets during 2023-2027 and expand its clean power-generation portfolio. Given its strong dividend history and growth opportunities, WEC makes for a solid investment option in the utility sector.

Let’s focus on the factors that make this Zacks Rank #2 (Buy) stock a strong investment option at the moment. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Growth Projections & Earnings Growth

The Zacks Consensus Estimate for fiscal 2023 earnings per share (EPS) has increased 0.2% to $4.6 in the past 30 days. This implies a year-over-year increase of 3.4%.

The company’s long-term (three- to five-year) earnings growth is pegged at 5.8%. It delivered an average earnings surprise of 7.99% in the last four quarters.

Return on Equity

Return on equity (ROE) indicates how efficiently a company has been utilizing its funds to generate higher returns. Currently, WEC Energy’s ROE is 12.24%, higher than the industry’s average of 4.6%. This indicates that the company has been utilizing its funds more constructively than its peers in the electric power utility industry.

Dividend History

The utility company has been consistently hiking dividends. In January 2023, WEC’s board of directors approved a dividend hike of 7.2% from the previous payout figure, which resulted in an annual dividend of $3.12 per share. This hike marks the 322th consecutive quarter and the 20th consecutive year of dividend increase for the company. WEC Energy’s current dividend yield is 3.31%, better than the Zacks S&P 500 Composite’s yield of 1.6%.

Systematic Investments

The company plans to invest $20.1 billion during 2023-2027 for strengthening its infrastructure, increasing LNG facilities and adding more renewable assets to its portfolio. It is also focused on improving operating efficiency. WEC reduced other operations and maintenance (O&M) costs by 3.4% in 2022 from the 2021 level. It expects to reduce O&M expenses by $30-$35 million in the coming years.

The company is also investing in cost-effective zero-carbon generation sources like solar and wind. WEC plans to invest $5.4 billion in regulated renewables to build 3,300 MWs of solar, wind and battery storage in the 2023-2027 period. It is also focused on replacing older generation facilities with zero-carbon-emitting renewable and natural gas-based generation by 2025.

WEC is working on maintaining reliable and affordable services for customers. It has received regulatory approval for two Liquefied Natural Gas (LNG) facilities to address the demand for additional natural gas supply in Wisconsin. The commercial operation of LNG facilities is expected to begin by late 2023 and 2024.

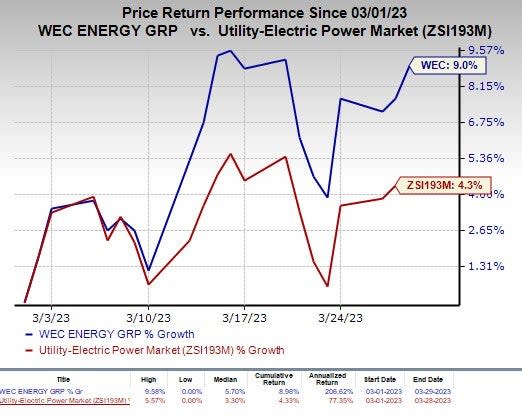

Price Performance

In the past month, WEC Energy Group’s shares have gained 9% compared with the industry’s average growth of 4.3%.

Image Source: Zacks Investment Research

Other Stocks to Consider

A few other top-ranked stocks from the same industry are FirstEnergy Corporation FE, MGE Energy Inc. MGEE and NiSource Inc. NI, each holding a Zacks Rank #2 at present.

FirstEnergy’s long-term (three- to five-year) earnings growth is pegged at 6.5%. The Zacks Consensus Estimate for 2023 EPS is $2.5, implying a year-over-year increase of 3.7%.

MGE Energy’s long-term earnings growth is pegged at 5.4%. The Zacks Consensus Estimate for 2023 EPS is $3.36, implying a year-over-year increase of 9.5%.

NiSource’s long-term earnings growth is pegged at 6.8%. The Zacks Consensus Estimate for 2023 EPS is $1.57, implying a year-over-year increase of 6.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NiSource, Inc (NI) : Free Stock Analysis Report

FirstEnergy Corporation (FE) : Free Stock Analysis Report

WEC Energy Group, Inc. (WEC) : Free Stock Analysis Report

MGE Energy Inc. (MGEE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance