Radian Group Inc (RDN) Reports Q1 2024 Earnings: Surpasses Analyst Revenue Forecasts

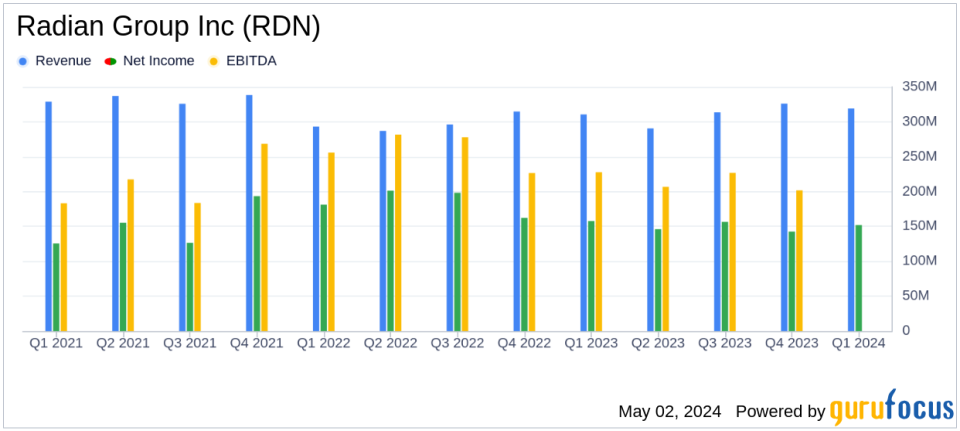

Net Income: Reported at $152 million for Q1 2024, surpassing the estimated $130.94 million.

Earnings Per Share (EPS): Achieved $0.98 per diluted share, exceeding the estimated $0.84.

Revenue: Total revenue reached $319 million, significantly above the estimated $236.63 million.

Return on Equity (ROE): Recorded at 13.8%, with an adjusted net operating return on equity of 14.5%.

Book Value Per Share: Grew 12% year-over-year to $29.30, reflecting strong financial health.

Primary Mortgage Insurance: Grew by 4% year-over-year, reaching a record high of $271 billion in force.

Default Rate: Decreased to 2.1%, marking the lowest rate with the highest quarterly cure rate in over two decades.

Radian Group Inc (NYSE:RDN) released its 8-K filing on May 1, 2024, detailing a robust financial performance for the first quarter of 2024. The company reported a net income of $152 million, translating to $0.98 per diluted share, aligning with the previous year's earnings per share but surpassing the current quarterly analyst estimate of $0.84. This performance underscores a stable profitability trajectory, despite slight variations in net income from the prior year's $158 million.

Radian Group Inc, a key player in the mortgage insurance sector, provides critical coverage and services across the United States. The companys primary revenue streams stem from insurance premiums, complemented by services revenue and investment income. Operating through segments like Mortgage and homegenius, Radian has demonstrated a consistent growth in its mortgage insurance in force, which has reached an all-time high of $271 billion, marking a 4% year-over-year increase.

Financial Highlights and Strategic Moves

The company's total revenue saw a year-over-year increase of approximately 3%, rising to $319 million. This growth is slightly above the analyst's expectation of $236.63 million for the quarter. The return on equity stood at 13.8%, with an adjusted net operating return on equity of 14.5%. These figures represent a slight decrease from the previous year's 15.7% but indicate a strong underlying financial health and operational efficiency.

Radian's strategic financial management was highlighted by the completion of a $625 million senior notes offering and the redemption of $525 million in senior notes during the quarter. These actions reflect the company's proactive capital management and its commitment to maintaining a robust balance sheet.

Operational Successes and Market Position

The quarter also witnessed the lowest default rate in over two decades at 2.1%, alongside the highest quarterly cure rate, signaling effective risk management and a healthy housing market. The growth in book value per share, which increased by 12% year-over-year to $29.30, further exemplifies Radian's ability to enhance shareholder value through its operational strategies and market positioning.

CEOs Perspective

Radians CEO, Rick Thornberry, commented on the results, emphasizing the strategic capital management and the intrinsic value of Radian's high-quality mortgage insurance portfolio. He stated:

We had a strong start to the year with excellent first quarter operating results for Radian. We increased book value per share by 12% year-over-year and delivered return on equity of approximately 14%. These results demonstrate the embedded economic value of our high-quality mortgage insurance portfolio, which is the main driver of future earnings for our company and reached an all-time high of $271 billion during the quarter.

Outlook and Forward Guidance

Looking ahead, Radian is poised to continue leveraging its robust mortgage insurance portfolio and strategic initiatives to drive growth and shareholder value. The company plans to discuss these results and future strategies in more detail during their upcoming conference call.

Radian Group Incs first quarter performance for 2024 not only aligns with analyst expectations on earnings per share but also showcases a revenue surpassing forecasts, positioning the company well for sustained growth in the competitive mortgage insurance market.

Explore the complete 8-K earnings release (here) from Radian Group Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance