Price & Time: End of Month is Key For Gold

Talking Points

Several Fibonacci timing relationships converging next week in the metal

EUR/USD in consolidation mode below key level

USD/CAD nearing key resistance zone

New to Currency Trading? Learn More HERE

Foreign Exchange Price & Time at a Glance:

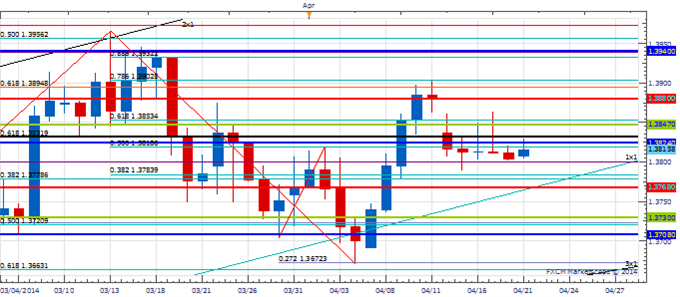

Price & Time Analysis: EUR/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

EUR/USD has traded in a sideways to lower range since failing earlier in the month at the 78.6% retracement of the March to April decline in the 1.3900 area

Our near-term trend bias is positive in the Euro while over 1.3730

A move through 1.3900 is required to signal that a new move higher is underway

A very minor cycle turn window is seen today

Only weakness below the 2nd square root relationship of the year’s high at 1.3730 would turn us negative on the Euro

EUR/USD Strategy: Looking to buy on weakness against 1.3730.

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

EUR/USD | *1.3730 | 1.3760 | 1.3815 | *1.3900 | 1.3930 |

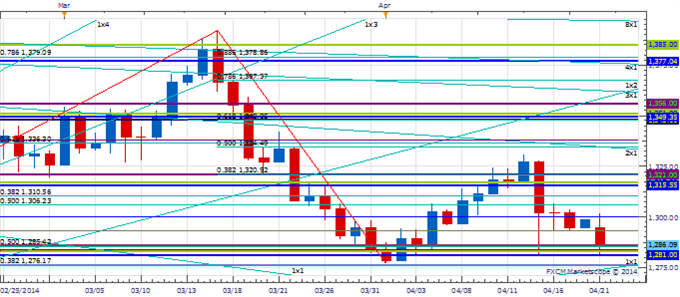

Price & Time Analysis: USD/CAD

Charts Created using Marketscope – Prepared by Kristian Kerr

USD/CAD has moved steadily higher since finding support at the 4th square root relationship of the year’s high in the 1.0855 area earlier in the month

Our near-term trend bias is higher in Funds while above 1.0910

Interim resistance is eyed around 1.1030, but a more important pivot come into play at a key Gann/Fibonacci convergence in the 1.1055/65 region

Minor cycle turn windows are seen tomorrow and at the end of the week

A move under 1.0910 would turn us negative on the exchange rate

USD/CAD Strategy: Like being square. May look to buy on weakness later in the week.

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

USD/CAD | *1.0910 | 1.0960 | 1.1015 | 1.1030 | *1.1065 |

Focus Chart of the Day: GOLD

The compression in volatility in the FX space is making cycle analysis much more challenging as identifying what is a significant swing point in such an environment is extremely difficult. The good news is that historically such low levels of vol are usually followed by periods of high vol as it reverts to its mean. The second half of 2014 should see volatility pick up if history repeats. For the meantime, we will focus on markets with the clearer cyclical picture. Gold has fit this bill since peaking during a key cycle turn window back in mid-March. The recent month-to-date high in the metal also came just after an important turn window. The next couple of days look to be a minor cyclical pivot for the XAU/USD, but the real window of focus is around the middle of next week as a couple of Fibonacci time relationships will be converging at this time. Continued weakness into this period would likely set up an important low.

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter @KKerrFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance