Reasons to Add Maximus (MMS) Stock to Your Portfolio Now

Maximus, Inc. MMS shares have returned 4.3% in the past three months and we believe that the stock has the potential to sustain its momentum in the near term.

The company carries a Zacks Rank #2 (Buy) at present. Our research shows that stocks with a Zacks Rank #1 (Strong Buy) or 2, offer attractive investment opportunities. Thus, MMS is a compelling investment proposition at the moment. You can see the complete list of today’s Zacks #1 Rank stocks here.

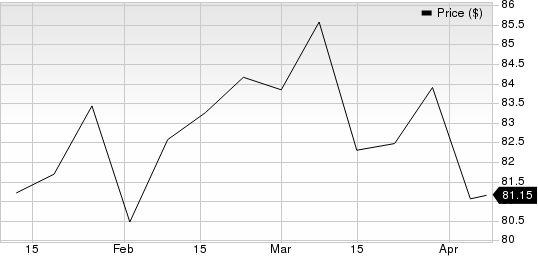

Maximus, Inc. Price

Maximus, Inc. price | Maximus, Inc. Quote

The Zacks Consensus Estimate for fiscal 2024 earnings is pegged at $5.41, reflecting 41.3% year-over-year growth. Earnings are expected to register 5.7% growth in fiscal 2025. Over the past 60 days, the consensus estimate has moved 0.6% north.

With more than 40 years of experience, Maximus has grown to be a leading operator of government health and human services programs globally. The company’s business process management expertise and its ability to deliver cost-effective, efficient and high-scale solutions position it as a lucrative partner to governments.

Maximus maintains solid relationships and a strong reputation with governments. Its long-term contracts provide the company with predictable recurring revenue streams. It continuously seeks long-term relationships with clients in not only those markets where they operate but also in adjacent ones.

MMS is also focused on expanding its foothold in clinical services, as well as in long-term services and supports. Moreover, complex health needs have increased the requirement for government social benefits and safety-net programs. This is expected to continue driving demand for the company’s services.

MMS has a solid track record of dividend payments. During fiscal 2023, 2022 and 2021, Maximus paid cash dividends of $68 million, $68.7 million and $68.8 million, respectively. Such moves indicate Maximus’ commitment to create value for shareholders and underline its confidence in its business.

Other Stocks to Consider

A couple of other top-ranked stocks from the broader Zacks Business Services sector are APi Group APG and Cellebrite DI Ltd. CLBT.

APi Group currently sports a Zacks Rank of 1. It has a long-term earnings growth expectation of 17.9%. APG delivered a trailing four-quarter earnings surprise of 5.1%, on average.

Cellebrite DI Ltd. currently carries a Zacks Rank of 2. It has a long-term earnings growth expectation of 18%. CLBT delivered a trailing four-quarter earnings surprise of 237.5%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Maximus, Inc. (MMS) : Free Stock Analysis Report

APi Group Corporation (APG) : Free Stock Analysis Report

Cellebrite DI Ltd. (CLBT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance