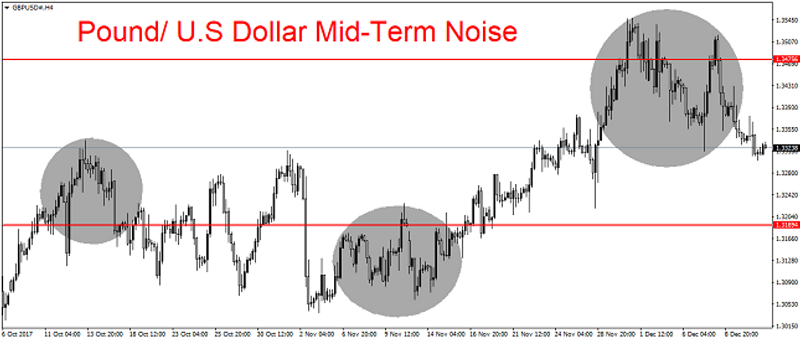

Pound Noise a Constant for Traders

Inflation data from the U.K continues to deliver challenging circumstances. The Pound is testing important short-term support.

Tidal Changes a Certainty for Pound

The Pound continues to deliver a variety of daily waves for traders. The British currency is near important support as critical central bank announcements lay ahead the next twenty-four hours.

The Pound is around 1.3330 against the U.S Dollar, but traders should be prepared for tidal changes in the coming hours. The Bank of England releases its monetary policy summary tomorrow.

Bank of England Outlook is an Impetus

Governor Mark Carney will not raise interest rates tomorrow, but he will have to address the issue of inflation in the U.K which continues to persist at an uncomfortable level while growth remains lackluster.

The Bank of England’s outlook tomorrow will be crucial for investors. Yesterday’s Consumer Price Index from the U.K was higher than its estimate.

U.K Political Dynamics and Developments

Another critical piece of the puzzle for the Pound is Brexit politics, which continue to create dynamic and sometimes troubling developments. Infighting within the Theresa May led coalition has been a consistent problem for months.

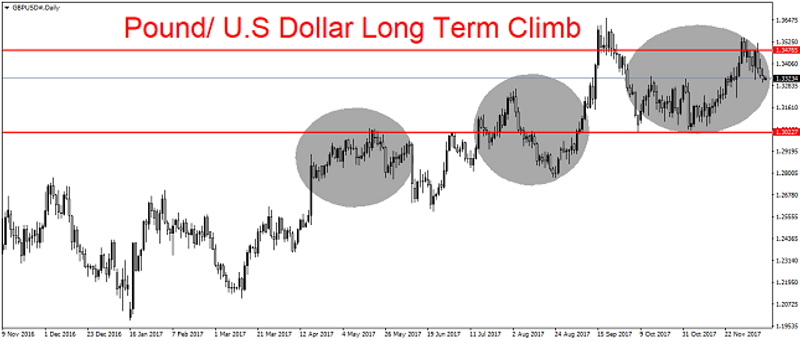

However, amid churning political waters and an economic picture which remains challenging, the Pound has, in fact, continued to produce gains over the long term.

In the short term, we are unbiased. However, for the mid-term, we believe the Pound may be positive. In the long-term we are unbiased.

Yaron Mazor is a senior analyst at SuperTraderTV.

SuperTraderTV Academy is a leader in investing and stock trading education. Sign up for a class today to learn proven strategies on how to trade smarter.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance