Americans Owe $1.75 Trillion In Student Loan Debt, And These 22 Screenshots Show Exactly Why People Call The System A Scam

It's May, which means a whole new round of graduates are turning their tassels and entering the workforce. This also means that their first student loan payments are around the corner, and 2024's numbers are overwhelming, to say the least. This year, Forbes reports $1.75 trillion in total private and federal student loan debt and an average of $28,950 owed per borrower in the US.

News / Via giphy.com

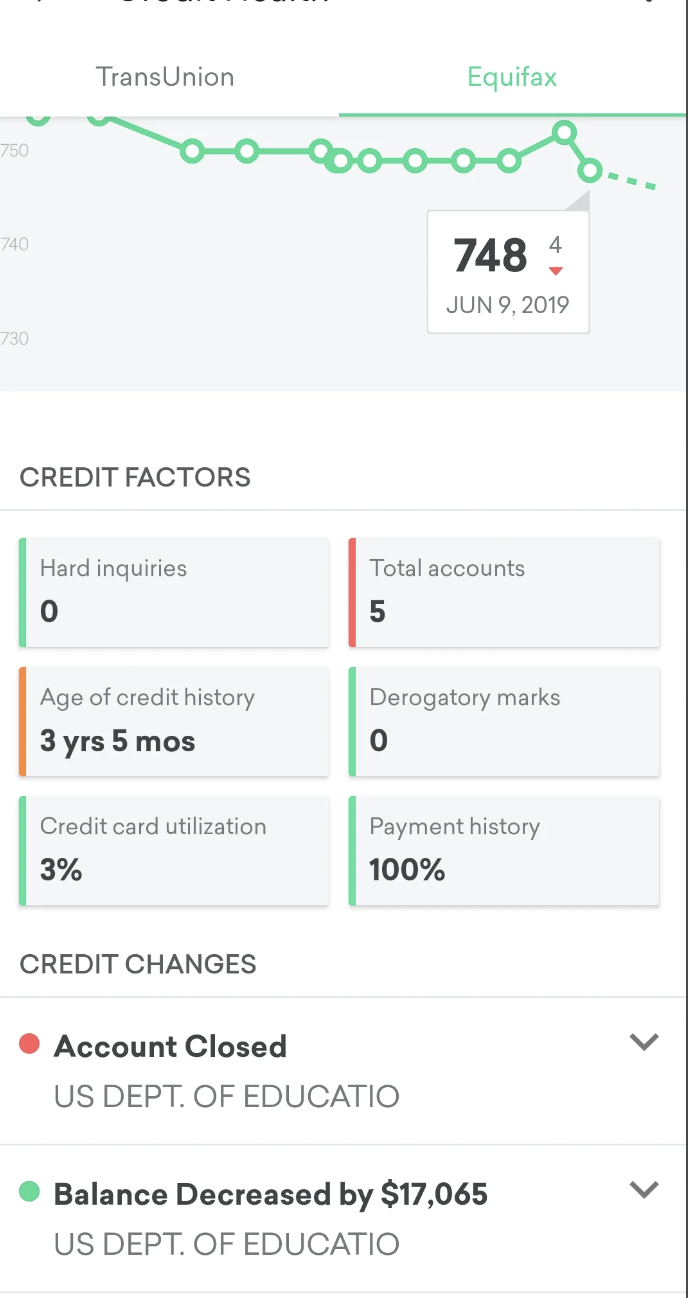

While President Joe Biden has rolled out several rounds of student loan forgiveness, an aid package for borrowers of all circumstances has yet to be approved. Meanwhile, college degrees are failing to hold the same weight as they used to, and salaries remain nearly stagnant while the cost of living rises.

Basically, it's hard out here, and student loans aren't helping. In fact, bloated interest rates are arguably making things worse.

According to Nerd Wallet, 2024–2025 student borrowers are looking down the barrel at a 6.53% federal student loan interest rate, making the cost of seeking an education higher than it has been in 16 years.

This is why some call student loans "predatory" and a scam. And if you're not convinced, these 22 screenshots may change your mind:

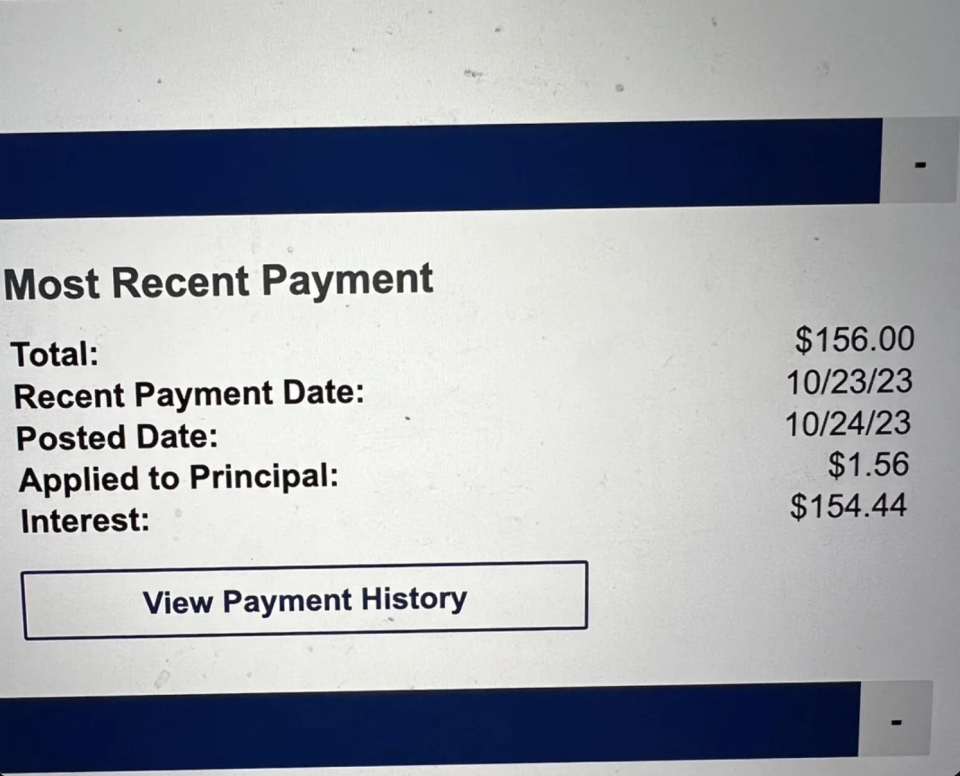

1.After making a $156 payment, only $1.56 went to this person's principal, and the rest went to interest.

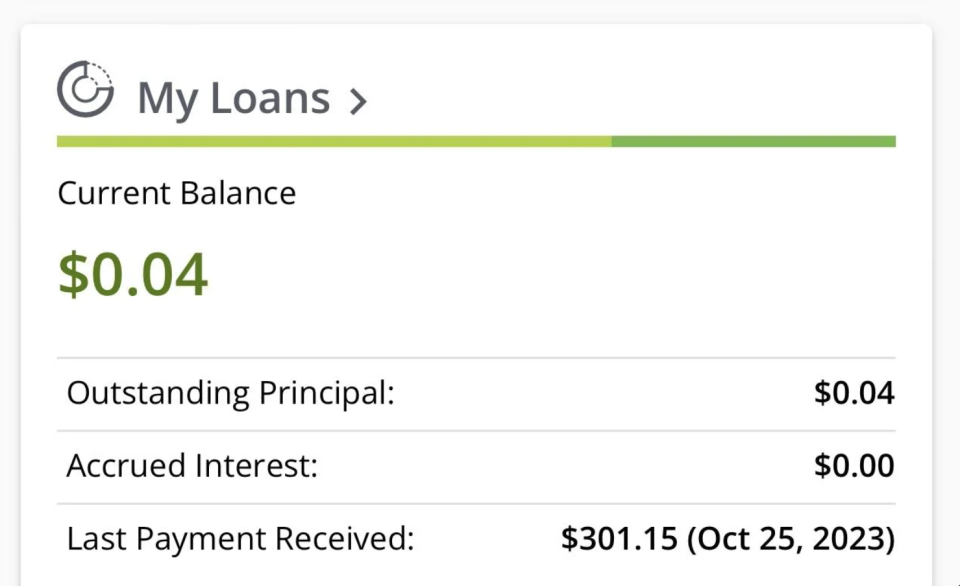

2.This person was just about to celebrate paying off all their student loans when four cents in interest accrued while their payment was processing.

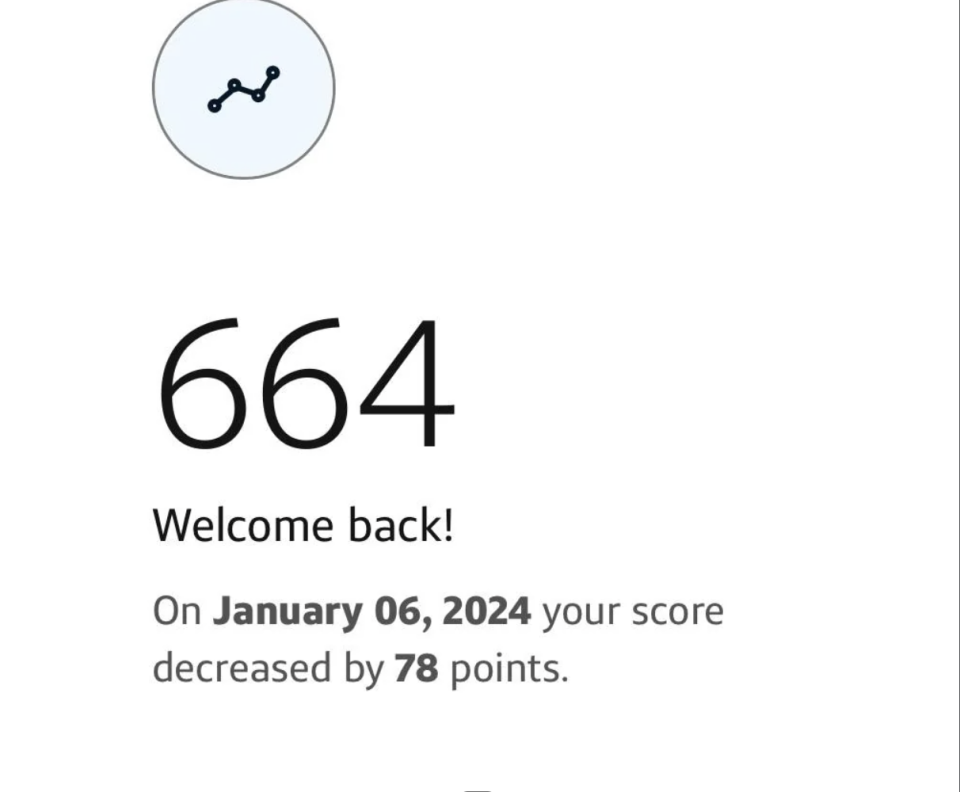

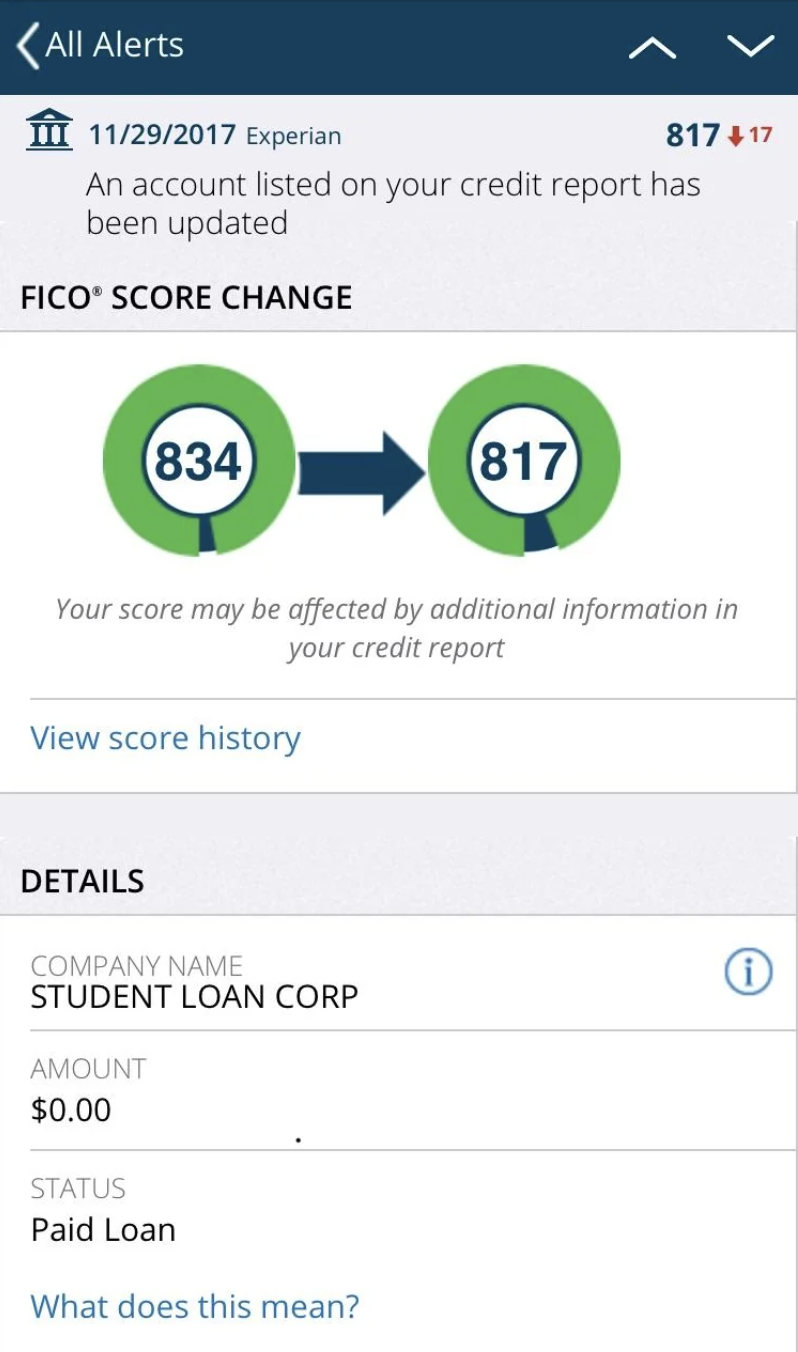

3.This person couldn't even think about celebrating paying off their loans because it caused their credit score to drop nearly 80 points.

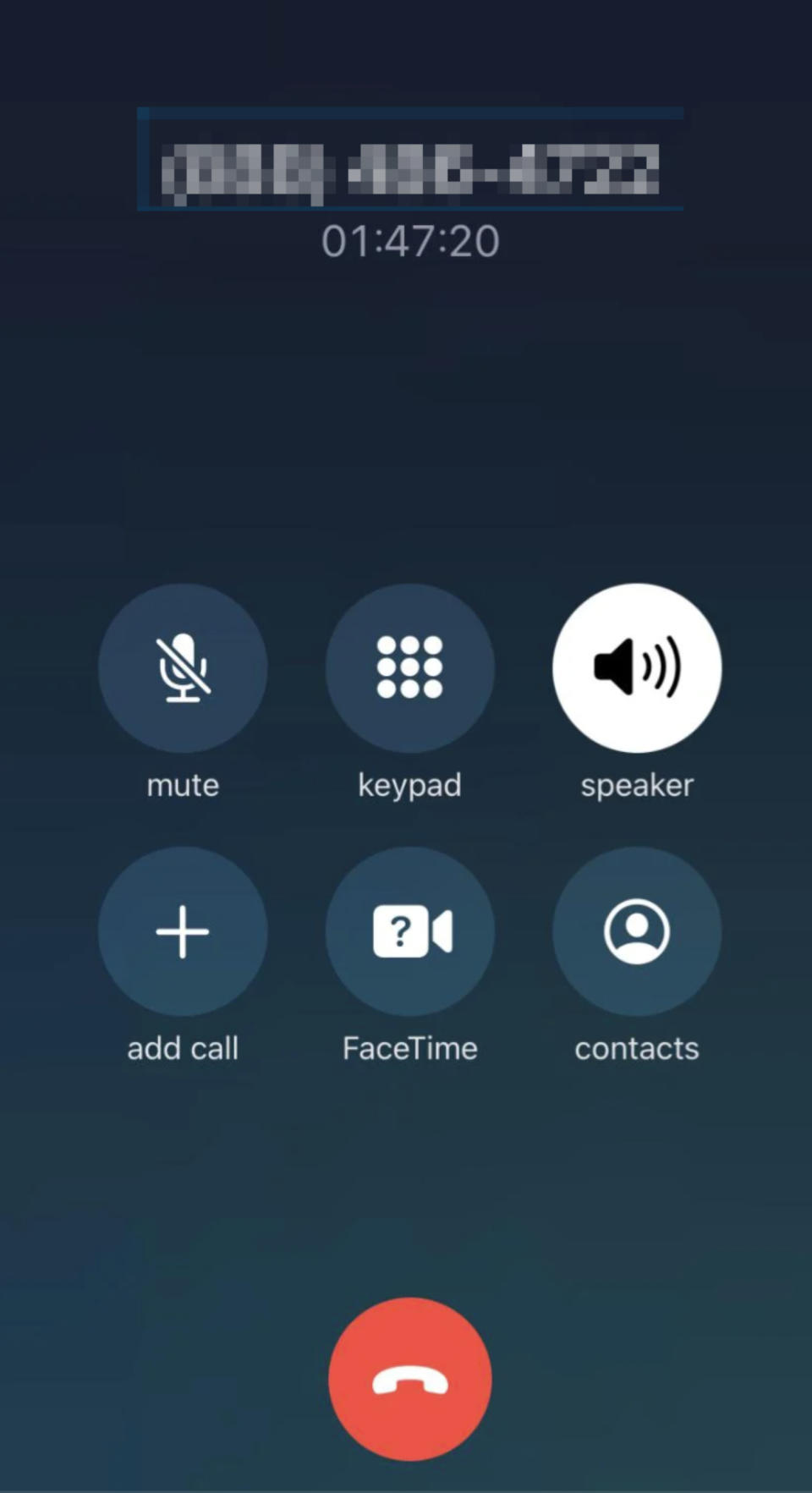

4.This person had a question about their student loans and spent over 1 hour and 47 minutes on hold...

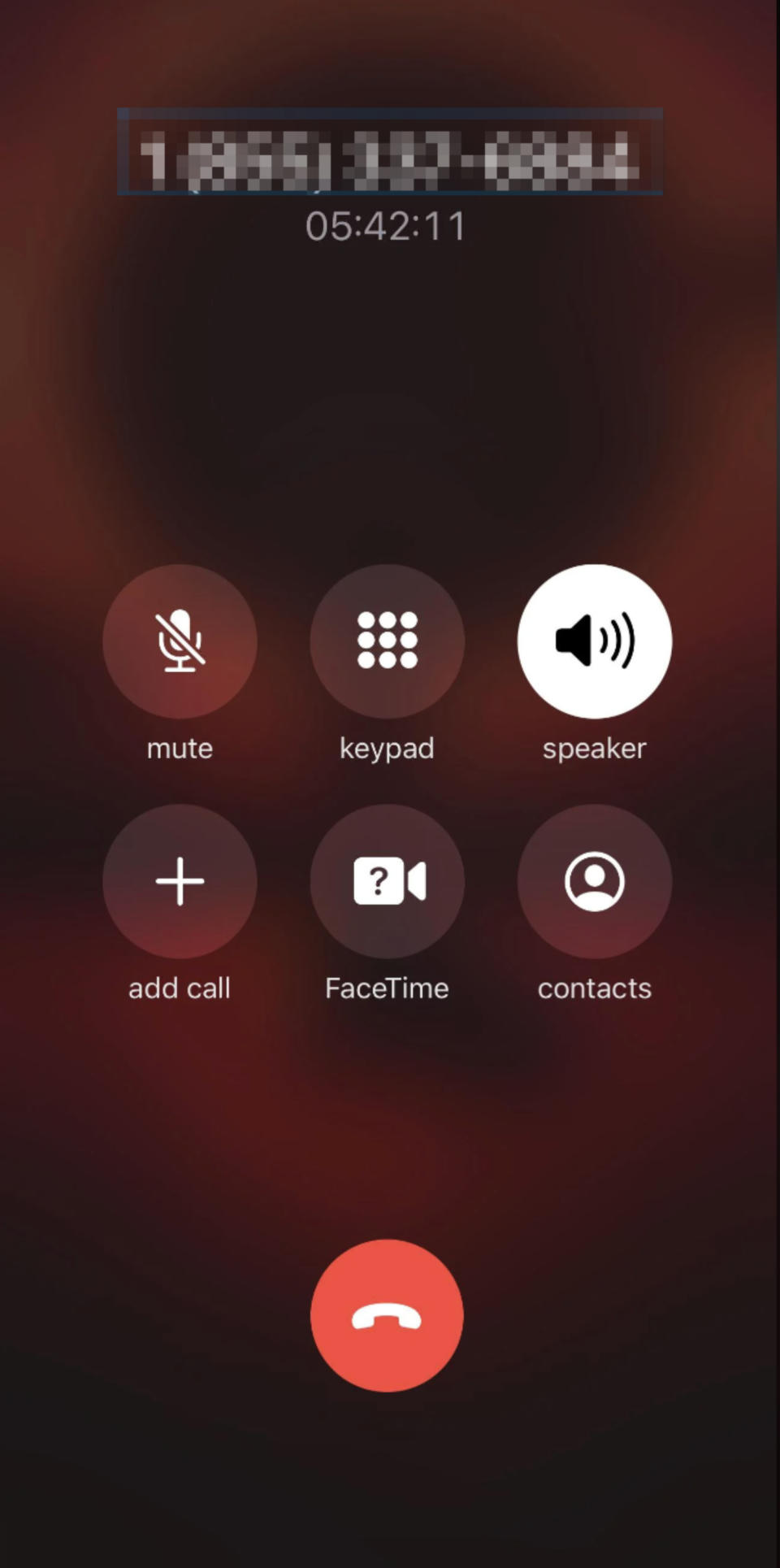

5....which is egregious, but nothing is compared to this person's nearly six-hour wait time.

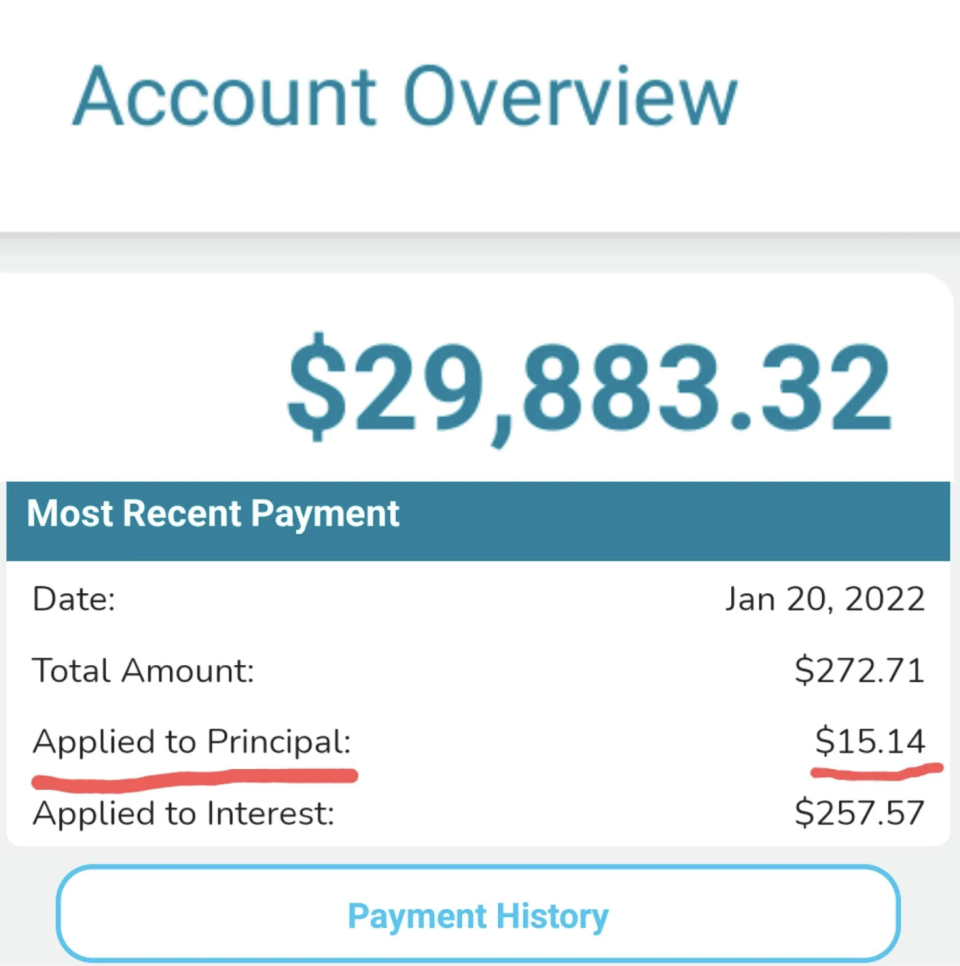

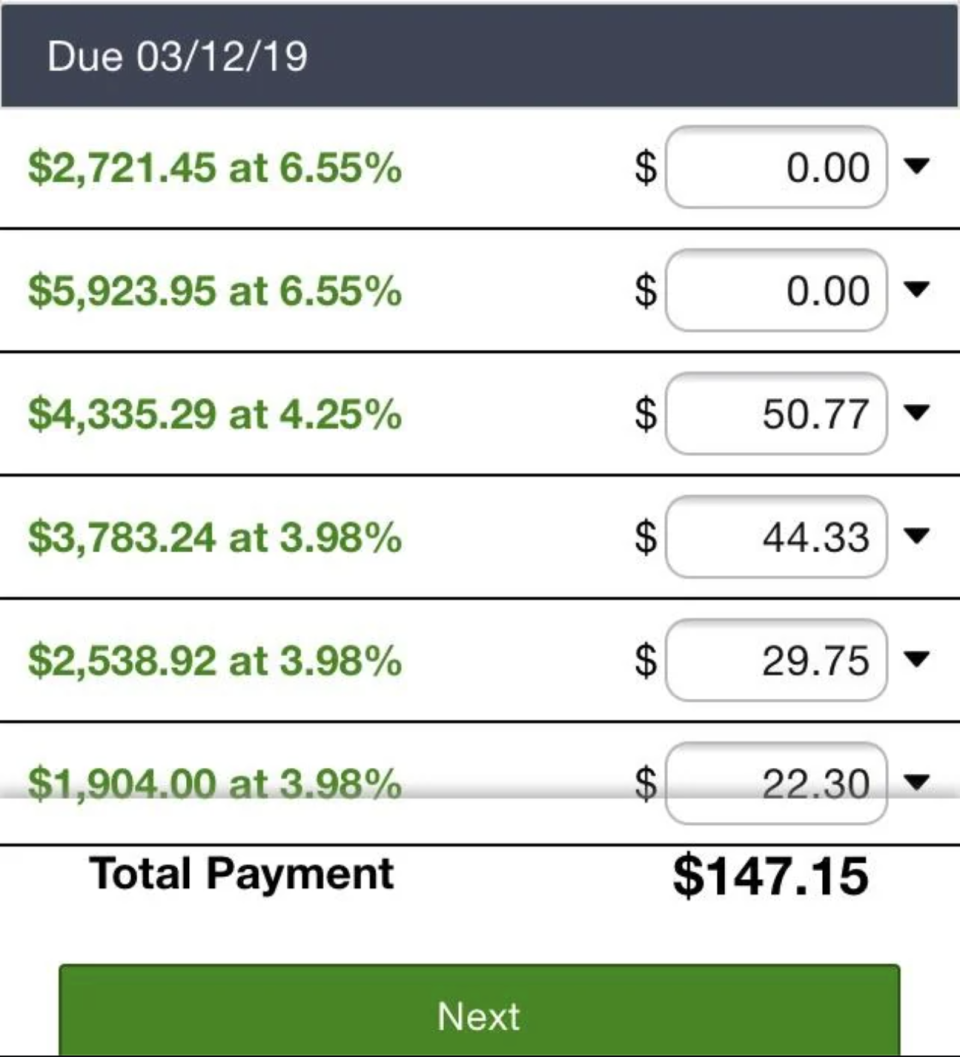

6.This person can't imagine getting ahead of their nearly $30,000 balance when only $15 out of their $272 monthly payments is going toward the principal.

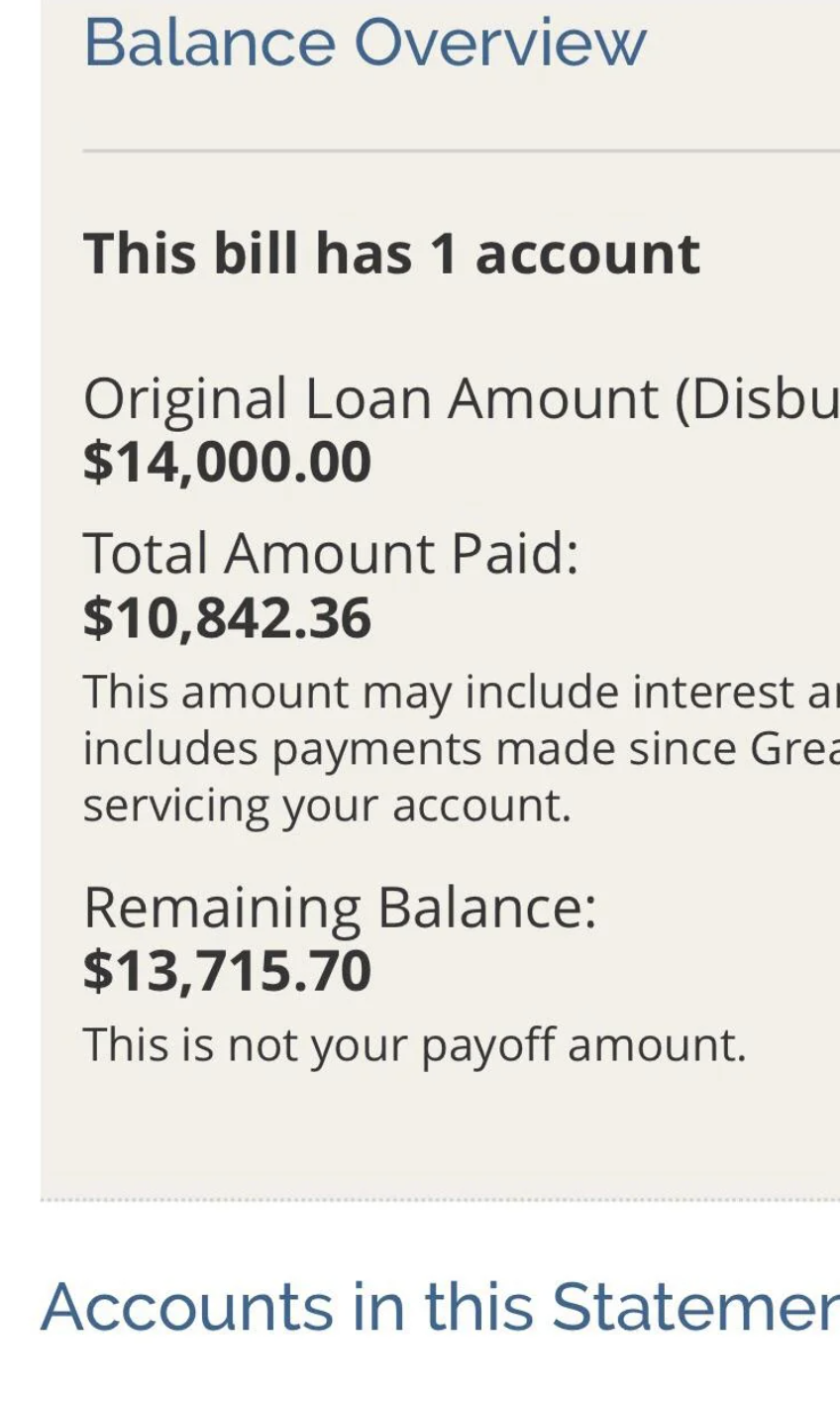

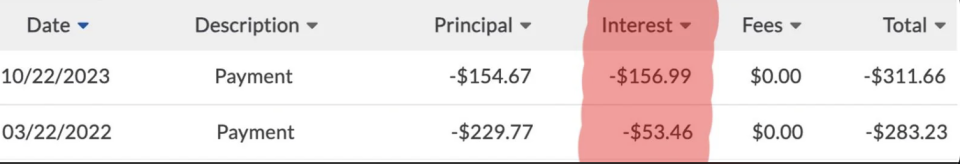

7.This person graduated from college over eight years ago, and after paying nearly $11,000 toward their loans, their principal is almost exactly where it started.

8.This person thought paying off their loans would finally open the door for them to afford a home — if it wasn't for their credit score dropping by result.

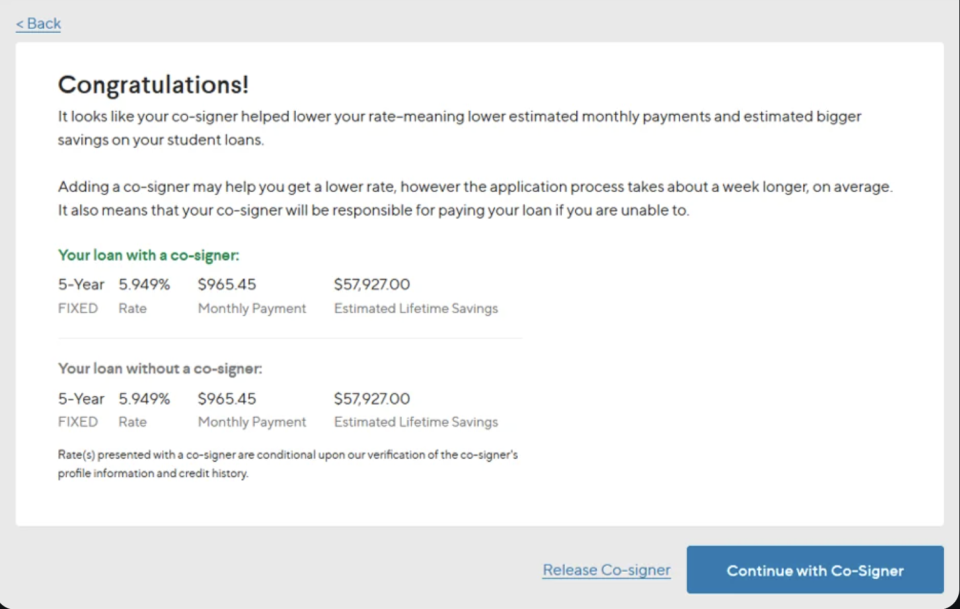

9.This guy considered adding his wife as a co-signer on his loan with the hopes of lowering the interest rate...but it stayed exactly the same.

10.A credit card company "offered" this person student loans as a way to "celebrate [their] hard work."

11.This person held on to an interest rate of 3.5% for 12 years, and then it suddenly shot up to 7.75% despite them never missing a payment. Now their monthly payments are three times as much.

12.This person is disgusted by how their student loan servicer automatically gave their highest balance a larger interest rate.

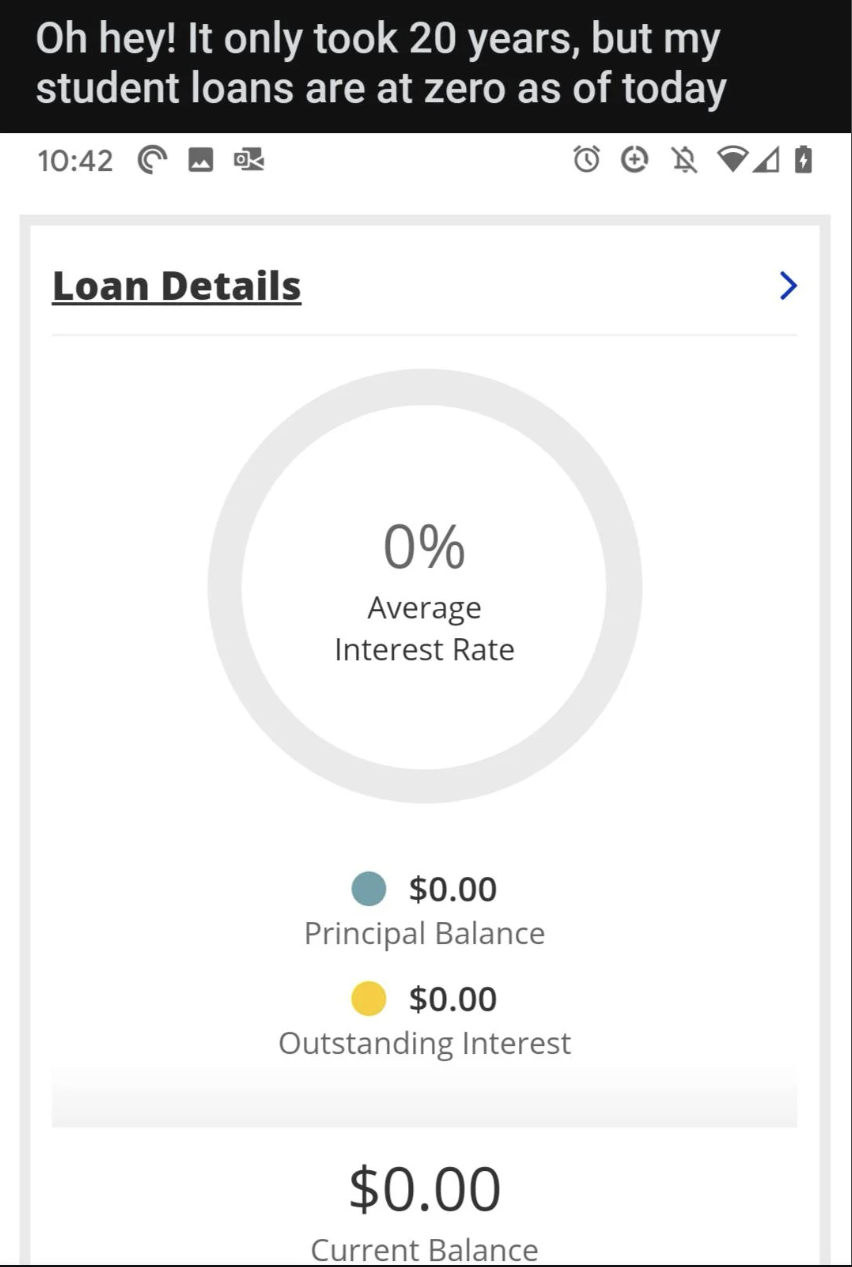

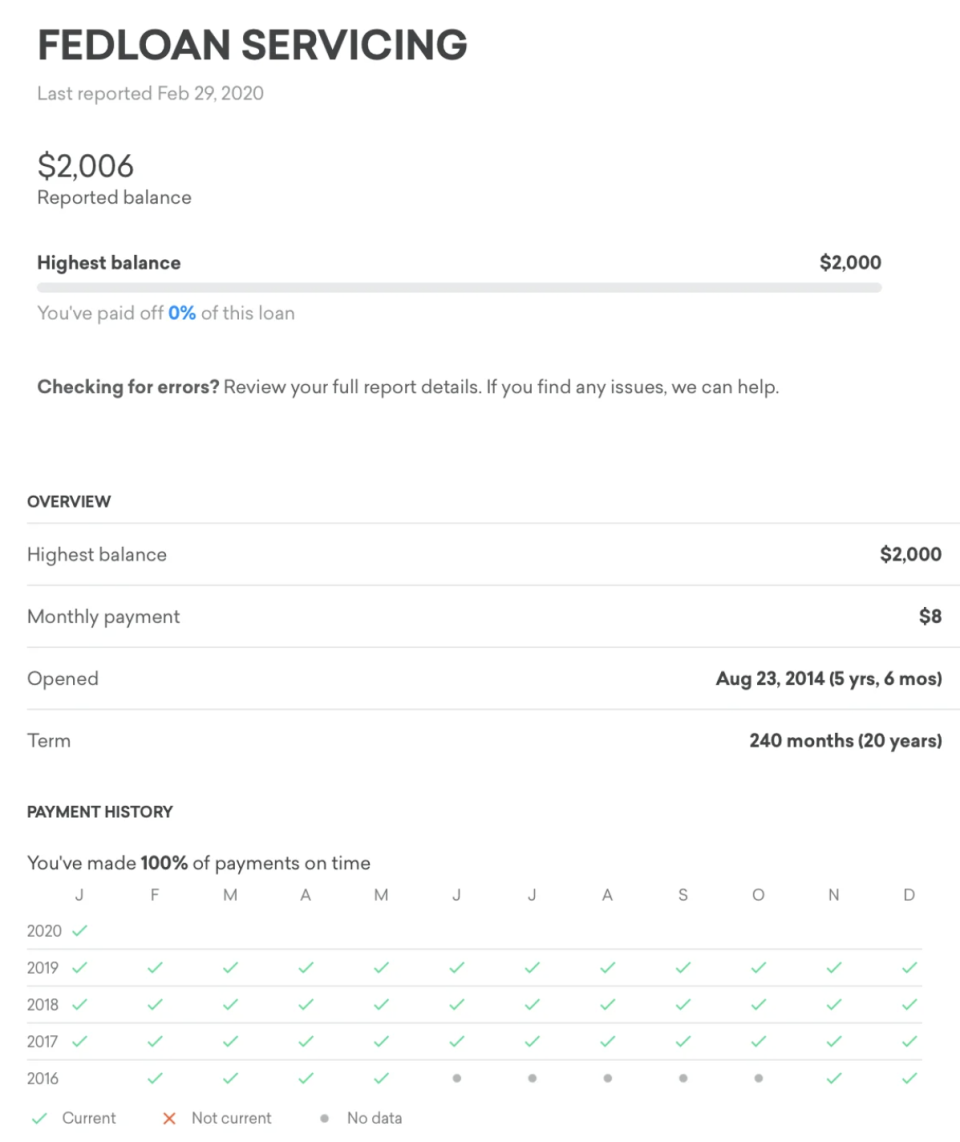

13.This person paid off their loans! It only took them 20 years. You know, like a quarter of their entire life.

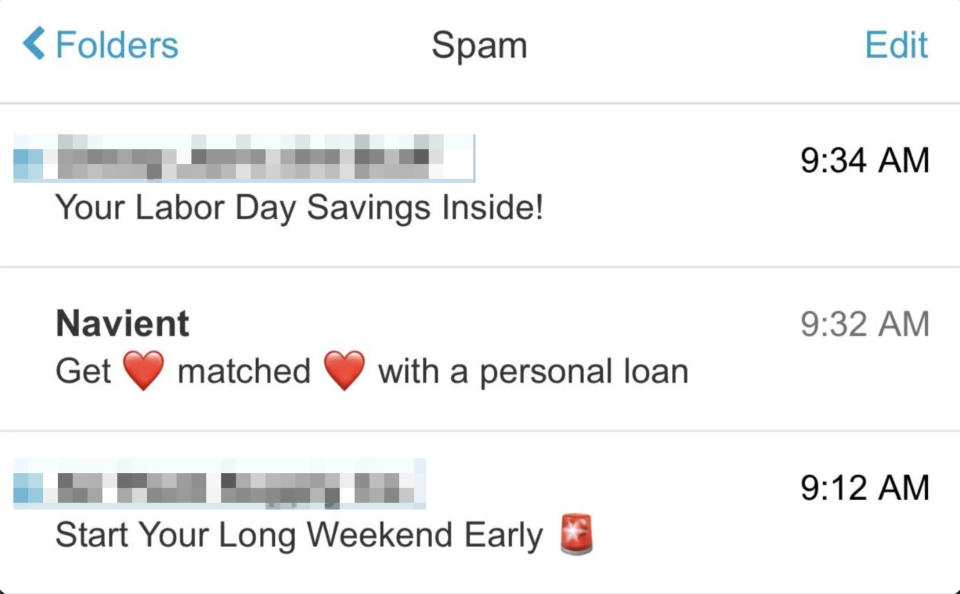

14.This person's student loan provider — to which they already owe over $100,000 — sent them a text with cute little hearts, offering them another loan.

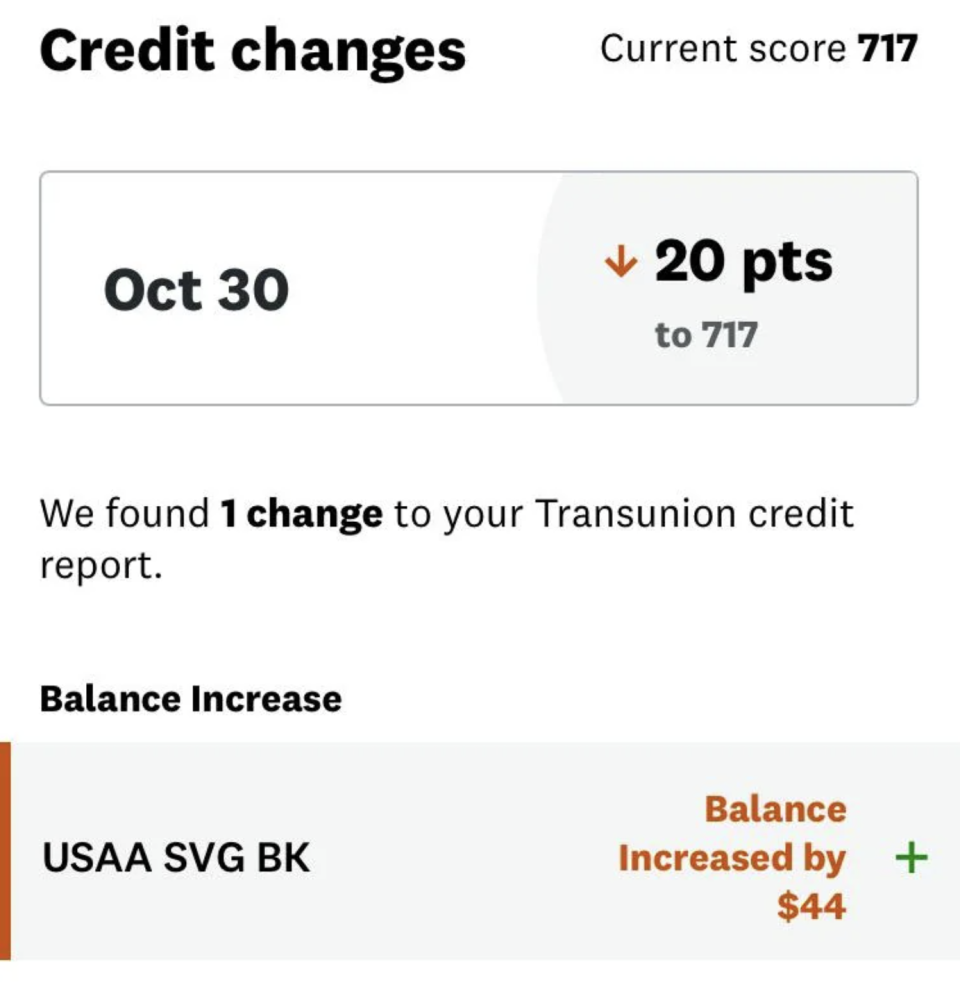

15.This person tried to charge a $44 dinner to their credit card, but their credit score went down because their student loan balance + the dinner made their credit usage too high.

16.After making 40 student loan payments, this person's balance went up $6.

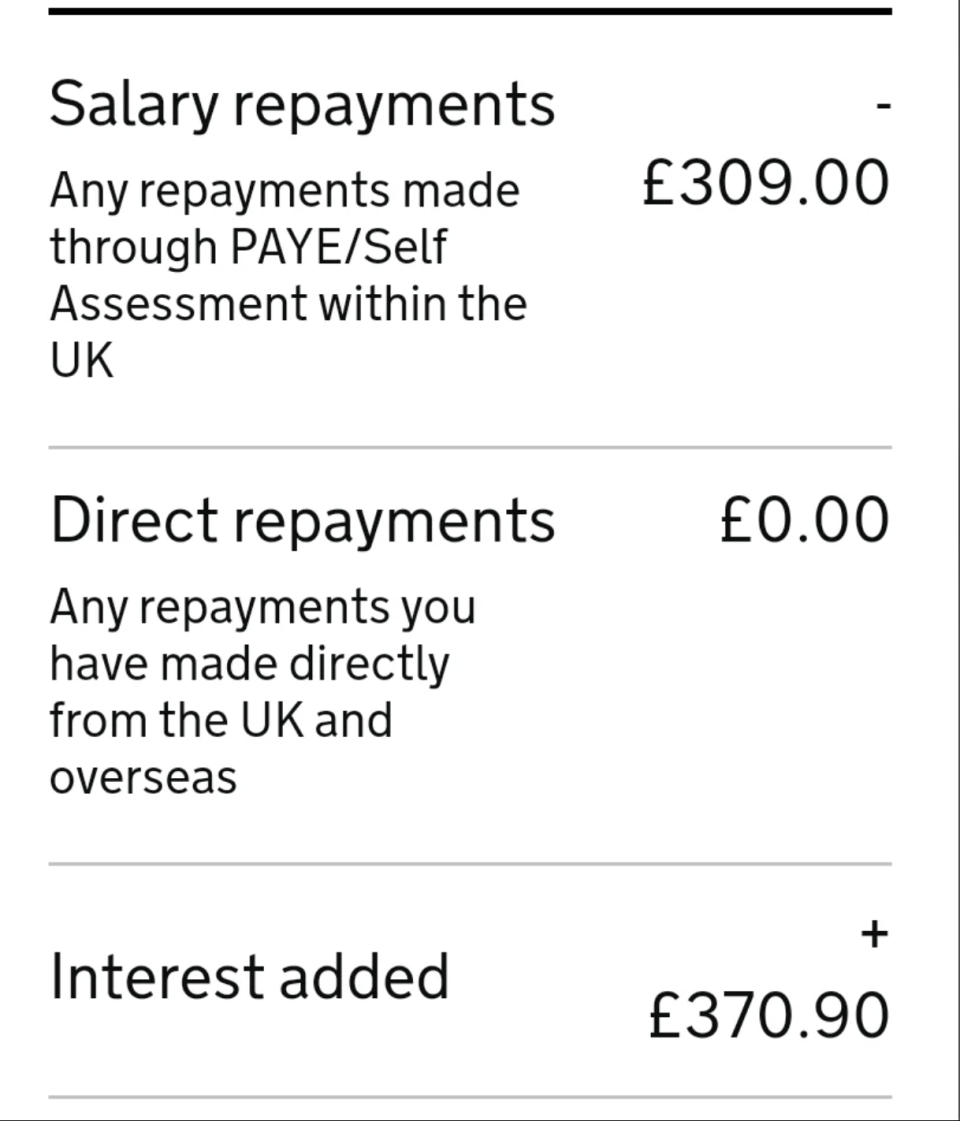

17.This person's interest goes up by about €370, despite their monthly payments being €309.

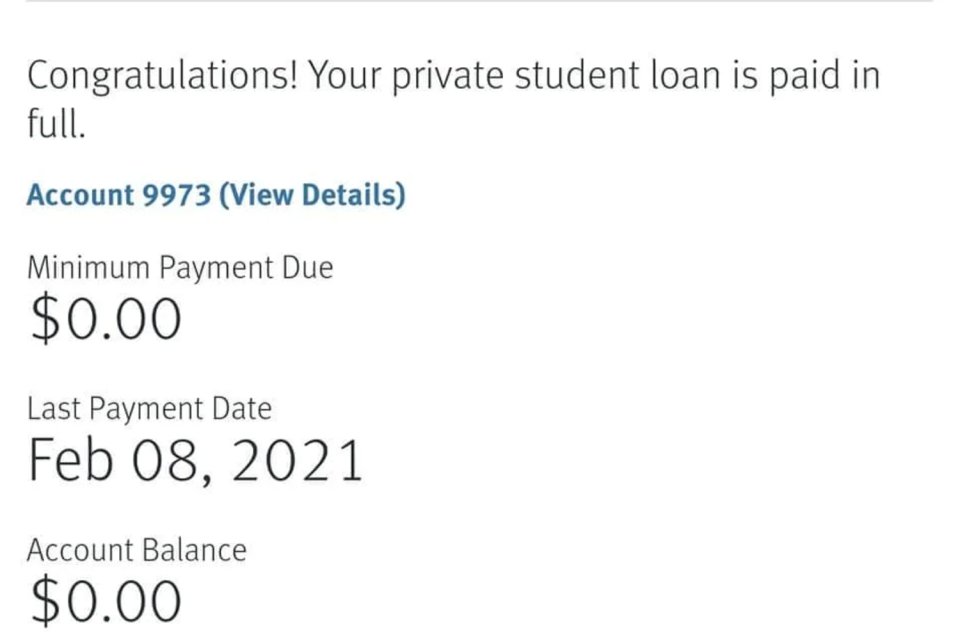

18.This person paid off their $14,547 student loan bill, and it's all thanks to the settlement money they received following a car accident. "I am sobbing with relief and gratitude," they said.

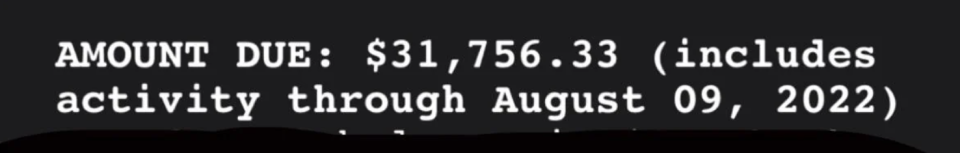

19.This is one semester's tuition at some poor soul's university:

20.Oh look, another credit score drop — the price of being student loan-free.

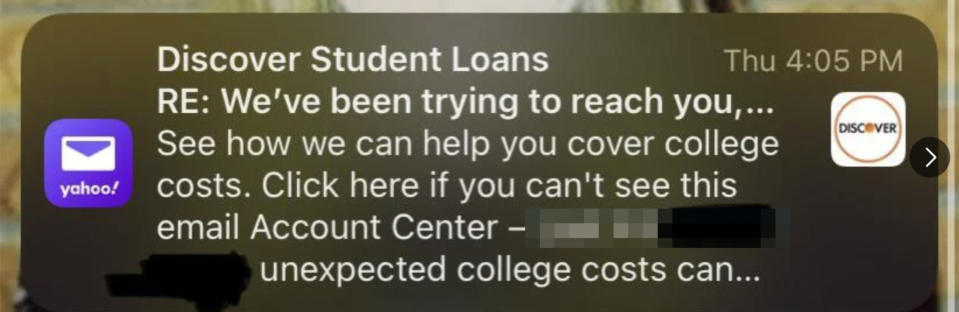

21.This loan servicer sent an ominous "We've been trying to reach you" email to someone they want to continue borrowing from them.

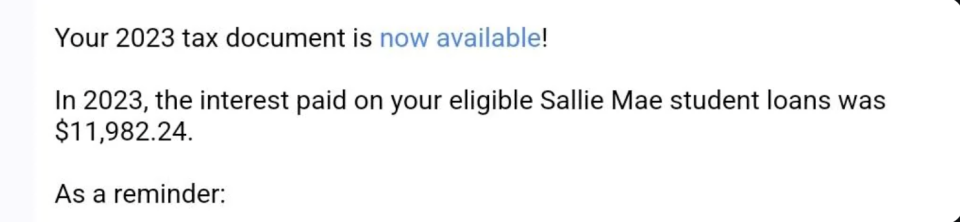

22.And finally, this person paid nearly $12,000 toward interest alone in a single year. Yay!

What are your thoughts? Let us know in the comments.

Yahoo Finance

Yahoo Finance