Read This Before You Buy Dogness (International) Corporation (NASDAQ:DOGZ) Because Of Its P/E Ratio

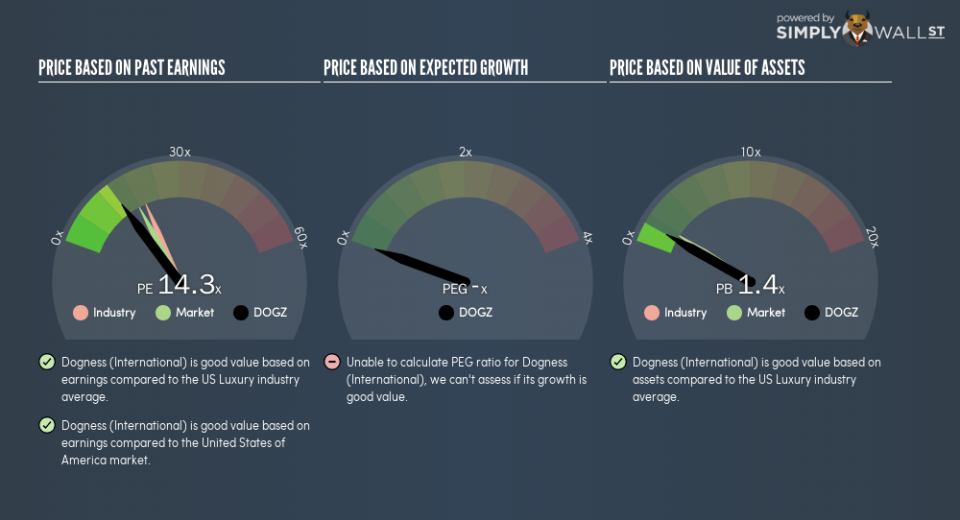

This article is written for those who want to get better at using price to earnings ratios (P/E ratios). We’ll show how you can use Dogness (International) Corporation’s (NASDAQ:DOGZ) P/E ratio to inform your assessment of the investment opportunity. Dogness (International) has a P/E ratio of 14.33, based on the last twelve months. That means that at current prices, buyers pay $14.33 for every $1 in trailing yearly profits.

See our latest analysis for Dogness (International)

How Do You Calculate A P/E Ratio?

The formula for P/E is:

Price to Earnings Ratio = Share Price ÷ Earnings per Share (EPS)

Or for Dogness (International):

P/E of 14.33 = $3.17 ÷ $0.22 (Based on the year to June 2018.)

Is A High Price-to-Earnings Ratio Good?

A higher P/E ratio means that investors are paying a higher price for each $1 of company earnings. That is not a good or a bad thing per se, but a high P/E does imply buyers are optimistic about the future.

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. That’s because companies that grow earnings per share quickly will rapidly increase the ‘E’ in the equation. That means even if the current P/E is high, it will reduce over time if the share price stays flat. Then, a lower P/E should attract more buyers, pushing the share price up.

Dogness (International) shrunk earnings per share by 33% over the last year. But over the longer term (3 years), earnings per share have increased by 8.0%.

How Does Dogness (International)’s P/E Ratio Compare To Its Peers?

The P/E ratio indicates whether the market has higher or lower expectations of a company. If you look at the image below, you can see Dogness (International) has a lower P/E than the average (20) in the luxury industry classification.

Its relatively low P/E ratio indicates that Dogness (International) shareholders think it will struggle to do as well as other companies in its industry classification. Many investors like to buy stocks when the market is pessimistic about their prospects. It is arguably worth checking if insiders are buying shares, because that might imply they believe the stock is undervalued.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

The ‘Price’ in P/E reflects the market capitalization of the company. In other words, it does not consider any debt or cash that the company may have on the balance sheet. Theoretically, a business can improve its earnings (and produce a lower P/E in the future), by taking on debt (or spending its remaining cash).

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

Dogness (International)’s Balance Sheet

The extra options and safety that comes with Dogness (International)’s US$30m net cash position means that it deserves a higher P/E than it would if it had a lot of net debt.

The Bottom Line On Dogness (International)’s P/E Ratio

Dogness (International) trades on a P/E ratio of 14.3, which is below the US market average of 17.9. Falling earnings per share are likely to be keeping potential buyers away, the relatively strong balance sheet will allow the company time to invest in growth. If it achieves that, then there’s real potential that the low P/E could eventually indicate undervaluation.

Investors have an opportunity when market expectations about a stock are wrong. If it is underestimating a company, investors can make money by buying and holding the shares until the market corrects itself. Although we don’t have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with modest (or no) debt, trading on a P/E below 20.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance