RBB Bancorp (RBB) Q1 2024 Earnings Overview: Exceeds EPS Estimates, Faces Net Income and ...

Net Income: Reported $8.0 million, surpassing the estimated $6.18 million.

Earnings Per Share (EPS): Achieved $0.43, exceeding the estimated $0.34.

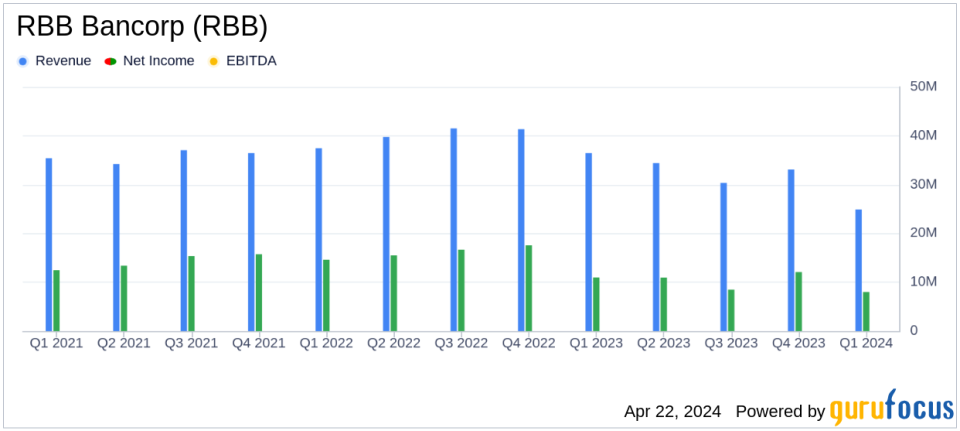

Revenue: Totalled $24.9 million in net interest income, falling short of the estimated $27.65 million.

Net Interest Margin: Declined slightly to 2.69%, reflecting a 4 basis point decrease from the previous quarter.

Share Repurchase: Repurchased 80,285 shares for $1.5 million under the newly authorized stock repurchase program.

Return on Average Assets: Decreased to 0.81% from 1.20% in the previous quarter.

Book Value Per Share: Increased to $27.67, up from $27.47 at the end of last quarter.

RBB Bancorp (NASDAQ:RBB) released its 8-K filing on April 22, 2024, revealing a mixed financial performance for the first quarter of 2024. The company reported earnings per share (EPS) of $0.43, surpassing the analyst estimate of $0.34. However, it fell short on estimated net income and revenue, posting $8.0 million and $24.9 million respectively against expectations of $6.18 million and $27.65 million.

Company Overview

RBB Bancorp operates as a bank holding company offering a range of banking products and services such as checking, savings accounts, and more. It primarily serves the Asian communities across various U.S. locations, providing tailored services like commercial real estate loans, SBA loans, and trade finance.

Financial Performance Analysis

The company's net income of $8.0 million this quarter represents a decrease from the $12.1 million reported in the previous quarter, largely due to the absence of a one-time Community Development Financial Institution (CDFI) award received in the last quarter of 2023. The net interest margin slightly declined by four basis points to 2.69%, reflecting challenges in the rising interest rate environment and competitive deposit market.

Strategic Developments and Leadership Updates

Amidst these financial figures, RBB Bancorp announced strategic moves including the appointment of Lynn Hopkins as the Executive Vice President and Chief Financial Officer, aiming to strengthen its leadership team. Additionally, the Board authorized a stock repurchase program for up to 1 million shares, underscoring its confidence in the company's value proposition to shareholders.

Operational and Market Challenges

The bank faces operational challenges such as managing deposit costs and loan yields in a fluctuating rate environment. The competitive landscape for deposits remains intense, impacting the bank's ability to attract and retain cost-effective funding sources.

Balance Sheet and Credit Quality

As of March 31, 2024, total assets stood at $3.9 billion, marking a decrease from the previous periods. The loan portfolio showed a slight contraction, particularly in residential mortgages and commercial loans. Credit quality metrics indicated an increase in nonperforming assets, highlighting potential concerns in asset quality amidst economic uncertainties.

Outlook and Forward-Looking Statements

Looking ahead, RBB Bancorp remains cautiously optimistic about improving margins as it navigates through the interest rate cycles and competitive pressures. The management's focus will continue on strategic initiatives to enhance operational efficiencies and shareholder value.

Conclusion

While RBB Bancorp navigates through some headwinds, its strategic initiatives, such as leadership enhancements and share repurchase programs, align with its long-term objectives to bolster financial stability and shareholder returns. Investors and stakeholders will likely watch closely how the bank manages its operational challenges and capitalizes on growth opportunities in the coming quarters.

Explore the complete 8-K earnings release (here) from RBB Bancorp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance