Palo Alto Networks (PANW) Closes CloudGenix Buyout Deal

Palo Alto Networks PANW recently announced that it has completed the acquisition of CloudGenix, a software-defined wide area network (SD-WAN) provider. Notably, on Mar 31, Palo Alto Networks had announced entering into a deal to acquire CloudGenix for a total cash consideration of approximately $420 million.

Palo Alto Networks’ latest acquisition is well timed amid the coronavirus-led global lockdown, which has spurred the necessity of remote working. Due to the global quarantine situation, organizations are moving to cloud so that their employees can work from home uninterruptedly.

However, the transition of workload to the cloud has several concerns, security being the most important. In the current environment, where a massive global workforce is compelled to work remotely, the security risk multiplies several times.

Here, with the CloudGenix solution, organizations will be shielded from security threats caused by traffic entering their servers from multiple unknown devices. Founded in 2013, CloudGenix helps its clients manage and secure network traffic at branches or distributed locations.

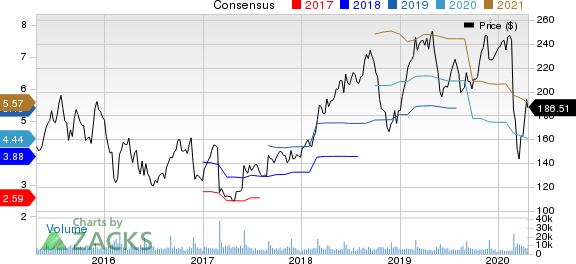

Palo Alto Networks, Inc. Price and Consensus

Palo Alto Networks, Inc. price-consensus-chart | Palo Alto Networks, Inc. Quote

Palo Alto Networks, which offers network security solutions to enterprises, service providers and government entities worldwide, aims at bolstering its cloud-security offerings with this acquisition. CloudGenix will help Palo Alto Networks expand its market share in the SD-WAN space, where Cisco CSCO is the current leader.

CloudGenix will be integrated into Palo Alto’s PrismaAccess cloud security platform, enabling the latter to add end-to-end serverless application security to its capabilities.

Palo Alto Networks’ strategy of making acquisitions to boost growth is long documented. Since 2017, the firm has spent nearly $2 billion for buying several small companies, specializing in a particular aspect of security. Last year, the company acquired five companies, including Demisto and Twistlock.

These buyouts have helped the company expand its product portfolio and customer base, thereby bringing in incremental revenues. Notably, the company has registered stellar double-digit revenue growth in the trailing five years.

To remain competitive, companies in the security space acquire businesses to enhance their capabilities. Palo Alto Networks’ close competitor Cisco has acquired seven companies in 2019, including the $2.6-billion buyout of Acacia.

Last year, Fortinet FTNT bought two companies — CyberSponse and enSilo — for an undisclosed amount. Another competitor, FireEye FEYE, acquired a cloud security company — Cloudvisory — for an undisclosed amount this January. Moreover, the company purchased Verodin last May in a cash-and-stock deal worth roughly $250 million.

Palo Alto Networks currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report

FireEye, Inc. (FEYE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance