Property tycoon playboy sued by investors

Self-confessed property tycoon Ricky Dean Hirsch, whose company was collapsed after it was banned from operating in WA, could be set to lose his multimillion-dollar beachfront mansions over unpaid loans.

Prime Capital Securities Pty Ltd is suing Ricky Hirsch – of the failed FTD Construction – after he allegedly failed to meet repayments of more than $5 million.

In two writs lodged this week in the in the WA Supreme Court, Prime Capital Securities alleges it loaned FTD Construction a total of $4,085,500 in July 2021.

Mr Hirsch had used his properties, 42 and 42a West Coast Drive, as collateral.

However, the business lender claims Mr Hirsch’s company – which falls under the now defunct company umbrella of Fulfil The Dream – had failed to pay interest and fees on the loan.

FTD and Mr Hirsch were given two written demands on in February 2023, which stated Prime Capital Securities were seeking more than $414,000 in accrued repayments after FTD allegedly breached its loan plan.

Mr Hirsch had originally agreed to use his two properties as guarantee to the loan.

By defaulting, he would be forced to vacate the two mansions in order for Prime Capital Securities to recoup its money.

However, when both FTD and Mr Hirsch allegedly failed to make any repayments on the loan by November 2023, Prime Capital Securities informed both parties it was cancelling the initial agreements.

The new written notices were demanding the repayment of the initial loan plus ongoing interest and fees, which totalled more than $5 million.

Prime Capital Securities has now taken its legal battle to the Supreme Court after it allegedly failed to receive a single cent from Mr Hirsch or his company.

The Perth-based developer is 100 per cent owned by its sole director, Mr Hirsch.

The business went into liquidation in January, with Mathieu Tribut from GTS Advisory appointed as liquidator.

In a statement last September, Building Services Board said it was refusing to renew its registration because it was not satisfied FTD met financial, management and supervision requirements for registration.

It’s understood Mr Hirsch is currently overseas.

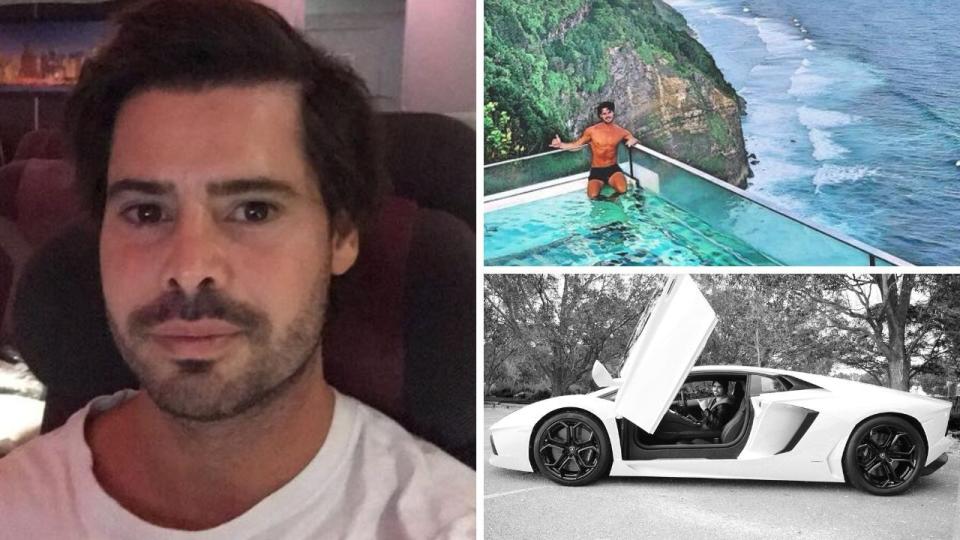

His social media has shown his adventurous playboy lifestyle across the globe.

Yahoo Finance

Yahoo Finance