Raymond James (RJF) Q4 Earnings & Revenues Beat Estimates

Raymond James RJF reported fourth-quarter fiscal 2019 (ended Sep 30) adjusted earnings of $2.00 per share, which beat the Zacks Consensus Estimate by a penny. Also, on a year-over-year basis, it increased 19%.

Results benefited from increase in revenues and decent assets growth. However, higher operating expenses acted as an undermining factor.

Net income (GAAP basis) was $265 million or $1.86 per share, up from $263 million or $1.76 per share in the prior-year quarter.

For fiscal 2019, adjusted earnings of $7.40 per share increased 14%, and also surpassed the consensus estimate by a penny. Net income (GAAP basis) totaled $1.03 billion or $7.17 per share, up from $857 million or $5.75 per share in fiscal 2018.

Revenues & Costs Rise

Net revenues amounted to $2.02 billion, growing 7% year over year. The rise was largely driven by increase in all components except total brokerage revenues. Also, the top line beat the Zacks Consensus Estimate of $1.99 billion.

For fiscal 2019, net revenues increased 6% to $7.74 billion. The top line also outpaced the consensus estimate of $7.71 billion.

Segment wise, in the reported quarter, RJ Bank registered an increase of 11% in net revenues. Capital Markets witnessed a rise of 10% in the top line, and Private Client Group recorded 6% growth. Further, Asset Management witnessed a 3% rise, and Others recorded significant top- line growth.

Non-interest expenses were up 8% year over year to $1.67 billion. The increase was mainly due to rise in almost all cost components except professional fees.

As of Sep 30, 2019, client assets under administration grew 6% from the prior-year quarter to $838.3 billion. Further, financial assets under management were $143.1 billion, on par with the prior-year quarter level.

Strong Balance Sheet & Capital Ratios

As of Sep 30, 2019, Raymond James reported total assets of $38.8 billion, up slightly sequentially. Total equity increased 1% from the prior quarter to $6.6 billion.

Book value per share was $47.76, up from $43.73 as of Sep 30, 2018.

As of Sep 30, 2019, total capital ratio came in at 25.7%, increasing from 25.3% on Sep 30, 2018. Also, Tier 1 capital ratio was 24.8% compared with 24.3% as of September 2018 end.

Return on equity (annualized basis) was 16.2% at the end of the reported quarter compared with 16.8% in the prior-year quarter.

Share Repurchase Update

During the fiscal fourth quarter, Raymond James repurchased nearly 2.13 million shares for $161.2 million.

Our Take

Raymond James remains well positioned to grow via acquisitions, given its strong liquidity position. However, mounting expenses are likely to continue hurting bottom-line growth.

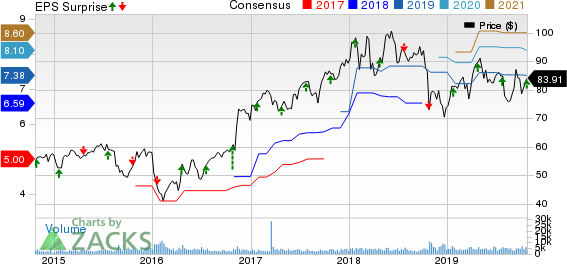

Raymond James Financial, Inc. Price, Consensus and EPS Surprise

Raymond James Financial, Inc. price-consensus-eps-surprise-chart | Raymond James Financial, Inc. Quote

Currently, the company has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Investment Brokerage Firms

Charles Schwab’s SCHW third-quarter 2019 adjusted earnings of 74 cents per share beat the Zacks Consensus Estimate of 65 cents. Also, the bottom line increased 14% from the prior-year quarter.

Riding on top-line strength, E*TRADE Financial ETFC delivered a positive earnings surprise of 8% in third-quarter 2019. Earnings of $1.08 per share comfortably surpassed the Zacks Consensus Estimate of $1.00. Moreover, the results compared favorably with the prior-year quarter’s $1.00.

Interactive Brokers Group IBKR recorded third-quarter 2019 earnings per share of 45 cents. The figure compared unfavorably with the prior-year quarter’s earnings of 51 cents.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

E*TRADE Financial Corporation (ETFC) : Free Stock Analysis Report

Raymond James Financial, Inc. (RJF) : Free Stock Analysis Report

The Charles Schwab Corporation (SCHW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance