House prices expected to rebound in July 2021 – except in Melbourne

Economists from the Commonwealth Bank of Australia are feeling more positive about Australia’s property market and are now predicting a “solid recovery” in the second half of 2021.

Former CBA forecasts from April predicted house prices would fall 10 per cent.

But this figure has been revised upwards in light of the modest fall in home values so far despite the “extraordinary negative economic shock”.

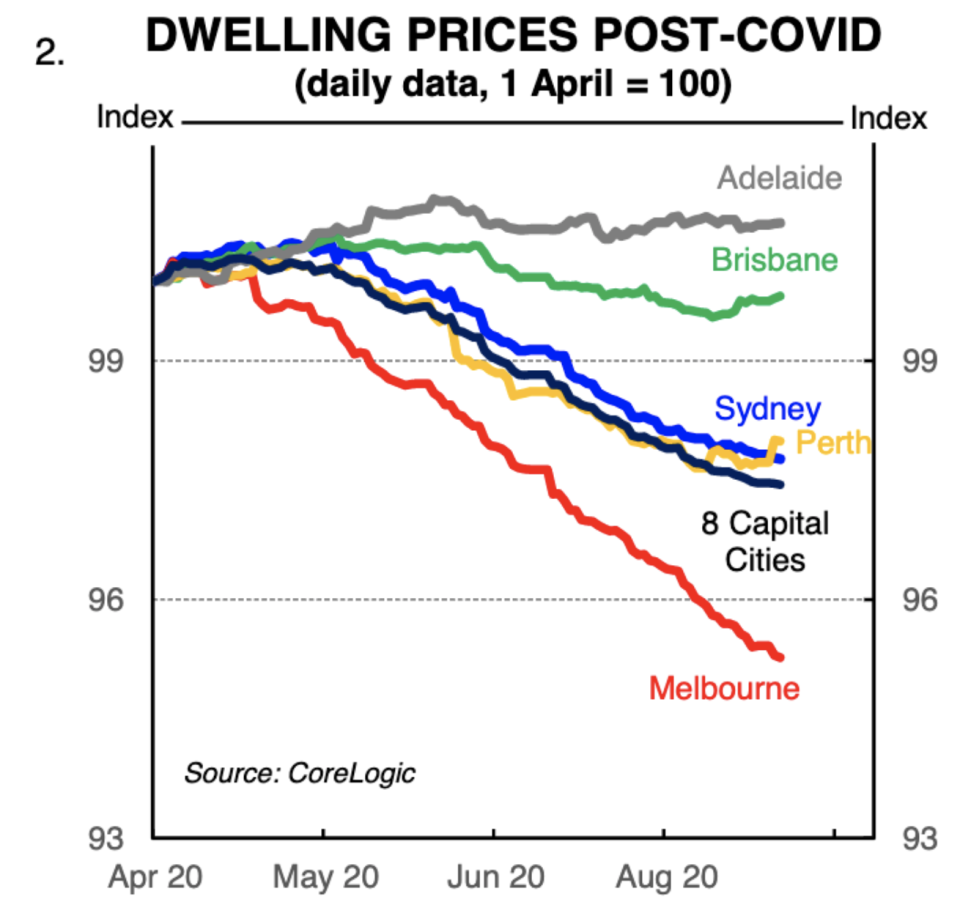

According to CBA head of Australian economics Gareth Aird, two key themes stand out: the fall in house prices has been much smaller than expected, while the variation between the capital cities has been greater than expected.

“Parking the Melbourne issues to one side, what has genuinely surprised us is the resilience of house prices in some of the other capital cities considering the negative shock to labour markets around the country,” Aird said in a research note.

While house prices are expected to continue to soften, the CBA economists now expect a peak-to-trough fall of 6 per cent rather than 10 per cent.

And this trough is now expected to hit the first quarter of 2021, rather than the end of 2020 as previously anticipated. House prices will plateau between March and June of 2021, and then begin rising from July.

“Our forecast is for solid price growth in the second half of 2021 as the economic recovery gains traction and incredibly low interest rates once again become the dominant influence on dwelling prices.

“We expect a much larger disparity between outcomes by capital city than initially forecast,” Aird added.

“For example, we have forecast a fall in Melbourne property prices of 12 per cent from April 20 to Q1 2021, whilst prices are expected to increase modestly in Hobart and the ACT over that period.”

Melbourne’s property market has undoubtedly been significantly hampered by the severe lockdowns.

“The reason for Melbourne’s underperformance is obvious – the stage 3 and stage 4 lockdowns from July,” he said.

“It is clear that had Melbourne not gone back into lockdown price falls would be more modest.”

Interest rates ‘single most important driver’

Aird revealed that the cost of borrowing would again be the biggest factor in driving house prices as unemployment and falling rent eases next year.

“The RBA has tended to play down the influence of monetary policy decisions on dwelling prices. But we believe that changes in interest rates are the single most important driver of real property prices over the longer run,” Aird said.

Reserve Bank governor Philip Lowe has also indicated that the official interest rate, which is currently at 0.25 per cent, will remain very low for the next couple of years to come.

And as Australians return to more normal levels of income and spending, with interest rates remaining low, the idea of purchasing a property may be more attractive.

“Lower interest rates increase the demand for dwellings for both owner-occupiers and investors and they influence the price at which buyers and sellers will transact.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, economy, property and work news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance