How Should You Play Centene (CNC) Ahead of Q1 Earnings?

Centene Corporation CNC is set to report its first-quarter 2024 results on Apr 26, before the opening bell. Analysts are anticipating a robust performance in its commercial segment, although lower Medicaid membership may offset its results.

Let’s delve deeper.

The company’s memberships are on a decline, especially in Medicaid and Medicare, due to redeterminations. We expect total Medicaid membership to decline almost 13% year over year in the first quarter, along with an 11% fall in Medicare membership.

The Zacks Consensus Estimate for first-quarter earnings per share of $2.09 suggests a 1% decrease from the prior-year figure. The consensus mark remained stable over the past week. Centene beat the consensus estimate for earnings in three of the prior four quarters and missed once, with the average surprise being 7.1%. The consensus estimate for first-quarter revenues of $36.4 billion indicates a 6.4% decrease from the year-ago reported figure.

The Zacks Consensus Estimate for first-quarter premium indicates a 2.2% decline from a year ago, which makes an earnings beat uncertain. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. That is not the case here. The company’s Earnings ESP is -1.87% now. This is because the Most Accurate Estimate currently stands at $2.05 per share, lower than the Zacks Consensus Estimate of $2.09. It currently has a Zacks Rank #3.

Now, let’s focus on its price performance so far this year.

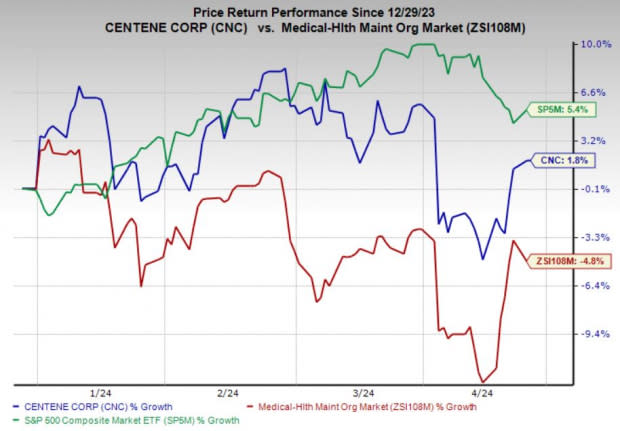

YTD Price Performance

Centene’s shares have gained 1.8% while the industry has declined 4.8% and the S&P 500 Index has jumped 5.4% in the year-to-date period. With the resumption of elective procedures that were paused due to pandemic-related constraints earlier, medical costs are on the rise, leaving lower profit levels for companies in the managed care industry, concerning the investors.

Image Source: Zacks Investment Research

Even if we look at a bigger industry player, UnitedHealth Group Incorporated UNH, its operating costs were $91.9 billion in the first quarter of 2024, which escalated 9.6% year over year due to higher medical and operating expenses and cost of products sold. As such, industry players are likely to increase premium rates to counter medical cost trends, as can be seen from Elevance Health, Inc.’s ELV first-quarter 2024 results.

UnitedHealth reported first-quarter 2024 adjusted earnings per share of $6.91 per share, beating the Zacks Consensus Estimate by 4.2%, while Elevance Health’sadjusted earnings of $10.64 per share surpassed the Zacks Consensus Estimate by 0.9%.

Nevertheless, investors are considering several other factors for Centene, like its focus on growing operations, favorable valuation, membership growth in the commercial marketplace and investment income growth. Centene’s mergers, acquisitions and partnerships will keep bolstering its capabilities, aiding long-term growth. Although this will increase the burden on its debt-laden balance sheet, management seems focused on reducing debt.

Centene's forward 12-month price-to-earnings ratio stands at 10.8X, which is lower than the industry average of 15.5X. This suggests that the stock is more affordable than its peers, making it a relatively attractive option for investors. Also, its growing commercial marketplace membership is a major driver, which will provide the company some respite amid falling premiums. In fact, for the first quarter of 2024, our model predicts a more than 33% year-over-year jump in commercial marketplace membership.

To sum up, while Centene may have a lower likelihood of surpassing earnings estimates in the first quarter, its favorable valuation, promising growth prospects, and management's efforts to enhance financial flexibility position it as a significant stock to monitor closely.

A Stock to Consider

While an earnings beat looks uncertain for Centene, here’s one company from the broader Medical space that you may want to consider, as our model shows that it has the right combination of elements to post an earnings beat this time around:

TransMedics Group, Inc. TMDX has an Earnings ESP of +240.00% and is a Zacks #1 Ranked player. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for TransMedics’ bottom line for the to-be-reported quarter indicates 37.5% year-over-year growth. TMDX beat earnings estimates in each of the past four quarters, the average surprise being 107.8%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

Centene Corporation (CNC) : Free Stock Analysis Report

TransMedics Group, Inc. (TMDX) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance