Rainbows and Unicorns: TG Therapeutics, Inc. (NASDAQ:TGTX) Analysts Just Became A Lot More Optimistic

TG Therapeutics, Inc. (NASDAQ:TGTX) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's forecasts. The consensus statutory numbers for both revenue and earnings per share (EPS) increased, with their view clearly much more bullish on the company's business prospects. TG Therapeutics has also found favour with investors, with the stock up a worthy 18% to US$16.42 over the past week. We'll be curious to see if these new estimates convince the market to lift the stock price higher still.

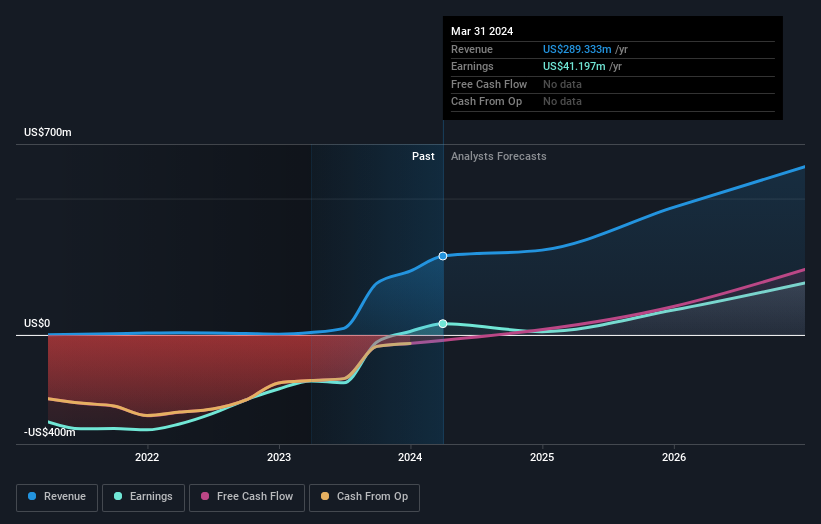

Following the upgrade, the most recent consensus for TG Therapeutics from its seven analysts is for revenues of US$311m in 2024 which, if met, would be a satisfactory 7.5% increase on its sales over the past 12 months. Statutory earnings per share are anticipated to plummet 72% to US$0.079 in the same period. Yet prior to the latest estimates, the analysts had been forecasting revenues of US$268m and losses of US$0.11 per share in 2024. It looks like there's been a definite improvement in business conditions, with a revenue upgrade supposed to lead to profitability sooner than previously forecast.

See our latest analysis for TG Therapeutics

It will come as no surprise to learn that the analysts have increased their price target for TG Therapeutics 5.5% to US$31.38 on the back of these upgrades.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's pretty clear that there is an expectation that TG Therapeutics' revenue growth will slow down substantially, with revenues to the end of 2024 expected to display 10% growth on an annualised basis. This is compared to a historical growth rate of 95% over the past five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 18% per year. Factoring in the forecast slowdown in growth, it seems obvious that TG Therapeutics is also expected to grow slower than other industry participants.

The Bottom Line

The most important thing to take away from this upgrade is that there is now an expectation for TG Therapeutics to become profitable this year, compared to previous expectations of a loss. Pleasantly, analysts also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow slower than the wider market. With a serious upgrade to expectations and a rising price target, it might be time to take another look at TG Therapeutics.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. At Simply Wall St, we have a full range of analyst estimates for TG Therapeutics going out to 2026, and you can see them free on our platform here..

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance