Quaker Houghton Q1 2024 Earnings: Aligns Closely with Analyst Projections

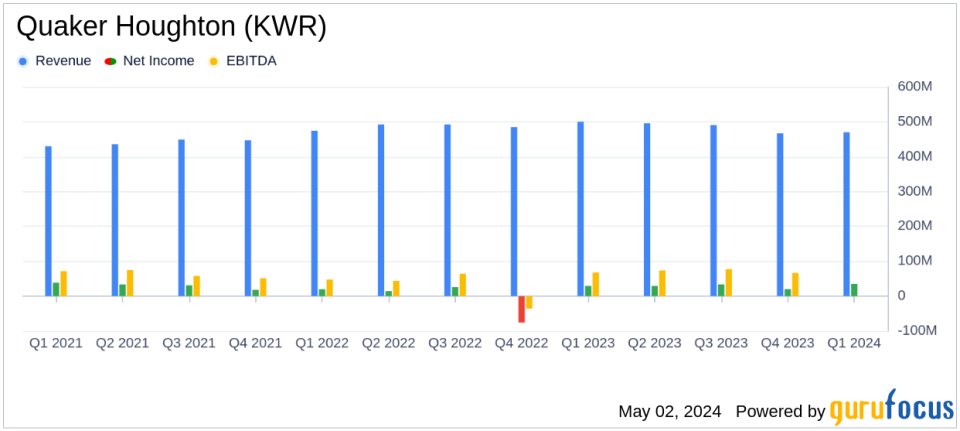

Revenue: Reported $469.8 million, a decrease of approximately 6% year-over-year, falling short of estimates of $494.52 million.

Net Income: Achieved $35.2 million, aligning closely with estimates of $35.25 million.

Earnings Per Share (EPS): Recorded at $1.95 per diluted share, slightly below the estimate of $1.99.

Gross Margin: Improved by 400 basis points compared to the previous year, marking the 7th consecutive quarterly year-over-year increase.

Adjusted EBITDA: Increased to $83.3 million, up 6% from $78.8 million in Q122.

Operating Cash Flow: Generated $27.2 million, a decrease from $37.8 million in the same period last year.

Non-GAAP Net Income: Reported at $37.7 million with non-GAAP EPS of $2.09, both showing improvements from the previous year.

On May 2, 2024, Quaker Houghton (NYSE:KWR) released its 8-K filing, announcing the financial results for the first quarter of 2024. The company, a global leader in industrial process fluids, reported net sales of $469.8 million and net income of $35.2 million, with earnings per diluted share standing at $1.95. These figures align closely with analyst expectations, which projected earnings per share of $1.99 and net income of $35.25 million.

Company Overview

Quaker Houghton manufactures and sells a diverse range of industrial process fluids. Its product portfolio includes metal removal fluids, cleaning fluids, corrosion inhibitors, and many other specialty chemicals. The company operates through geographic segments in America, EMEA, Asia/Pacific, and Global Specialty Businesses, with the majority of its revenue generated from the Americas.

Performance Insights

The results for Q1 2024 reflect a slight decline in net sales compared to the previous year, primarily due to a decrease in selling price and product mix, alongside a modest decline in sales volumes. This was partially offset by improved volumes in the Asia/Pacific segment and new business wins across all segments. Despite these challenges, the company managed to increase its net income and earnings per share year-over-year, from $29.5 million and $1.64 respectively in Q1 2023.

Quaker Houghton's adjusted EBITDA for the quarter was $83.3 million, marking a 6% increase from $78.8 million in Q1 2023. This growth is attributed to a 400 basis point improvement in gross margins, marking the seventh consecutive quarterly year-over-year increase. This consistent margin enhancement underscores the company's operational efficiency and its ability to manage costs effectively.

Segment Performance

The Americas and EMEA segments experienced a decrease in net sales due to lower sales volumes and adverse selling price and product mix, which were influenced by index-based customer contracts. However, the Asia/Pacific segment saw an increase in sales, driven by a significant improvement in sales volumes, showcasing resilience in diverse market conditions.

Financial Position and Outlook

Quaker Houghton's cash flow generation remains robust, with $27.2 million generated from operating activities during the quarter. The company's total gross debt stood at $769.6 million, with cash and cash equivalents of $195.8 million, resulting in net debt of approximately $573.8 million. The net debt to adjusted EBITDA ratio was approximately 1.8x, indicating a healthy balance sheet that supports ongoing and future business operations.

CEO Andy Tometich expressed confidence in the company's strategy and its positioning for 2024, emphasizing ongoing investments to enhance operational performance and create long-term shareholder value. Despite a dynamic global macroeconomic environment, the company is poised for volume and earnings growth, leveraging its differentiated portfolio and strong market presence.

Conclusion

Quaker Houghton's first quarter results of 2024 demonstrate a solid financial performance, aligning closely with market expectations. The company's strategic focus on operational efficiency and market expansion continues to bear fruit, positioning it well for sustained growth amidst fluctuating global market conditions.

Explore the complete 8-K earnings release (here) from Quaker Houghton for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance