Pharma Stock Roundup: ABBV & NVO's New M&As, FDA Nod to JNJ & MRK PAH Drugs

This week, AbbVie ABBV announced plans to buy Landos Biopharma, while Novo Nordisk NVO offered to acquire Germany-based biotech Cardior Pharmaceuticals. The FDA approved J&J’s JNJ and Merck’s MRK pulmonary arterial hypertension ("PAH") drugs, Opsynvi and Winrevair (sotatercept), respectively, and AstraZeneca’s AZN rare disease drug, Ultomiris, for a new indication.

Recap of the Week’s Most Important Stories

AbbVie to Buy Landos Biopharma: AbbVie announced a definitive agreement to acquire Landos Biopharma to boost its portfolio in inflammatory and autoimmune disease drugs. Landos’ lead pipeline candidate is NX-13, which is in phase II development for the treatment of ulcerative colitis (UC). NX-13 is an oral NLRX1 agonist with a bimodal mechanism of action. It has the potential to treat UC and Crohn's disease with a new approach.

AbbVie will acquire Landos for $20.42 per share in cash, which adds up to a total purchase consideration of approximately $137.5 million. In addition, Landos will also be entitled to one non-tradable contingent value right per share with a value of up to $11.14 per share, or approximately an additional $75 million in the aggregate, subject to the achievement of a clinical development milestone. The transaction is expected to be closed in the second quarter of 2024.

Novo Nordisk to Acquire Cardior to Strengthen Cardiovascular Presence: Novo Nordisk agreed to acquire Germany-based biotech Cardior Pharmaceuticals, which makes RNA-based therapeutics for cardiovascular diseases. Novo Nordisk will make a payment of 1.025 billion euros, which includes an upfront payment as well as certain development and commercial milestone payments. Cardior’s lead pipeline candidate is CDR132L, which is currently in phase II development for the treatment of heart failure.

Novo Nordisk plans to initiate a second phase II study on CDR132L for treating chronic heart failure with cardiac hypertrophy. Novo Nordisk believes CDR132L has the potential to become a disease-modifying therapy for heart failure. The transaction is expected to be closed in the second quarter of 2024.

FDA Approves Merck’s Winrevair/Sotatercept for PAH: The FDA granted approval to Merck’s novel activin signaling inhibitor, Winrevair (sotatercept), for treating adult patients with pulmonary arterial hypertension (PAH, WHO Group 1). The approval was based on data from the STELLAR study.

Winrevair holds the key to Merck’s long-term growth plans. PAH is a rare, progressive blood vessel disorder that affects the arteries in the lungs, resulting in elevated blood pressure. It exerts significant strain on the heart, as it works harder to pump blood through the lungs, eventually leading to heart failure if left untreated. Winrevair works by blocking the proteins that contribute to the thickening of blood vessel walls in the lungs.

FDA Approves J&J’s Single Tablet PAH Regimen, Opsynvi: The FDA also approved J&J’s Opsynvi, which is a once-daily single tablet combination of Opsumit (macitentan -10mg) and tadalafil (40mg) for the chronic treatment of PAH, WHO Group II-III. The approval was based on data from the phase III A DUE study.

The study met its primary endpoint, demonstrating statistically significant improvement in pulmonary hemodynamics (blood flow through pulmonary blood vessels) upon treatment with Opsynvi compared with macitentan and tadalafil monotherapies in the above-mentioned PAH patient population. A marketing authorization application seeking approval of the PAH combination regimen is also under review in the EU.

The FDA granted Fast Track designation to J&J’s key pipeline candidate, nipocalimab, to reduce the risk of fetal neonatal alloimmune thrombocytopenia (FNAIT) in alloimmunized pregnant adults. Nipocalimab is being evaluated in the phase III FREESIA program for the treatment of FNAIT, a rare and severe condition that occurs when the immune system of a pregnant person mistakenly attacks platelets in a developing fetus. J&J’s nipocalimab is in mid-and late-stage development for this rare autoantibody-driven disease.

FDA Approves AstraZeneca’s Ultomiris for NMOSD: The FDA granted approval to AstraZeneca’s Ultomiris for treating adult patients with neuromyelitis optica spectrum disorder (NMOSD) who are anti-aquaporin-4 (AQP4) antibody positive (Ab+). The approval makes Ultomiris the first and only long-acting C5 complement inhibitor approved for AQP4 Ab+ NMOSD, a rare neurological disease. The approval of Ultomiris for AQP4 Ab+. NMOSD was based on data from the CHAMPION-NMOSD phase III study, which demonstrated that Ultomiris led to unprecedented relapse risk reduction in NMOSD patients.

We remind investors that in September last year, the FDA had issued a complete response letter to Ultomiris for the AQP4 Ab+. NMOSD indication. Ultomiris is already approved for AQP4 Ab+ NMOSD indication in the EU and in Japan. In the United States, Ultomiris is presently approved for treating three indications — generalized Myasthenia Gravis, paroxysmal nocturnal hemoglobinuria and atypical hemolytic uremic syndrome.

The NYSE ARCA Pharmaceutical Index rose 1.35% in the last five trading sessions.

Large Cap Pharmaceuticals Industry 5YR % Return

Large Cap Pharmaceuticals Industry 5YR % Return

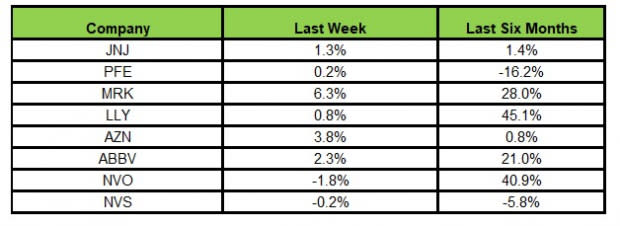

Here’s how the eight major stocks performed in the last five trading sessions.

Image Source: Zacks Investment Research

In the last five trading sessions, Merck rose the most (6.3%), while Novo Nordisk declined the most (1.8%).

In the past six months, Novo Nordisk has risen the most (45.1%), while Pfizer has declined the most (16.2%).

(See the last pharma stock roundup here: AZN to Buy FUSN, PFE to Sell Stake in HLN & Other Updates)

What's Next in the Pharma World?

Watch for regular pipeline and regulatory updates next week.

AbbVie, Novo Nordisk, Merck, AstraZeneca and J&J have a Zacks Rank #3 (Hold) each. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance