Qorvo (QRVO) Q4 Earnings Beat Estimates, Revenues Rise Y/Y

Qorvo Inc. QRVO reported fourth-quarter fiscal 2020 non-GAAP earnings of $1.57 per share, which increased 28.7% on a year-over-year basis. The figure surpassed the Zacks Consensus Estimate by 18.9%. However, earnings declined 15.6% sequentially.

Revenues on a non-GAAP basis fell 9.4% sequentially but increased 15.7% year over year to $787.8 million. Further, the top line outpaced the consensus mark by 2.5%.

The results can be attributed to improvement in Infrastructure and Defense (IDP) as well as strong demand for Mobile Products (MP). Moreover, the company benefited from broad-based demand in 5G handsets, Wi-Fi 6 and IoT products.

Notably, shares have returned 34.2% in the past year, outperforming the industry’s rally of 18.5%.

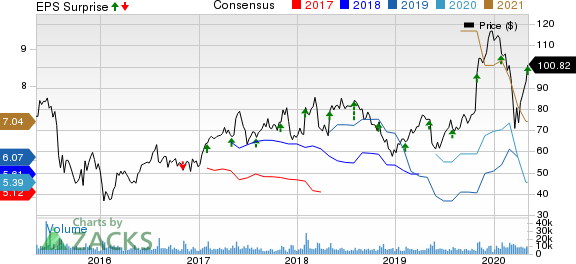

Qorvo Inc Price, Consensus and EPS Surprise

Qorvo Inc price-consensus-eps-surprise-chart | Qorvo Inc Quote

Quarter Details

Segment-wise, mobile products (MP) revenues were $556 million that fell 16% sequentially but rallied 25.5% year over year. Notably, revenues exceeded the company’s expectations, driven by strong mobile and handset demand. Impact of global supply chain disruptions due to COVID-19 was also less than initially expected.

During the fiscal fourth quarter, the company witnessed robust traction for its 5G and LTE-Advanced Pro solutions. These are highly integrated and high performance solutions, which enable customers to reduce product footprint and accelerate products to market.

Additionally, Qorvo’s ultra-high-band solutions are being adopted by all leading 5G chipsets. Notably, the company’s mid-high-band and ultra-high-band 5G solutions were adopted by Samsung to support its Galaxy S20 platform during the fiscal fourth quarter.

Further, the acquisition of Decawave and integration of its radio technology has significantly expanded Qorvo’s capabilities and well positioned it to benefit from growing demand for proximity awareness, secure payments as well as secure access for smartphones, automotive and IoT.

IDP revenues declined 2.5% year over year to $232 million. However, revenues increased 12.1% sequentially primarily owing to infrastructure and Wi-Fi growth.

Notably, shipments of gallium nitride or GaN high-power amplifiers and small signal components improved during the quarter, driven by increasing deployment of massive MIMO antennas.

In the connectivity and broadband business, the company increased shipments of Wi-Fi 6 solutions and secured multiple cable amplifier design wins to support increased need for data to the home due to COVID-19 induced lockdowns. Notably, Qorvo expanded its global customer base for Wi-Fi 6 solutions, which includes front-end modules (FEM) and BAW filters, during the quarter.

In defense, the company expanded its portfolio of GaN-based solid state amplifiers for millimeter wave applications, including SATCOM radar and electronic warfare, with the launch of broadband 100 and 130 millimeter to 131 millimeter wave power amplifiers. Moreover, the acquisition of Custom MMIC enhanced Qorvo’s capabilities in the defense end-market.

In the programmable power management business, the company’s programmable ICs enjoyed solid momentum driven by robust growth in data center, computing and gaming consoles.

Operational Details

Non-GAAP gross margin expanded 140 basis points (bps) from the year-ago quarter’s tally to 49.6%. This can be attributed to lower manufacturing cost and favorable product mix.

Non-GAAP operating expenses increased 12.6% year over year to $181 million, due to acquisition related expenses.

Non-GAAP operating margin expanded 220 bps from the year-ago quarter’s level to 26.8%.

Balance Sheet & Cash Flow

As of Mar 28, 2020, cash and cash equivalents were $714.9 million compared with $1.09 billion reported as of Dec 28, 2019. Long-term debt was $1.567 billion compared with $1.569 billion in the prior quarter.

Net cash provided by operating activities was $214.3 million compared with $300.8 million in the previous quarter. Free cash flow during the reported quarter came in at $179.2 million, compared with $260.1 in the prior quarter.

During the fourth quarter, the company repurchased shares worth $125 million under the share repurchase program.

Guidance

For first-quarter fiscal 2021, Qorvo anticipates revenues between $710 million and $750 million. The Zacks Consensus Estimate for revenues is pegged at $698.7 million, which indicates decline of 9.9% from the year-ago quarter’s figure.

The guidance range for revenues is wider than normal due to COVID-19 induced uncertainties prevailing in the market. However, consistent growth in mobile 5G and infrastructure is anticipated to drive performance in first-quarter fiscal 2021.

Non-GAAP earnings are projected to be $1.13 per share at the mid-point. The consensus mark for earnings is currently pegged at $1.02, which indicates a decline of 25% from the prior-year quarter’s reported quarter.

Non-GAAP gross margin is anticipated to be 47.5%.

Zacks Rank & Stocks to Consider

Currently, Qorvo carries a Zacks Rank #3 (Hold).

Cogent Communications Holdings, Inc. CCOI, NeoPhotonics Corporation NPTN and InterDigital, Inc. IDCC are some better-ranked stocks worth considering in the broader computer and technology sector, each flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for NeoPhotonics and InterDigital is pegged at 15% each, while the same for Cogent is pegged at 11.46%.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

InterDigital Inc (IDCC) : Free Stock Analysis Report

Cogent Communications Holdings Inc (CCOI) : Free Stock Analysis Report

Qorvo Inc (QRVO) : Free Stock Analysis Report

NeoPhotonics Corporation (NPTN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance