Ping An Insurance (Group) Co. of China Ltd's Dividend Analysis

Exploring the Dividend Performance and Sustainability of Ping An Insurance

Ping An Insurance (Group) Co. of China Ltd (PNGAY) recently announced a dividend of $0.41 per share, scheduled for payment on August 5, 2024, with an ex-dividend date of June 11, 2024. As investors anticipate this upcoming disbursement, it's crucial to examine the company's dividend track record, yield, and growth rates. Utilizing GuruFocus data, this analysis delves into the dividend performance of Ping An Insurance (Group) Co. of China Ltd and evaluates its sustainability.

Company Overview

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

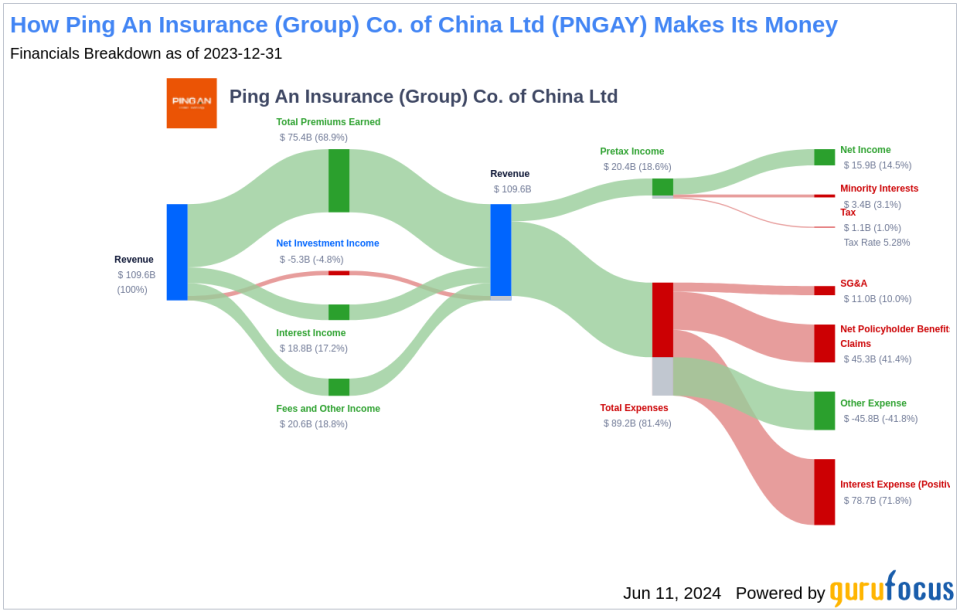

Established in 1988 and based in Shenzhen, Ping An Insurance is a comprehensive financial service provider with a significant presence in China's insurance sector. It ranks as the country's second-largest life and property & casualty insurer. The company's business model integrates life insurance, property & casualty insurance, banking, and other financial services, along with technology solutions. In 2023, these segments contributed variably to the company's operating profits, with life insurance being the most significant at 89%.

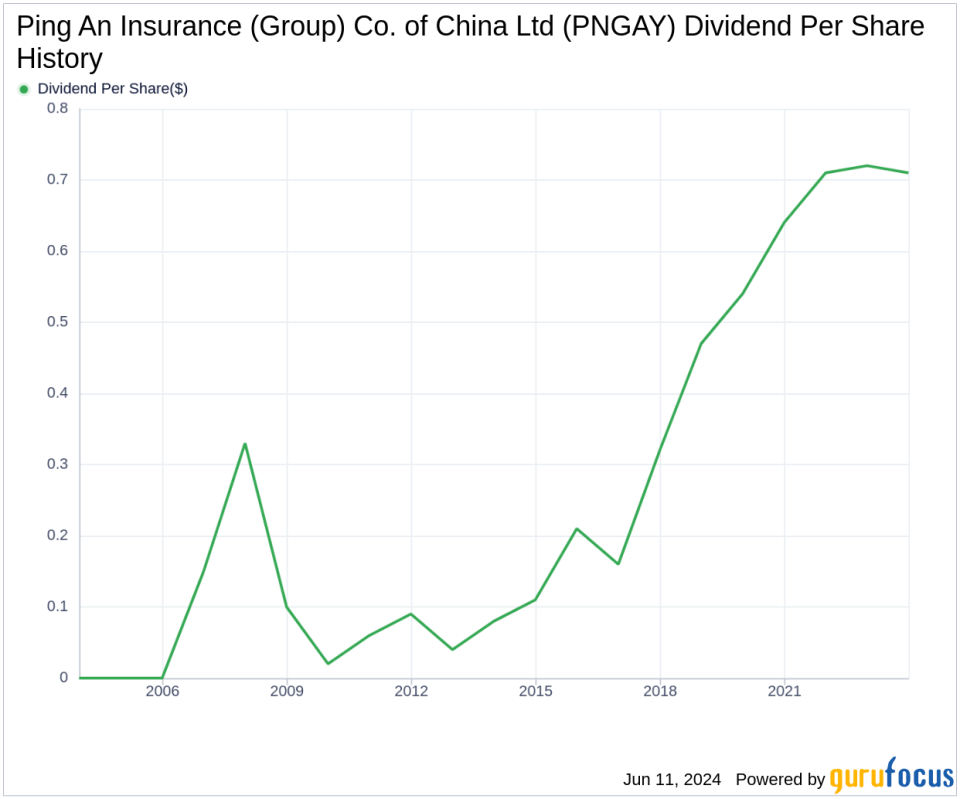

Review of Dividend History

Since 2006, Ping An Insurance (Group) Co. of China Ltd has maintained a consistent record of dividend payments, distributed bi-annually. Tracking the historical trends in dividends per share provides valuable insights into the company's financial commitment to its shareholders.

Dividend Yield and Growth Analysis

Currently, Ping An Insurance (Group) Co. of China Ltd boasts a trailing dividend yield of 6.91% and a forward dividend yield of 6.71%, indicating a slight expected decrease in dividend payments over the next year. Over the past three years, the company has achieved an annual dividend growth rate of 5.00%, which expands to 8.70% over five years, and impressively, 28.20% over the last decade. The 5-year yield on cost for Ping An Insurance (Group) Co. of China Ltd's stock is approximately 10.49% today.

Evaluating Dividend Sustainability

The sustainability of dividends is often gauged by examining the dividend payout ratio, which for Ping An Insurance (Group) Co. of China Ltd stands at 0.42 as of March 31, 2024. This ratio indicates a healthy balance between earnings distribution and retention for future growth. The company's profitability rank of 5 out of 10, combined with a consistent record of positive net income over the past decade, reinforces its financial stability.

Future Growth and Revenue Metrics

While Ping An Insurance (Group) Co. of China Ltd's growth rank also stands at 5 out of 10, its revenue and earnings growth rates suggest areas for improvement. The company has experienced a revenue decline of approximately -10.30% annually over the last three years, and its earnings have decreased by about -16.10% annually during the same period. These figures highlight potential challenges in maintaining dividend growth unless reversed.

Conclusion: Assessing Dividend Viability and Strategic Moves

In conclusion, while Ping An Insurance (Group) Co. of China Ltd demonstrates a strong history of dividend growth and a reasonable payout ratio, the declining trends in revenue and earnings growth warrant cautious optimism. Investors should monitor these metrics closely, as they are critical for sustaining future dividend payments. For those interested in exploring further, GuruFocus Premium provides tools like the High Dividend Yield Screener to discover high-yield investment opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance