How much pocket money to pay your child – and for what chores

The question I’m asked most often about kids and money is: How much pocket money should I pay?

The answer has a few facets.

Related story: To give or not to give? Pocket money splits Aussie parents

Related story: Investing in shares for your kids is a no-brainer: Here’s how to do it

Related story: How to get your credit score ready for a mortgage

Firstly, the average amount people think appropriate for a child under 12 is now $22 a week, according to the latest survey by data house Finder.

In my books, that’s high. And indeed, women nominated just $12 a week while men said $31.

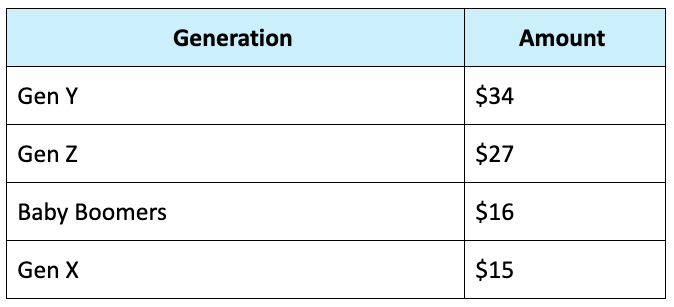

But opinions differ just as dramatically with respondents’ age. Millennials are the most generous of the lot, naming $34 as a good amount.

The toughest generation is Gen X, who believe $15 is fair, followed closely by Baby Boomers at $16.

As a female Gen X-er, my kids get the short end of the stick: they receive only $10 a week. But there are significant caveats too…

How much pocket money should kids receive each week?

Pocket money should be earned

When your children hit 14 years and nine months, they will be able to get an official job and earn some extra money. And they should.

But they also shouldn’t be surprised at that point that they have to work to earn money – they should already know from you and their experience of pocket money.

Three-quarters of Aussies agree, says Finder, while only 9 percent think kids should be paid regardless of whether they pitch in around the house.

Not only should younger kids somehow earn their money, though, they should do it from chores that are above and beyond those that are simply part of being a participant in a functioning household.

That’s real life, after all.

Which chores fall where will be particular to your household. But in our household, daily duties like unpacking the dishwasher, setting the table, clearing the table and helping with the preparation of all meals is just expected (like I said, short end of the stick).

But extras like washing and vacuuming the car, and helping out in our family business, attract pocket money.

We also have what we call a bonus star – much like a work bonus – that can be randomly bestowed for especially awesome efforts on behalf of our family team. Say, helping a sibling clean their room out of sheer generosity – that has actually happened!

A bonus star is worth $5, is given in physical cash on the spot and can be spent however they like.

However, that’s not the case with the $10 of pocket money….

Introduce the concepts of ‘future you’ and goal targeting

There are two vital lessons every parent must teach their children for them to be equipped for the real world.

The first is that money runs out – whether in physical or virtual form – and you need to make careful choices about where you spend it.

The second is that good things come to those who wait; to ‘future you’.

At every opportunity, talk about and get your child to practice prioritising their next-week, next-month, next-year and even 18-year-old selves… because the ability to delay gratification in anticipation of a bigger reward down the track is the secret to financial success.

You can even introduce this mentality at a very early, pre-pocket money age—food is a great proxy for money. See how your child goes saving some for later.

So what of the perennial question: cash or digital pocket money? We give both – and use a great app to facilitate their goal targeting and help prepare them for the virtual wealth world.

The Rooster Money app allows parents to either set a weekly automatic amount or ‘pay’ an amount when earned. Of course, we do the latter.

Then we get the kids themselves to allocate the 10 percent we insist they save for ‘future you’… to their car, 17-year-old savings goal. Miss Six already has $34 and it’s going to be pink.

The rest is split amongst their clearly defined, and pictured, so-tantalizing-they-can-almost-taste-them personal savings goals, like Star Wars Lego, and cow and pig onesies. I know: We need to talk more about smart spending.

Because if a 10-year-old saves $20 per week into today’s top-paying children’s account (2.76 percent from BCU Scoot's Super Saver), they’ll have over $9300 by the time they turn 18.

And it could be goodbye to the bank of mum and dad!

Nicole Pedersen-McKinnon gives Smart Money Start presentations in schools and is the author of How to get mortgage-free like me, available at www.nicolessmartmoney.com. Follow Nicole on Facebook, Twitter, LinkedIn, YouTube and Instagram.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance