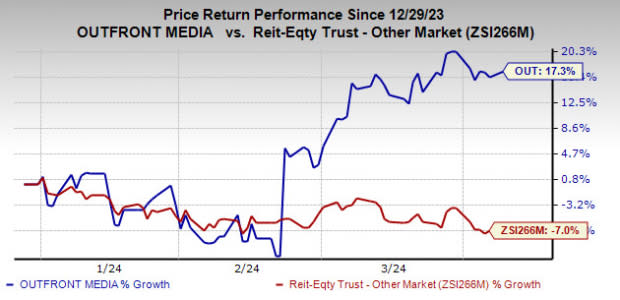

OUTFRONT Media (OUT) Soars 17.3% YTD: Will the Trend Last?

Shares of OUTFRONT Media OUT have soared 17.3% year to date against the industry’s decline of 7%.

This New York-based advertising real estate investment trust’s (REIT) diverse portfolio of advertising sites and large-scale presence, efforts to bolster its digital presence and strategic acquisitions over the years have enabled it to ride the growth curve so far.

Analysts seem bullish about this Zacks Rank #2 (Buy) company. The Zacks Consensus Estimate for its 2024 funds from operations (FFO) per share has moved marginally upward over the past month.

Image Source: Zacks Investment Research

Let us now find out the factors behind the surge in the stock price and check whether this trend will last.

OUTFRONT Media enjoys a geographically diverse portfolio of advertising sites, with a presence across 150 markets in the United States and Canada. The company’s large-scale presence paves the way for its clients to reach a national audience and provides the flexibility to tailor campaigns to specific regions or markets. This OOH advertising company provides communication and advertising services to several transit authorities.

The company caters to various industries, including professional services, healthcare/pharmaceuticals and retail. Hence, the company’s large-scale presence and diversified portfolio with respect to geography and industry make its revenues less volatile. We estimate the total revenues to increase 1.5% and 2% year-over-year in 2024 and 2025, respectively.

OUTFRONT Media is making efforts to convert its business from traditional static billboard advertising to digital displays and has made strategic investments in its digital billboard portfolio over the years. This has helped the company expand the number of new advertising relationships, providing scope to boost its digital revenues.

Its total digital billboard displays reached 2,191 at the end of 2023, increasing from 1,970 at the end of 2022. Also, in 2023, the company built or converted 84 new digital billboard displays in the United States and 45 in Canada.

It built, converted or replaced 5,624 digital transit and other displays in the United States and 23 in Canada during this period. Such efforts are likely to pay off well in the upcoming period, poising the company well for growth. We estimate a year-over-year increase of 1.5% in billboard revenues in 2024.

The company is leveraging out-of-home (OOH) advertising, which has a lower cost compared with other forms of media, to drive its performance. In the upcoming years, higher technology investments are expected to provide further support to OOH advertising. Capitalizing on this, the company is expanding its footprint and providing unique technology platforms to marketers in order to tap growth opportunities.

OUTFRONT Media is also focused on enhancing its portfolio quality via strategic acquisitions. In 2023, the company acquired several assets for around $33.7 million. Moreover, in 2022, it completed acquisitions worth $353.9 million. With such expansion efforts, it remains well-poised to grow over the long term.

Other Stocks to Consider

Some other top-ranked stocks from the broader REIT sector are Host Hotels & Resorts HST and Iron Mountain IRM, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for HST’s 2024 funds from operations (FFO) per share has been raised 2.6% northward over the past month to $1.97.

The consensus estimate for IRM’s current-year FFO per share has moved nearly 1% upward over the past month to $4.42.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Host Hotels & Resorts, Inc. (HST) : Free Stock Analysis Report

Iron Mountain Incorporated (IRM) : Free Stock Analysis Report

OUTFRONT Media Inc. (OUT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance