Proto Labs Inc (PRLB) Q1 2024 Earnings: Beats on EPS Estimates, Surpasses Revenue Forecasts

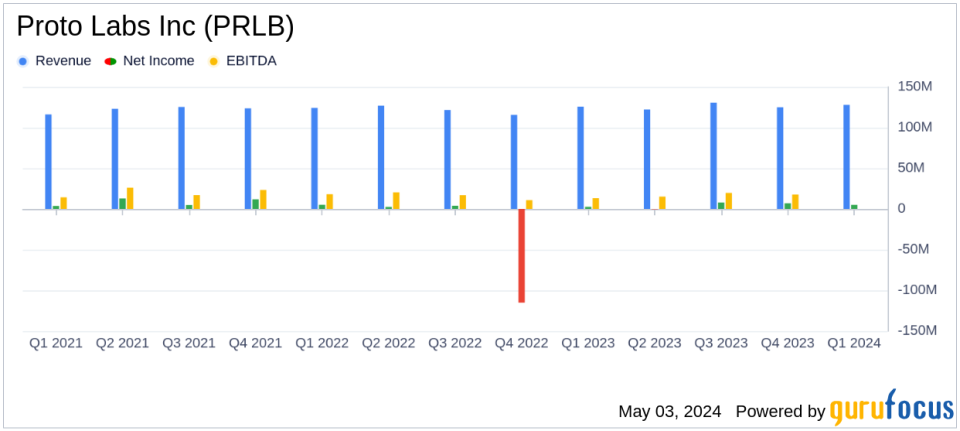

Revenue: Reported at $127.9 million, up 1.6% year-over-year, slightly exceeding the estimated $124.68 million.

Net Income: Reached $5.3 million, significantly below the estimated $8.04 million.

Earnings Per Share (EPS): Non-GAAP EPS was $0.40, beating the estimated $0.31; GAAP EPS was $0.20.

Gross Margin: Improved to 44.9% from 42.7% in the previous year, indicating enhanced profitability.

Protolabs Network Revenue: Grew by 38.9% to $23.9 million, highlighting strong segment performance.

Operational Efficiency: Adjusted EBITDA rose to $20.2 million, or 15.8% of revenue, compared to $17.8 million, or 14.1% of revenue, in the prior year.

Capital Return: Repurchased $16.0 million of common stock, equivalent to 85% of free cash flow, demonstrating a commitment to returning value to shareholders.

On May 3, 2024, Proto Labs Inc (NYSE:PRLB), a leader in digital manufacturing services, released its 8-K filing, revealing the financial outcomes for the first quarter ended March 31, 2024. The company reported a total revenue of $127.9 million, slightly above the analyst's expectation of $124.68 million, marking a 1.6% increase from the previous year. Further, the adjusted earnings per share (EPS) stood at $0.40, topping the estimated $0.31.

Proto Labs, recognized for its rapid manufacturing of custom prototypes and on-demand production parts, utilizes advanced technologies such as injection molding, CNC machining, and 3-D printing. The company primarily serves the U.S. market, providing significant solutions across various stages of product development and manufacturing.

Financial and Operational Highlights

The first quarter saw Proto Labs achieving a net income of $5.3 million, a notable improvement from $2.7 million in the same quarter of the previous year. The non-GAAP net income also rose to $10.4 million, or $0.40 per diluted share, compared to $7.9 million, or $0.30 per diluted share, in the first quarter of 2023. This increase is attributed to higher revenue per customer contact, which grew by 5.3% year-over-year to $5,693, and a robust gross margin of 44.9%.

President and CEO Rob Bodor commented on the results, emphasizing the company's strong financial and operational performance and its ongoing commitment to driving profitable growth throughout 2024. CFO Dan Schumacher highlighted the role of increased order growth and performance in higher-margin Factory business as key drivers behind the positive outcomes.

Challenges and Strategic Focus

Despite the positive revenue growth, Proto Labs faced challenges in meeting the GAAP EPS estimates, which could be attributed to varying operational costs and investments in technology upgrades. The company's strategic focus remains on expanding its customer base and increasing order sizes through its hybrid manufacturing model, aiming to enhance overall profitability and shareholder value.

Future Outlook and Investor Relations

Looking ahead to the second quarter of 2024, Proto Labs expects revenue to range between $122 million and $130 million. The projected EPS is set between $0.11 and $0.19 for GAAP and between $0.30 and $0.38 for non-GAAP measures. These projections reflect the company's cautious optimism about its operational efficiency and market demand.

The company also continues its commitment to returning capital to shareholders, having repurchased $16.0 million of common stock in the quarter, which represents 85% of the free cash flow.

Proto Labs has scheduled a conference call to discuss these results and provide more detailed insights into its future strategies. Interested parties can access the call through the investor relations section of the Proto Labs website or directly via the provided link.

For detailed financial figures and further information, refer to the full earnings release and financial statements available in the 8-K filing.

Explore the complete 8-K earnings release (here) from Proto Labs Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance