A Quick Analysis On Zelira Therapeutics' (ASX:ZLD) CEO Compensation

Richard Hopkins has been the CEO of Zelira Therapeutics Limited (ASX:ZLD) since 2018, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Zelira Therapeutics.

Check out our latest analysis for Zelira Therapeutics

How Does Total Compensation For Richard Hopkins Compare With Other Companies In The Industry?

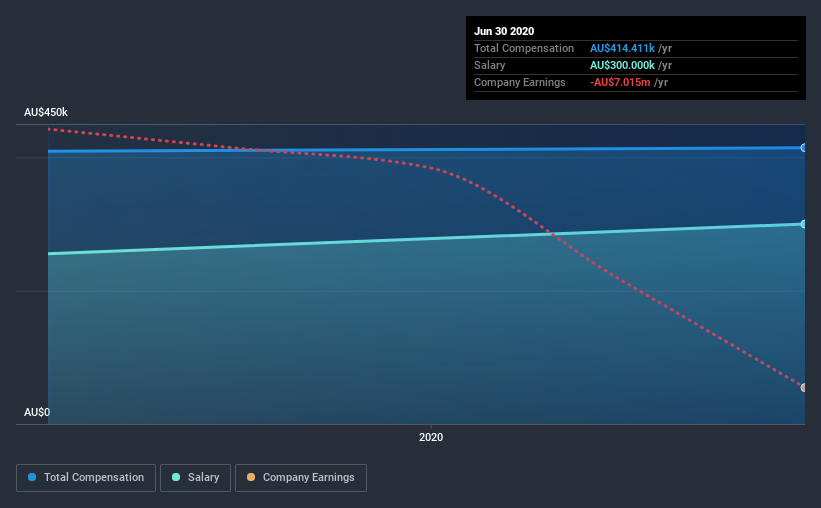

According to our data, Zelira Therapeutics Limited has a market capitalization of AU$107m, and paid its CEO total annual compensation worth AU$414k over the year to June 2020. This means that the compensation hasn't changed much from last year. In particular, the salary of AU$300.0k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the industry with market capitalizations below AU$260m, we found that the median total CEO compensation was AU$427k. So it looks like Zelira Therapeutics compensates Richard Hopkins in line with the median for the industry. What's more, Richard Hopkins holds AU$156k worth of shares in the company in their own name.

Component | 2020 | 2019 | Proportion (2020) |

Salary | AU$300k | AU$256k | 72% |

Other | AU$114k | AU$153k | 28% |

Total Compensation | AU$414k | AU$409k | 100% |

Speaking on an industry level, nearly 66% of total compensation represents salary, while the remainder of 34% is other remuneration. Zelira Therapeutics is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Zelira Therapeutics Limited's Growth Numbers

Over the last three years, Zelira Therapeutics Limited has shrunk its earnings per share by 1.9% per year. It achieved revenue growth of 27% over the last year.

The reduction in EPS, over three years, is arguably concerning. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Zelira Therapeutics Limited Been A Good Investment?

Given the total shareholder loss of 16% over three years, many shareholders in Zelira Therapeutics Limited are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

As previously discussed, Richard is compensated close to the median for companies of its size, and which belong to the same industry. Still, the company is logging healthy revenue growth over the last year. On the other hand, shareholder returns for Richard are negative over the same period. EPS growth is also negative, adding insult to injury. We'd say CEO compensation isn't unfair, but shareholders may be wary of a bump in pay before the company substantially improves overall performance.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 5 warning signs for Zelira Therapeutics (3 are concerning!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance