Post Holdings (POST) Benefits From Buyouts, Foodservice Unit

Post Holdings, Inc. POST appears to be in good shape, thanks to gains from acquisitions as well as a recovery in the foodservice business. These upsides, together with pricing, worked well for the company amid cost inflation, as witnessed in third-quarter fiscal 2022. During the quarter, both top and bottom lines improved year over year and came ahead of the Zacks Consensus Estimate.

Let’s take a closer look.

Buyouts & Foodservice Gains

Post Holdings has been benefiting from its focus on acquisitions, which has in turn expanded its customer base. During the third quarter of fiscal 2022, the company’s top line included $128.1 million in net sales from acquisitions. These acquisitions include the Lacka Foods Limited, Private label ready-to-eat (PL RTE) cereal business, the Egg Beaters liquid egg brand, the Almark Foods business and related assets and the Peter Pan nut butter brand.

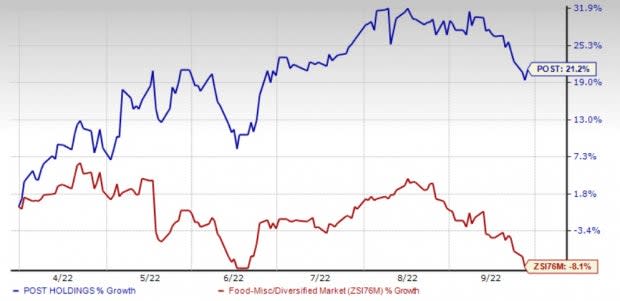

Image Source: Zacks Investment Research

On Apr 5, 2022, Post Holdings acquired Lacka Foods Limited. Lacka Foods is a U.K.-based marketer of high-protein, ready-to-drink (RTD) shakes under the UFIT brand.

Post Holdings acquired Almark Foods (or Almark) on Feb 1, 2021. Almark, which is renowned for its hard-cooked and deviled egg products, provides conventional, organic and cage-free products.

On Jan 25, Post Holdings acquired Conagra Brands’ Peter Pan peanut butter brand. On the same day, POST unveiled a collaboration with Hungry Planet, which is a plant-based meat company.

On Jul 1, 2020, the company completed the acquisition of Henningsen Foods, Inc., which forms part of its Foodservice segment. In June 2021, the company stated that it had completed the acquisition of PL RTE Cereal Business of TreeHouse Foods.

The company is also benefiting from a recovery in the Foodservice business. During the third quarter of fiscal 2022, Foodservice sales increased 33.1% to $579 million in the quarter under review. Volumes rose 6.2% owing to the increased demand for away-from-home eggs and potatoes. Egg volumes rose 7.2% and potato volumes rallied 8.5%. Overall, Foodservice volumes remained below pre-pandemic levels in the quarter. However, management expects Foodservice to exceed the pre-pandemic profitability level by the fourth quarter and enter fiscal 2023 with solid momentum.

Cost Woes Persist

During third-quarter fiscal 2022, Post Holdings’ gross margin contracted from 29.5% to 23.9% due to higher raw material, freight and manufacturing costs. Labor shortages and supply-chain hurdles caused manufacturing inefficiencies and capacity constraints in the third quarter of 2022. These limitations harmed sales, lowered throughput and increased per-unit product costs.

Management stated that its operations have been hurt by high inflation, rising fuel and energy prices and restricted availability – thereby raising the cost of certain raw materials and other commodities. It expects the costs of energy and raw materials to remain inflated due to the Ukraine-Russia war. Apart from this, Post Holdings has been seeing a rise in SG&A costs for a while.

A Look at Q3 & Ahead

Third-quarter results reflect solid pricing actions across the business and the recovery of volume demand in the Foodservice segment in the face of raw material as well as freight inflation and higher manufacturing expenses. Adjusted earnings from continuing operations of 69 cents per share increased from 50 cents reported in the prior-year quarter. The bottom line also surpassed the Zacks Consensus Estimate of 58 cents. The company registered sales of $1,524.9 million, up 22.2% year over year, with all segments witnessing growth. Further, the figure exceeded the consensus mark of 1,364 million. The company now anticipates fiscal 2022 adjusted EBITDA of $930-$945 million, up from $910-$940 million projected earlier.

Clearly, it looks like Post Holdings is likely to continue with its growth story. Shares of the Zacks Rank #3 (Hold) company have surged 21.2% in the past six months, against the industry’s decline of 8.1%.

Solid Food Stocks Worth Considering

Better-ranked stocks in the same space are Lancaster Colony LANC, General Mills GIS and J. M. Smucker SJM.

Lancaster Colony, which manufactures and markets food products for the retail and foodservice markets, currently sports a Zacks Rank of 1 (Strong Buy). LANC delivered an earnings surprise of 170% in the last reported quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Lancaster Colony’s current financial-year sales and EPS suggests growth of 9.6% and 38.3%, respectively, from the corresponding year-ago reported figures.

General Mills, a manufacturer and marketer of branded consumer foods, currently carries a Zacks Rank #2 (Buy). GIS has a trailing four-quarter earnings surprise of 6.1%, on average.

The Zacks Consensus Estimate for General Mills’ current financial-year sales suggests growth of 2.5% from the year-ago reported number.

J. M. Smucker, which manufactures and markets branded food and beverage products, carries a Zacks Rank #2 at present. J. M. Smucker has a trailing four-quarter earnings surprise of 20.8%, on average.

The Zacks Consensus Estimate for SJM’s current financial-year sales suggests growth of 4.4% from the year-ago period’s reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Mills, Inc. (GIS) : Free Stock Analysis Report

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

Lancaster Colony Corporation (LANC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance