Price & Time: What Is GBP Volume Telling Us?

DailyFX.com -

Talking Points

USD/JPY nearing key support

NZD/USD stalls at trendline

GBP/USD OBV falling sharply

Get real time volume on your charts for free. Click HERE

Foreign Exchange Price & Time at a Glance:

Price & Time Analysis: USD/JPY

ChartPrepared by Kristian Kerr

USD/JPY stalled out last week near the mid-June highs

Our near-term trend bias is higher in the exchange rate while above 122.20

A daily close above the 78.6% retracement of the June - July decline at 124.70 is needed to re-instill upside momentum into the rate

A very minor turn window is eyed here

A close under 122.20 would turn us negative on USD/JPY

USD/JPY Strategy: Like the long side while over 122.20

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

USD/JPY | *122.20 | 123.00 | 123.35 | 124.00 | *124.70 |

Price & Time Analysis: NZD/USD

ChartPrepared by Kristian Kerr

NZD/USD failed last week at trendline connecting the April/June highs near .6700

Our near-term trend bias is lower in the bird while below .6700

A move back under .6500 is needed to re-instill downside momentum into the exchange rate and set the stage for a test of the Fibonacci attraction just under .6400

A very minor turn window is seen today

A daily close above .6700 would turn us positive on the kiwi

NZD/USD Strategy: Like the short side while below .6700

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

NZD/USD | *.6500 | .6540 | .6610 | .6660 | *.6700 |

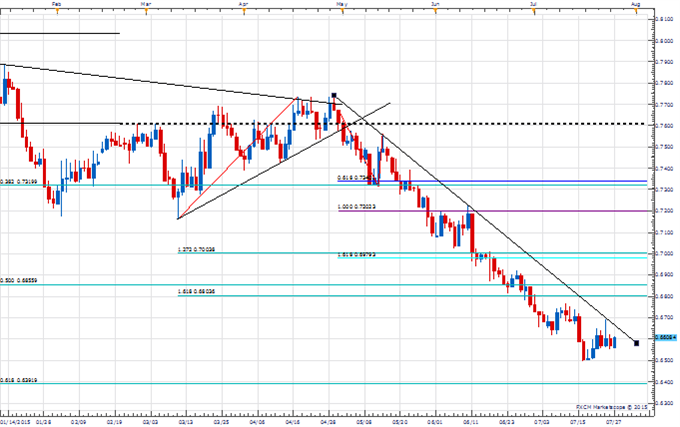

Focus Chart of the Day: GBP/USD

The idea that “volume precedes price” is a key concept of technical analysis. This has always been a source of contention for FX traders as the decentralized nature of the currency market made trading with volume all but impossible (unless one worked at a bank and had access to EBS/Reuters data). FXCM helped address this discrepancy last year with the introduction of real time volume figures and analytics. While not a large sample size, the result of having this extra bit of analytics has been quite useful. GBP/USD has been especially interesting as daily On-Balance Volume (essentially a running tally of volume flow) has done a good job of pinpointing various inflection points. For instance, last year’s high and the high last month were preceded by pretty clear OBV divergences. All this brings me to the point of this note today as daily OBV in cable has fallen rather dramatically over the past few weeks to new lows for the year. Is volume preceding price?

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter @KKerrFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance