Quest Diagnostics (DGX) Q1 Earnings Top Estimates, Margins Down

Quest Diagnostics Incorporated’s DGX first-quarter 2024 adjusted earnings per share (EPS) of $2.04 beat the Zacks Consensus Estimate by 9.7%. However, the metric came in line with the year-ago adjusted figure.

Certain one-time expenses, like the ones related to amortization expenses, certain restructuring and integration charges, other expenses and excess tax benefits associated with stock-based compensations, were excluded from the quarter’s adjusted figures.

GAAP earnings came in at $1.72 per share, down 3.4% from the last year’s comparable figure.

Quarterly Details

Revenues reported in the first quarter rose 1.5% year over year to $2.37 billion. The metric exceeded the Zacks Consensus Estimate by 3.3%.

Diagnostic Information Services revenues in the quarter were up 1.7% on a year-over-year basis to $2.30 billion. This figure compares with our model’s projection of $2.21 billion for the first quarter.

Volumes (measured by the number of requisitions) were up 1.6% year over year in the first quarter. Revenue per requisition increased 0.1% year over year.

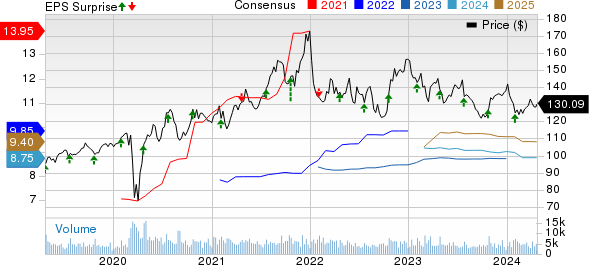

Quest Diagnostics Incorporated Price, Consensus and EPS Surprise

Quest Diagnostics Incorporated price-consensus-eps-surprise-chart | Quest Diagnostics Incorporated Quote

Margins

The cost of services during the reported quarter was $1.60 billion, up 2.2% year over year. The gross profit came in at $771 million, similar to the first-quarter 2023 figure. The gross margin was 32.6%, reflecting a 49-basis point (bps) contraction from the year-ago figure.

SG&A expenses increased 0.2% to $440 million in the quarter under review. The adjusted operating margin of 14% represented a 25 bps contraction year over year.

Cash, Capital Structure and Solvency

Quest Diagnostics exited the first quarter of 2024 with cash and cash equivalents of $474 million compared with $686 million at the end of 2023. The cumulative net cash provided by operating activities at the end of the first quarter of 2024 was $154 million compared with $94 million at the end of the first quarter of 2023.

The company has a five-year annualized dividend growth rate of 7.48%.

Guidance

Quest Diagnostics provided an updated full-year 2024 guidance.

Revenues for the full year are expected in the $9.40 billion-$9.48 billion band (previously $9.35 billion to $9.45 billion). The Zacks Consensus Estimate is pegged at $9.39 billion.

Adjusted EPS is expected in the range of $8.72-$8.97 (previously $8.60 to $8.90). The Zacks Consensus Estimate for the metric is pegged at $8.75.

Our Take

Quest Diagnostics reported better-than-expected earnings and revenues in the first quarter of 2024. The company achieved its revenue growth for the first time since the height of the pandemic nearly three years ago. Investments in advanced diagnostics enabled double-digit growth within multiple key clinical areas, including brain health, women's health and advanced cardiometabolic health, which is highly encouraging.

Furthermore, Quest Diagnostics’ Invigorate initiative, which includes ongoing investments in automation and AI, continued to improve productivity, as well as service levels and quality. Leveraging its strong commercial focus on physicians and hospitals, along with a broad health plan access, the company capitalized on sustained high rates of healthcare utilization to drive new customer growth. A raised financial outlook for the full year bodes well for the stock.

Meanwhile, the contraction of margins during the quarter is discouraging.

Zacks Rank and Key Picks

Quest Diagnostics currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space are Inspire Medical Systems INSP, Insulet PODD and Exact Sciences EXAS.

Inspire Medical Systems, sporting a Zacks Rank #1 (Strong Buy), reported a fourth-quarter 2023 EPS of 49 cents, which beat the Zacks Consensus Estimate of a loss of 4 cents. Revenues of $192.5 million topped the consensus estimate by 0.1%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Inspire Medical Systems has an estimated earnings growth rate of 51.4% in 2024 compared with the industry’s 19.4%. The company’s earnings surpassed estimates in each of the trailing four quarters, the average being 353.6%.

Insulet, carrying a Zacks Rank #2 (Buy), reported a fourth-quarter 2024 adjusted EPS of $1.40, which surpassed the Zacks Consensus Estimate by 108.9%. Revenues of $509.8 million outpaced the Zacks Consensus Estimate by 10.8%.

PODD has an estimated long-term earnings growth rate of 18.1% compared to the industry’s 11.4%. The company surpassed earnings estimates in each of the trailing four quarters, the average being 100.1%.

Exact Sciences, carrying a Zacks Rank #2, reported a fourth-quarter 2024 loss of 27 cents per share, narrower than the Zacks Consensus Estimate of a loss of 53 cents. Revenues of $646.9 million topped the Zacks Consensus Estimate by 2.4%.

EXAS has an estimated earnings growth rate of 23.9% in 2024 compared with the industry’s 13% growth. The company’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 51.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quest Diagnostics Incorporated (DGX) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report

Exact Sciences Corporation (EXAS) : Free Stock Analysis Report

Inspire Medical Systems, Inc. (INSP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance