Pinnacle Financial Partners Inc. (PNFP) Earnings Update: A Detailed Review of Q1 2024 Performance

Earnings Per Share (EPS): Reported at $1.57, slightly exceeding the estimated $1.54.

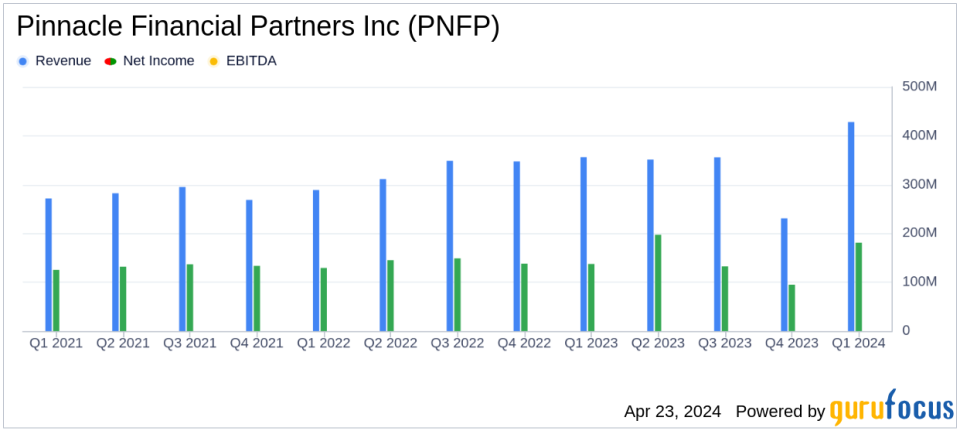

Total Revenue: Reached $428.1 million, surpassing the estimated $422.49 million.

Net Interest Income: Grew to $318.0 million, up 1.9% year-over-year.

Noninterest Income: Increased by 23.0% year-over-year to $110.1 million, reflecting strong performance in wealth management and mortgage services.

Loan Growth: Loans expanded at an annualized rate of 6.0%, indicating robust core business activities.

Asset Quality: Allowance for credit losses rose to 1.12% of total loans, reflecting a cautious approach in a challenging interest rate environment.

Deposits: Noninterest-bearing deposits saw a linked-quarter annualized increase of 2.6%, despite a year-over-year decrease of 11.8%.

Pinnacle Financial Partners Inc. (NASDAQ:PNFP) disclosed its first-quarter earnings for 2024 on April 22, revealing a slight outperformance against analyst expectations. The company reported a diluted earnings per share (EPS) of $1.57, modestly above the estimated $1.54. Total revenues reached $428.14 million, also surpassing the forecasted $422.49 million. This financial overview is detailed in PNFP's recent 8-K filing.

Pinnacle Financial Partners Inc., a prominent community bank, operates primarily in urban markets across Tennessee, including Nashville, Knoxville, Memphis, and Chattanooga. The bank focuses on a range of lending products targeted at individuals and small to medium-sized businesses. A significant portion of its revenue is derived from net interest income, with a substantial part of its loan portfolio concentrated in commercial real estate and industrial loans.

Financial Performance and Strategic Initiatives

The first quarter of 2024 saw PNFP navigate a complex economic landscape marked by persistent inflation and higher interest rates. Despite these challenges, the bank achieved a year-over-year revenue increase of 6.6% and a linked-quarter annualized increase of 32.1%. This growth was supported by strategic initiatives, including the recruitment of 37 new revenue producers and the expansion into new markets such as Atlanta and Washington D.C.

PNFP's balance sheet grew robustly with total assets reaching $48.9 billion, an 8.4% increase from the previous year. Loan growth was noted particularly in the commercial and industrial sectors, contributing to a 6.0% rise in total loans since the last quarter. However, the bank also recognized the need to bolster its allowance for credit losses, which increased to 1.12% of total loans, reflecting a cautious approach in a higher-for-longer interest rate environment.

Challenges and Adjustments

Amidst its financial growth, PNFP faced several challenges, including an increase in nonperforming assets and the need for additional credit loss provisions due to a problematic borrower. This situation underscores the broader difficulties faced by the banking sector, including the need for increased vigilance in loan quality amidst economic uncertainties.

Moreover, the bank incurred a $7.3 million noninterest expense due to a special FDIC assessment, which also impacted its financials in the previous quarter. These expenses highlight the ongoing regulatory and economic pressures on the banking industry.

Operational Highlights and Future Outlook

Operationally, PNFP continues to excel in its market positioning and employee engagement, being named No. 11 on the list of 100 Best Companies to Work For in the United States by FORTUNE and Great Place to Work. This recognition not only reflects the bank's strong corporate culture but also supports its effectiveness in attracting top talent, which is crucial for its service-driven business model.

Looking forward, PNFP's management remains cautiously optimistic. They anticipate continued growth in loans and deposits, albeit acknowledging the potential headwinds from the ongoing economic volatility. The bank's strategic focus remains on strengthening its balance sheet and enhancing shareholder value through prudent risk management and growth in core markets.

Conclusion

In conclusion, Pinnacle Financial Partners Inc. has demonstrated a resilient performance in the first quarter of 2024, slightly exceeding analyst expectations despite economic and regulatory challenges. With a strategic focus on market expansion and maintaining a robust balance sheet, PNFP is well-positioned to navigate future uncertainties and capitalize on growth opportunities in its core markets.

For detailed insights and further information, please refer to the full earnings report on PNFP's website.

Explore the complete 8-K earnings release (here) from Pinnacle Financial Partners Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance