S&P 500 Achieves a New Milestone: 5 Non-Tech Picks

U.S. stock markets have maintained their northbound journey in the first quarter of 2024 after an impressive 2023. After that, Wall Street melted in April, only to regain momentum in May. April is generally known to be favorable to investors. However, this year’s April was a disappointing one. Similarly, the adage — “Sell in May and go away” — is unlikely to prevail this year.

Year to date, the three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — have rallied 5.8%, 11.9% and 13.4%, respectively. Month to date, the Dow, the S&P 500 and the Nasdaq Composite are up 5.5%, 5.4% and 6.9%, respectively.

On May 15, Wall Street’s broad-market index – the S&P 500 – achieved a milestone breaching the key technical barrier of 5,300 for the first time in history. The index registered an all-time high of 5,311.76 and a record closing high of 5,308.15.

Aside from the S&P 500, the Dow and the Nasdaq Composite also posted record closing highs of 39,908 and 16,742.39, respectively, on May 15. So far in 2024, the S&P 500 has posted 24 record closing highs, while the Dow and the Nasdaq Composite have seen 18 and eight record closing highs. On May 16, the Dow crossed the crucial psychological barrier of 40,000 briefly for the first time in history, before retreating a little bit.

Meanwhile, the S&P 500 rally of the past 15 months was primarily driven by a massive euphoria on the global adoption of artificial intelligence (AI), especially generative AI. Several AI-centric stocks have skyrocketed in 2024.

Aside from tech giants, various non-tech stocks of the S&P 500 Index have popped year to date. Investment in these stocks with a favorable Zacks Rank should be prudent in the near future.

Our Top Picks

We have narrowed our search to five U.S. large-cap (market capital > $10 billion) stocks that have provided more than 25% returns year to date with more upside left. Moreover, these stocks have seen positive earnings estimate revisions in the last 30 days. Finally, each of our picks sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

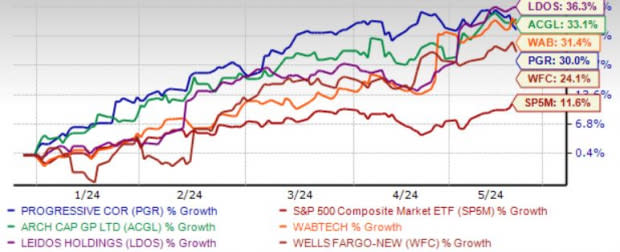

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

The Progressive Corp. PGR continues to gain on higher premiums, given its compelling product portfolio, leadership position and strength in both Vehicle and Property businesses. Focus on becoming a one-stop insurance destination, catering to customers opting for a combination of home and auto insurance, augurs well for PGR’s growth.

Policies in force and retention ratio should remain healthy. Competitive pricing to retain current customers and address customer needs with new offerings should continue to drive policy life expectancy.

The Progressive has an expected revenue and earnings growth rate of 18.2% and 84.8%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 7.6% over the last 30 days. The stock price of PGR has rallied 30% year to date.

Arch Capital Group Ltd. ACGL boasts a strong product portfolio and has a solid track of premium growth. Premiums should benefit from new business opportunities, rate increases, and growth in existing accounts and Australian single-premium mortgage insurance.

ACGL has also been diversifying its Mortgage Insurance business via strategic acquisitions that also complement the strength in the specialty insurance and reinsurance businesses. A solid capital position shields ACGL from market volatility. ACGL’s growing investment portfolio provides a meaningful tailwind to its bottom line.

Arch Capital Group has an expected revenue and earnings growth rate of 18.8% and 0.7%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.9% over the last seven days. The stock price of ACGL has surged 33.1% year to date.

Leidos Holdings Inc. LDOS has been benefiting from increased contract wins from the Pentagon and other U.S. allies. LDOS’ cost-effective defense solutions helped it to win major contracts. These contract wins led to a solid backlog of nearly $37 billion at the end of 2023, thereby substantially bolstering its revenue growth prospects.

The macroeconomic environment in the United States remains a major growth driver for LDOS. The company has also been growing inorganically through acquisitions. LDOS holds a solid solvency position.

Leidos Holdings has an expected revenue and earnings growth rate of 4.1% and 14.7%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 7.9% over the last 30 days. The stock price of LDOS has climbed 36.3% year to date.

Westinghouse Air Brake Technologies Corp. WAB continues to benefit from solid growth across its Freight and Transit segments. While the Freight segment benefits from growth in services and components, the Transit segment should gain from strong aftermarket and original equipment manufacturing sales.

For full-year 2024, WAB expects sales in the $10.05-$10.35 billion band. Adjusted earnings per share for 2024 are estimated between $6.50 and $6.90. Management anticipates strong cash flow generation, with operating cash flow conversion exceeding 90%. WAB’s pro-investor stance, which is evident from its announcements of a 17.6% dividend hike and a $1 billion share buyback authorization, looks encouraging.

Westinghouse Air Brake Technologies has an expected revenue and earnings growth rate of 6.5% and 21.1%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.1% over the last seven days. The stock price of WAB has climbed 31.4% year to date.

Wells Fargo & Co.’s WFC first-quarter 2024 results show improvement in non-interest income and a decline in provisions. Progress on efficiency initiatives, such as branch footprint reduction, will continue to support expense reduction and drive WFC’s bottom line.

A decent deposit balance will keep supporting WFC’s financials, given the strength in the consumer banking and lending segment and will aid its liquid profile. Additionally, WFC’s strong liquidity position will support its capital distribution activities.

Wells Fargo has an expected revenue and earnings growth rate of 2% and 9.7%, respectively, for next year. The Zacks Consensus Estimate for next-year earnings has improved 1.7% over the last 30 days. The stock price of WFC has climbed 24.1% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

Arch Capital Group Ltd. (ACGL) : Free Stock Analysis Report

Westinghouse Air Brake Technologies Corporation (WAB) : Free Stock Analysis Report

Leidos Holdings, Inc. (LDOS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance