Price & Time: European Déjà Vu

DailyFX.com -

Talking Points

EUR/USD fills weekend gap again

GBP/USD inching its way back towards 200-day moving average

USD/JPY falls to multi-week lows

Get real time volume on your charts for free. Click HERE

Foreign Exchange Price & Time at a Glance:

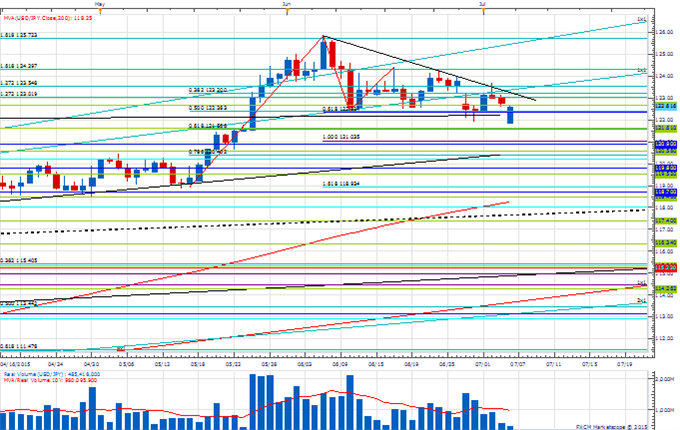

Price & Time Analysis: USD/JPY

ChartPrepared by Kristian Kerr

USD/JPYtraded to its lowest level since late May this morning before rebounding aggressively

Our near-term trend bias is lower in USD/JPY while below 124.40

The December/March closing highs around 121.40 remain an important downside attraction

A very minor turn window is eyed tomorrow

A close back over 124.40 would turn us positive on rate

USD/JPY Strategy: Like the short side while below 124.40

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

USD/JPY | *121.40 | 121.80 | 122.60 | 123.20 | *124.40 |

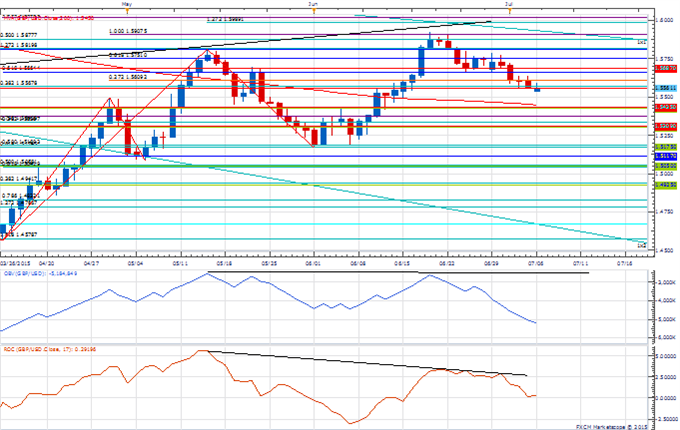

Price & Time Analysis: GBP/USD

ChartPrepared by Kristian Kerr

GBP/USDhas come under steady pressure since failing at the 50% retracement of the 2014-2015 decline at 1.5875 last month

Our near-term trend bias is lower in the pound while below 1.5790

The 200-day moving average around 1.5460 is a key pivot with weakness below needed to confirm that a more important move lower is underway

A minor turn window is seen on today

A daily close back above 1.5790 would turn us positive again on GBP/USD

GBP/USD Strategy: Like selling on strength against 1.5790.

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

GBP/USD | *1.5460 | 1.5535 | 1.5570 | 1.5675 | *1.5790 |

Focus Chart of the Day: EUR/USD

It was déjà vu all over again as EUR/USD started the week by gapping lower in response to adverse news from Greece before then rallying to fill the gap within a few hours. A cynic might say it all has a bit of a “managed response” feel about it. Whatever the case may be the near near-term levels of importance for the euro are now pretty well defined. On the downside, the lows from today and last week at 1.0967 and 1.0952 are clearly psychologically significant and a gateway to the more significant May low at 1.0820 (below which would confirm that the broader downtrend is resuming in the exchange rate). On the upside, the 50-day moving average and the top end of a median line channel coincide around 1.1180. Traction above there would warn that a low of some importance is in place. It is “wait and see” until then, but our bias remains lower while 1.1180 holds.

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter @KKerrFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance