Quest Diagnostics Q1 2024 Earnings: Aligns with Analyst EPS Projections, Raises Full-Year Guidance

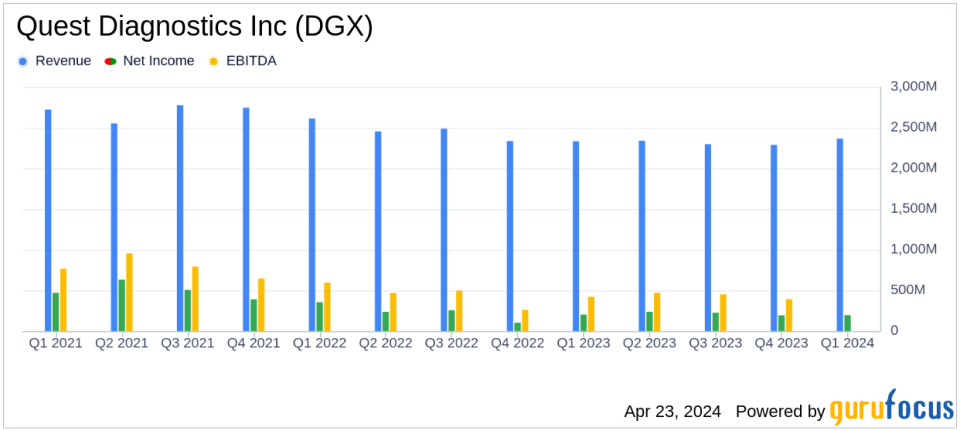

Revenue: Reported at $2.37 billion for Q1 2024, up 1.5% year-over-year, surpassing the estimate of $2.29 billion.

Net Income: Attributable to Quest Diagnostics was $194 million, a decrease of 3.9% from the previous year, falling short of the estimated $209.16 million.

Diluted EPS: Reported at $1.72, down 3.4% from the previous year, below the estimated $1.86.

Operating Cash Flow: Increased significantly to $154 million, up 64.8% from $94 million in Q1 2023.

Capital Expenditures: Decreased to $104 million, down 18.2% from $127 million in the prior year.

Full-Year Revenue Guidance: Raised to between $9.40 billion and $9.48 billion, reflecting an increase from the previous forecast.

Adjusted Full-Year EPS Guidance: Now expected to be between $8.72 and $8.97, an adjustment from earlier projections.

On April 23, 2024, Quest Diagnostics Inc (NYSE:DGX) disclosed its financial outcomes for the first quarter of 2024 through an 8-K filing. The company, a leader in diagnostic information services, reported first-quarter revenues of $2.37 billion, marking a 1.5% increase from the previous year. This performance is slightly above the analysts' revenue estimate of $2.29 billion. However, the reported diluted earnings per share (EPS) of $1.72 fell short of the estimated $1.86, reflecting a 3.4% decrease year-over-year. Adjusted diluted EPS stood at $2.04, consistent with the prior year and aligning with analyst projections.

Quest Diagnostics operates primarily in the U.S., offering a wide range of diagnostic testing and services. The company's revenue is largely generated from clinical testing, anatomic pathology, esoteric testing, and substance abuse testing, with a smaller segment dedicated to diagnostic solutions including clinical trials testing and IT solutions.

Financial and Operational Highlights

The company's financial health showed mixed signals. While total revenues increased, operating income slightly declined by 1.7% to $300 million, and net income attributable to Quest Diagnostics decreased by 3.9% to $194 million. Despite these challenges, Quest Diagnostics demonstrated efficiency in operational activities, evidenced by a 64.8% increase in cash provided by operations, which amounted to $154 million.

Quest Diagnostics' strategic initiatives, particularly its Invigorate initiative which focuses on automation and AI, have been pivotal in enhancing productivity and service quality. This operational efficiency is a critical factor for companies in the Medical Diagnostics & Research industry, where rapid and accurate diagnostics are essential for patient care.

Updated Financial Guidance and Strategic Outlook

Encouraged by the quarter's performance, Quest Diagnostics has revised its full-year 2024 revenue projections to between $9.40 billion and $9.48 billion, up from the previous forecast of $9.35 billion to $9.45 billion. The company also adjusted its EPS guidance, with reported diluted EPS now expected to range from $7.57 to $7.82, and adjusted diluted EPS from $8.72 to $8.97.

CEO Jim Davis commented on the results and outlook, stating,

In the first quarter, we delivered nearly 6% base business revenue growth, continuing the strong momentum of recent quarters... Given the strength of our business, we are raising our revenue and adjusted earnings guidance for the full year."

Investor and Analyst Perspectives

Quest Diagnostics' ability to meet adjusted EPS expectations and raise its financial outlook for the year reflects a resilient operational model and effective response to ongoing healthcare demands. However, the slight decline in net income and operating income highlights the competitive and challenging nature of the diagnostics market. Investors and analysts will likely monitor how the company's strategic investments in technology and efficiency measures continue to evolve in response to these challenges.

The company will discuss these results and more in detail during their quarterly conference call, accessible both via phone and webcast, providing an opportunity for investors to gain deeper insights into the companys strategies and market conditions.

For further details and continuous updates on Quest Diagnostics, investors and interested parties are encouraged to view additional financial documents and statements available on the Quest Diagnostics website under the investor relations section.

Explore the complete 8-K earnings release (here) from Quest Diagnostics Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance