How to Play Royal Caribbean (RCL) Ahead of Q1 Earnings?

Royal Caribbean Group RCL is scheduled to report first-quarter 2024 results on Apr 25, before the opening bell.

The Zacks Consensus Estimate for earnings is pegged at $1.30 per share. In the prior-year quarter, RCL reported adjusted loss per share of 23 cents. The consensus mark for revenues is pegged at $3.64 billion, suggesting 26.3% jump from a year ago.

The company is likely to have been aided by strong cruising demand from new and loyal guests, robust booking trends and new ship addition. Our model predicts passenger ticket revenues, and onboard and other revenues to improve 15.8% and 23.2% from the year-ago levels to $2,195.6 million and $1,218.1 million, respectively. We expect occupancy to be 105%.

The cruise industry giant's performance outlook appears promising, but investors must weigh potential risks against anticipated rewards before making investment decisions.

Royal Caribbean Cruises Ltd. Price and EPS Surprise

Royal Caribbean Cruises Ltd. price-eps-surprise | Royal Caribbean Cruises Ltd. Quote

Solid Booking Trends and New Ship Additions Drive Optimism

RCL’s results are likely to be aided by solid booking volumes concerning all key itineraries. Rise in consumer spending onboard and pre-cruise purchases are expected to bode well. With a load factor of 105% in the previous quarter, indicating full capacity operations, it is poised to capitalize on active consumer engagement and outperform the broader travel industry.

Early booking patterns and heightened onboard spending reflect active consumer engagement, positioning Royal Caribbean favorably to outperform the broader travel industry and attract new clients. With projected 40% earnings growth, 2024 is anticipated to be a record-breaking year, in line with the company's strategic objectives.

On the other hand, Royal Caribbean continues to benefit from new ship addition. Management focuses on new innovative ships and onboard experiences to differentiate its offering as well as deliver superior yields and margins. In 2023, RCL unveiled three new ships that align with its strategy and are poised to generate higher yields 2024 onward.

In 2024, management anticipates capacity to increase by 8.5% from the year-ago levels with the introduction of Utopia of the Seas and Silver Ray. The new vessels enhance vacation experiences, attract fresh customers to RCL’s brands, and contribute to yield improvements and overall profitability.

High Costs Pose Challenges

Despite the optimistic outlook, Royal Caribbean faces challenges associated with high expenses primarily due to a rise in food, fuel and onboard expenses. It also expects fuel costs to increase and continue through 2025. Our model predicts, total cruise operating expenses to increase 4.2% from the year-earlier levels in first-quarter 2024.

Investment Considerations: Balancing Risk and Reward

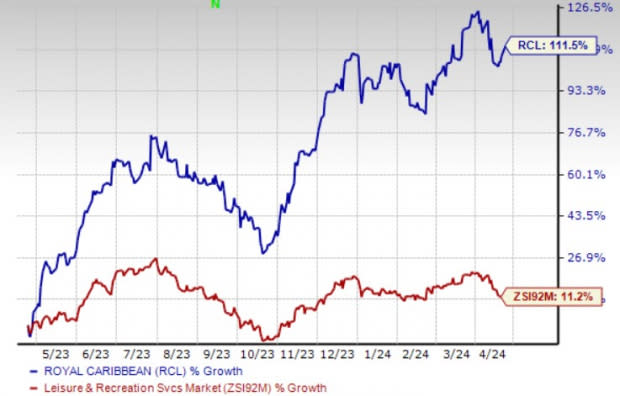

While Royal Caribbean's performance outlook appears promising, investors should exercise caution given the stock's recent surge in value. Over the past year, the company’s shares have skyrocketed by 111.5%, outperforming the industry's growth of 11.2%.

As RCL has significantly outperformed the industry in the past year, its valuation looks a bit stretched compared with its own range as well as the industry average. The stock is currently trading at 2.07X forward 12-month sales, which compares with 1.29X for the Zacks sub-industry and 1.61X for the Zacks sector.

As investors await Royal Caribbean's first-quarter earnings report, its solid booking trends, new ship additions and anticipated financial performance paint a positive picture. However, concerns over high costs and stretched valuation warrant caution for potential investors. While Royal Caribbean's long-term prospects remain promising as the travel industry continues to recover, it may be prudent to wait for a more attractive entry point.

Image Source: Zacks Investment Research

What the Zacks Model Unveils

Per our proven model, stocks with a combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) are likely to beat on earnings. At present, Royal Caribbean has an Earnings ESP of +5.30% and a Zacks Rank of 3. Hence, it is presumed that Royal Caribbean is likely to beat estimates this earnings season.

In the last reported quarter, RCL delivered an earnings surprise of 10.6%.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Other Stocks Poised to Beat on Earnings

Here are some other stocks from the Zacks Consumer Discretionary sector that investors may consider, as our model shows that these, too, have the right combination of elements to post an earnings beat.

Fox Corporation FOXA has an Earnings ESP of +15.53% and a Zacks Rank of 3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

FOXA is expected to register a 23.4% increase in earnings for the to-be-reported quarter. It reported better-than-expected earnings in each of the trailing four quarters, the average surprise being 71.1%.

DraftKings Inc. DKNG currently has an Earnings ESP of +36.22% and a Zacks Rank of 3.

DKNG’s earnings for the to-be-reported quarter are expected to increase 67.8%. It reported better-than-expected earnings in two of the trailing four quarters and missed on the other two occasions, with a negative surprise of 57.1%, on average.

Funko, Inc. FNKO currently has an Earnings ESP of +6.90% and a Zacks Rank of 3.

FNKO’s earnings for the to-be-reported quarter are expected to increase 40.8%. It reported better-than-expected earnings in three of the trailing four quarters and missed on one occasion, the average surprise being 42.8%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Fox Corporation (FOXA) : Free Stock Analysis Report

Funko, Inc. (FNKO) : Free Stock Analysis Report

DraftKings Inc. (DKNG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance