S&P 500 Technical Analysis: Down Move Set to Resume?

DailyFX.com -

Talking Points:

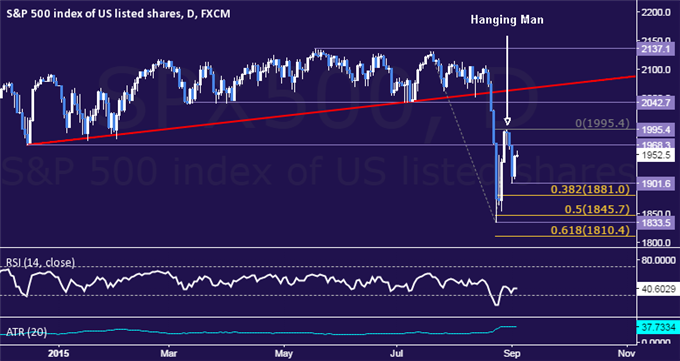

S&P 500 Recovery Falters Below 2000 Figure, as Expected

Prices in Digestion Mode, Overall Positioning Favors Weakness

The S&P 500 is in consolidation mode after turning lower as expected following the appearance of a Hanging Man candlestick. Prices launched a sharp recovery having found support after spiking down to 10-month lows above the 1800 figure. The move higher would prove short-lived however, with sellers swiftly regaining control below the 2000 threshold.

From here, a push below near-term support at 1901.60 marked by the September 1 low exposes the 38.2% Fibonacci expansion at 1881.00. The first key boundary on the topside sits at 1968.30, the December 16 2014 low now recast as resistance. A move above this barrier opens the door for another challenge of the August 28 high at 1995.40.

KEY UPCOMING EVENT RISK:

03 SEP 2015, 11:45 GMT – ECB Interest Rate Decision – Expected: 0.05%, Prev: 0.05%

03 SEP 2015, 12:30 GMT – ECB President Mario Draghi Holds Press Conference

04 SEP 2015, 12:30 GMT – US Nonfarm Payrolls (AUG) – Expected: 220K, Prev: 215K

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance