Property sellers cut prices to force through sales but hopes of tax saving evaporate

Sellers have cut asking prices on homes for the second month in a row as the possibility of completing before the March stamp duty holiday deadline all but disappears.

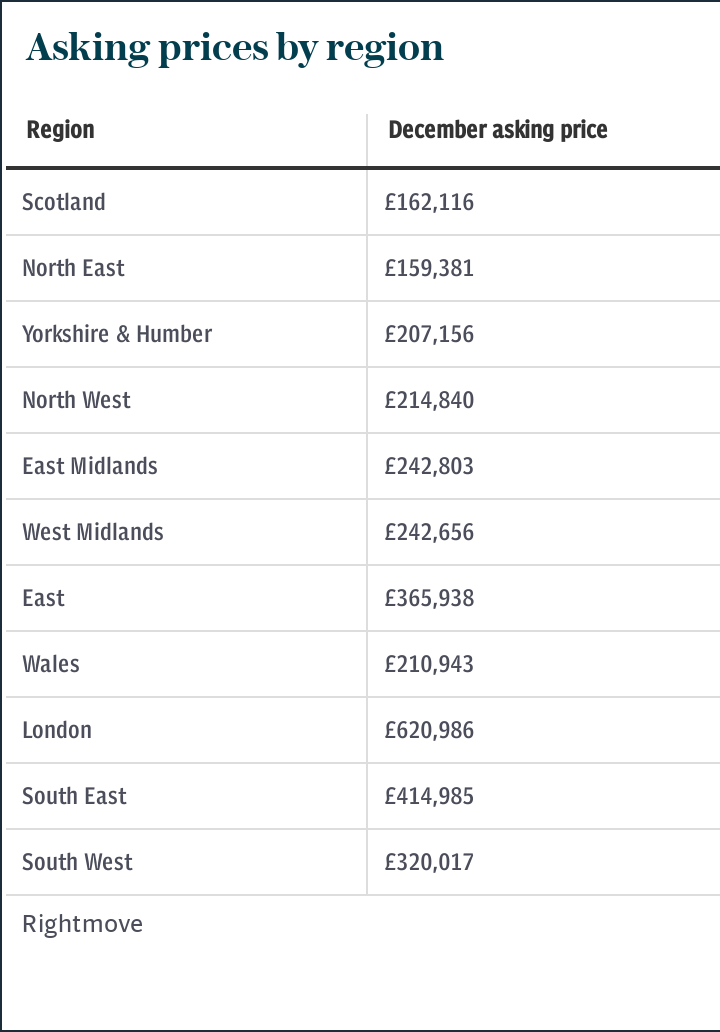

Asking prices in December fell by 0.6pc and was the second consecutive month of decline. However, price tags are still 6.6pc higher than 2019, according to property website Rightmove.

The average asking price in December was £319,945, a £19,920 jump compared with this time last year, but a £2,080 fall from November.

The price drop was most pronounced at the top of the market, where buyers benefit the most from the tax break. Sellers of four-bedroom detached houses or properties with five bedrooms or more cut asking prices by 1.4pc last month. Prices were still up 7.6pc over 12 months, but the shift suggested the boost of the tax break has begun to fade.

Meanwhile, asking prices on entry-level properties (two-bedrooms or less) dipped by 0.1pc month-on-month. First-time buyers do not benefit from the stamp duty break because they already had an exemption up to £300,000.

In July, Chancellor Rishi Sunak temporarily raised the nil-rate stamp duty band to £500,000, meaning buyers save up to £15,000 if they complete their purchase by March 31 2021. Around 130,000 sales were agreed in the last month, a 44pc jump on the same period in 2019.

In total, there are now 650,000 sales in the pipeline. This backlog means completed transactions at the beginning of next year will be strong, Rightmove said. The number of prospective buyers contacting estate agents in the last month was 53pc up on the same period last year.

This is despite the decreasing likelihood of a sale agreed now being completed in time for the tax holiday. Delays to local authority searches, mortgage processing times and conveyancing mean many transactions are taking longer than normal.

Tim Bannister, of Rightmove, said: “There’s likely to be a lull after April unless the stamp duty holiday is extended, but for many buyers its removal will not be make or break.”

It may, however, lead them to reduce their offers to compensate, said Mr Bannister. “Many sellers may be prepared to help to mitigate their buyer’s financial loss.

In the year to date in 2020, the number of properties coming to market was down 0.6pc on the same period in 2019, while the number of sales agreed was up 8.3pc.

As a consequence the number of available properties for sale is at a record low, Rightmove said. Therefore despite the looming uncertainties of Brexit and rising unemployment, there is still capacity for modest price growth next year.

Yahoo Finance

Yahoo Finance