Primoris' (PRIM) $200M Renewables Contracts Boost Backlog

Primoris Services Corporation PRIM won two renewables contracts worth $200 million within its Energy segment.

One of these contracts is for a carbon capture utilization and storage pipeline project located in the Midwest, slated to begin in the second quarter of 2024. The contract will broaden PRIM’s pipeline projects’ scope to better align with the ongoing energy transition.

The other contract’s scope includes engineering, procurement and construction of a utility-scale solar facility in the Southwest. This is expected to begin in third-quarter 2023, with projected completion in third-quarter 2024.

Tom McCormick, president and chief executive officer of PRIM, stated, “These awards add over $200 million to the more than $3 billion of backlog the Energy Segment started with in 2023.”

Shares of Primoris inched up 0.08% in the after-hour trading session on Apr 19.

Continuous Contract Flow: A Boon

Primoris — a Zacks Rank #3 (Hold) company — has been reaping benefits from strong project execution in the Energy segment, which accounted for 40.3% of its 2022 total revenues.

In early 2023, Primoris won multiple solar projects worth $290 million. These contracts expand the company’s presence in new geographies and diversifies its scope of work with smaller utility-scale solar projects.

It is to be noted that solar projects continue to drive the Energy segment. This segment’s revenues increased 48.2% in 2022. The upside was backed by a $430.1-million rise in renewable energy activity, a $106.4-million contribution from the PLH acquisition, and increased project work on electric power and hydrogen plants. The gross margin also rose 140 basis points in 2022 primarily on solid contributions from higher margin solar projects, a favorable mix of industrial projects and a decrease in the impacts of higher costs associated with a liquified natural gas plant project in the Northeast experienced in 2021.

Total backlog at 2022-end was $3,165 million, including $3,003 million as Fixed and $162 million as MSA.

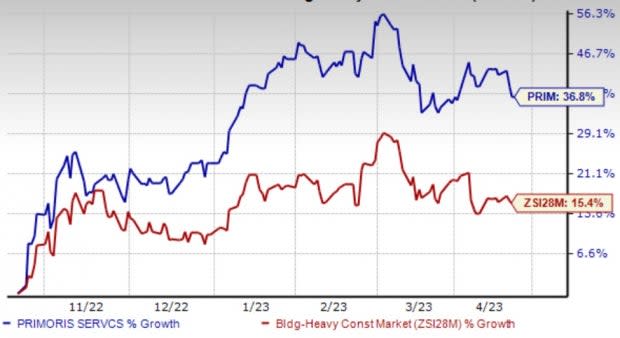

Image Source: Zacks Investment Research

Shares of this leading specialty contractor have outperformed the Zacks Building Products - Heavy Construction industry in the past six months. The company has been benefiting from solid performances across its segments. Biden’s renewable energy drive is also expected to boost the company’s growth.

Some Better-Ranked Stocks in the Construction Sector

EMCOR Group EME, a Zacks Rank #2 (Buy) company at present, has been benefiting from double-digit growth across the U.S. segments, resilient end markets, solid RPOs and bolt-on acquisitions.

The consensus mark for EME’s 2023 earnings suggests 9.2% year-over-year growth.

Altair Engineering Inc. ALTR has a trailing four-quarter earnings surprise of 135.8%, on average. The Zacks Consensus Estimate for ALTR’s 2023 sales and EPS indicates growth of 7.8% and 11.2%, respectively, from the previous year’s reported levels.

ALTR currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AECOM ACM carries a Zacks Rank #2 at present. ACM has a trailing four-quarter earnings surprise of 5.2%, on average.

The Zacks Consensus Estimate for ACM’s fiscal 2023 sales and EPS indicates growth of 3.9% and 5.8%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Altair Engineering Inc. (ALTR) : Free Stock Analysis Report

AECOM (ACM) : Free Stock Analysis Report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

Primoris Services Corporation (PRIM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance