I Ran A Stock Scan For Earnings Growth And Diamond Hill Investment Group (NASDAQ:DHIL) Passed With Ease

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Diamond Hill Investment Group (NASDAQ:DHIL). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Diamond Hill Investment Group

How Fast Is Diamond Hill Investment Group Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. Diamond Hill Investment Group managed to grow EPS by 15% per year, over three years. That's a good rate of growth, if it can be sustained.

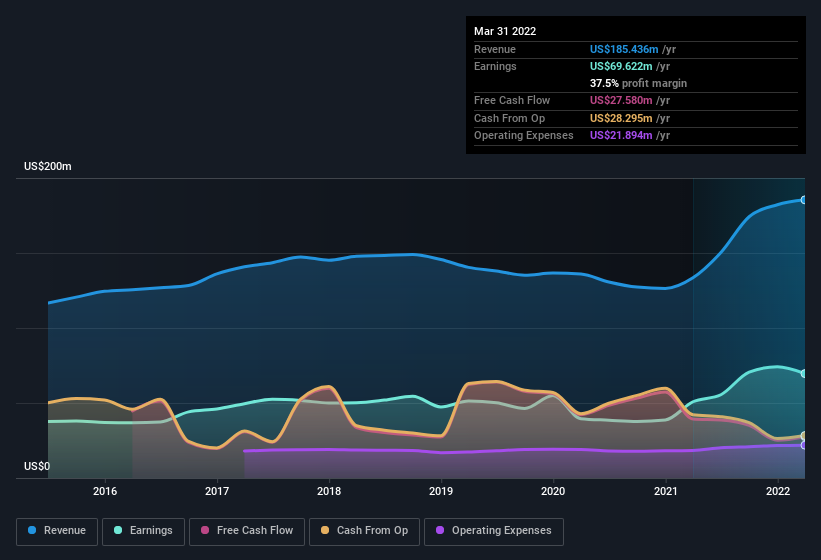

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Diamond Hill Investment Group shareholders can take confidence from the fact that EBIT margins are up from 29% to 44%, and revenue is growing. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Diamond Hill Investment Group Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Diamond Hill Investment Group insiders have a significant amount of capital invested in the stock. To be specific, they have US$19m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 3.6% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Does Diamond Hill Investment Group Deserve A Spot On Your Watchlist?

One positive for Diamond Hill Investment Group is that it is growing EPS. That's nice to see. If that's not enough on its own, there is also the rather notable levels of insider ownership. That combination appeals to me, for one. So yes, I do think the stock is worth keeping an eye on. You still need to take note of risks, for example - Diamond Hill Investment Group has 3 warning signs (and 1 which is a bit unpleasant) we think you should know about.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance