PayPal (NASDAQ:PYPL) is still Optimistically Valued after recent price Weakness

This article originally appeared on Simply Wall St News.

Yesterday, PayPal Holdings, Inc. ( NASDAQ:PYPL ) responded to last week’s rumors of a potential acquisition of Pinterest with a one-line press release . The press release simply stated: ‘In response to market rumors regarding a potential acquisition of Pinterest by PayPal, PayPal stated that it is not pursuing an acquisition of Pinterest at this time.’ While this statement doesn’t rule out a deal in the future, it certainly means there will not be a deal any time soon.

Last week the share price fell as much as 11% as a result of the rumor. Yesterday it recovered some of those losses, but it remains 20% below the all-time high of $310. This is a significant correction for a stock that is up more than 500% over the last five years and it's worth considering the potential opportunity PayPal now offers.

What is PayPal Holdings worth?

Our analysis of PayPal includes an estimate of its fair value which works out to $244 - just 1.6% below the current price. This estimate is based on the average cash flow forecasts from 13 analysts - so it will change as these forecasts change.

To get a sense of the current valuation in relative terms we can consider the price-to-earnings (or "P/E") ratio, which is 58x. This is a lot higher than the equity market (18X) and the American IT Industry (35.1x). PayPal’s P/E ratio implies that investors are still very optimistic about the company’s growth compared to the market. This means that if growth doesn’t outpace the broader market, the stock might not be able to maintain such a high price multiple.

What kind of growth will PayPal Holdings generate?

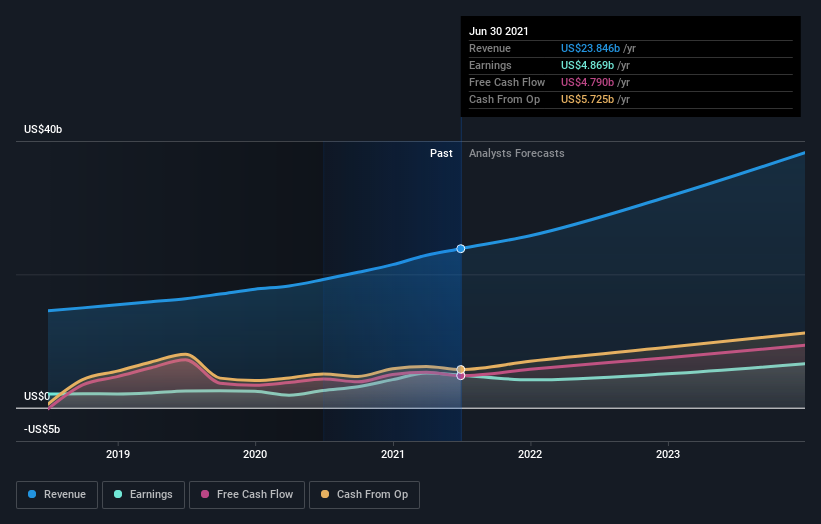

Considering PayPal’s historical and likely future growth, gives some perspective to the current valuation. Between 2013 and 2019, revenue growth ranged between 15 and 20%. In the last 18 months, this growth has accelerated to 24%, and even reached 30.6% in the first quarter this year - before dropping back to 18% in the second quarter.

In addition to the recent acceleration in revenue growth, PayPal’s profit margin has also widened over the last year, which results in net income growth of 88.5%.

Analysts now expect earnings growth of 20 to 25% over the next few years on revenue growth of 20 to 22%.

What does this mean for Investors?

PayPal is arguably the world’s leading fintech company, and its future remains bright. But there is a limit to the valuation it can trade on, and investors now have a expanding list of rapidly growing, smaller fintech companies to choose from.

Despite the 20% correction, the current valuation implies investors are still expecting significant outperformance. This may become a problem if the company cannot maintain the current trajectory or if margins revert to per-2020 levels.

The next set of quarterly results will be announced on the 8th November, and analysts are expecting revenue of $6.2 billion and EPS of $1.08. To maintain investor confidence, the company really needs to match or beat these numbers. Future guidance will also be key when these results are released.

Our full PayPal analysis includes the valuation and growth forecasts - the data is updated daily and any changes to analyst forecasts will be reflected soon after they are made.

If you are no longer interested in PayPal Holdings, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance