A Quick Analysis On Bass Oil's (ASX:BAS) CEO Salary

This article will reflect on the compensation paid to Tino Guglielmo who has served as CEO of Bass Oil Limited (ASX:BAS) since 2017. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for Bass Oil

How Does Total Compensation For Tino Guglielmo Compare With Other Companies In The Industry?

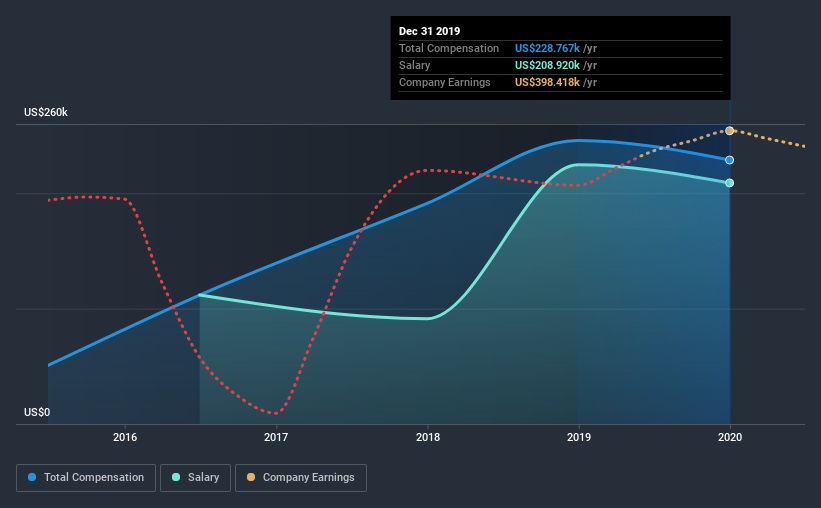

At the time of writing, our data shows that Bass Oil Limited has a market capitalization of AU$6.7m, and reported total annual CEO compensation of US$229k for the year to December 2019. We note that's a small decrease of 6.9% on last year. Notably, the salary which is US$208.9k, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations under AU$275m, the reported median total CEO compensation was US$260k. This suggests that Bass Oil remunerates its CEO largely in line with the industry average. Furthermore, Tino Guglielmo directly owns AU$571k worth of shares in the company.

Component | 2019 | 2018 | Proportion (2019) |

Salary | US$209k | US$225k | 91% |

Other | US$20k | US$21k | 9% |

Total Compensation | US$229k | US$246k | 100% |

On an industry level, roughly 74% of total compensation represents salary and 26% is other remuneration. It's interesting to note that Bass Oil pays out a greater portion of remuneration through salary, compared to the industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Bass Oil Limited's Growth

Bass Oil Limited's earnings per share (EPS) grew 158% per year over the last three years. In the last year, its revenue is up 5.8%.

Shareholders would be glad to know that the company has improved itself over the last few years. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Bass Oil Limited Been A Good Investment?

Given the total shareholder loss of 50% over three years, many shareholders in Bass Oil Limited are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be lessto generous with CEO compensation.

To Conclude...

As we touched on above, Bass Oil Limited is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. At the same time, the company has logged negative shareholder returns over the last three years. But EPS growth is moving in a favorable direction, certainly a positive sign. Considering positive EPS growth, we'd say compensation is fair, but shareholders may be wary of a bump in pay before the company logs positive returns.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 4 warning signs for Bass Oil (of which 2 are a bit unpleasant!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Bass Oil, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance