Otis Worldwide's (OTIS) Strategic Initiatives Aid Amid Cost Woes

Otis Worldwide Corporation OTIS is benefiting from solid Service segment performance thanks to strong repair volumes & maintenance pricing and strength of modernization. Also, strategic investments in research and development and digital initiatives, fostering its innovation capabilities, bode well.

The company introduced new product innovations in the first quarter of 2024 and will continue to collaborate with dealers, agents and distributors to expand sales channels and increase market share.

This Zacks Rank #3 (Hold) company’s earnings estimates for 2024 indicate a growth rate of 9.6% from the year-ago period on a 3.5% revenue improvement. Its earnings topped the Zacks Consensus Estimate in all the trailing four quarters, with the average surprise being 4.9%.

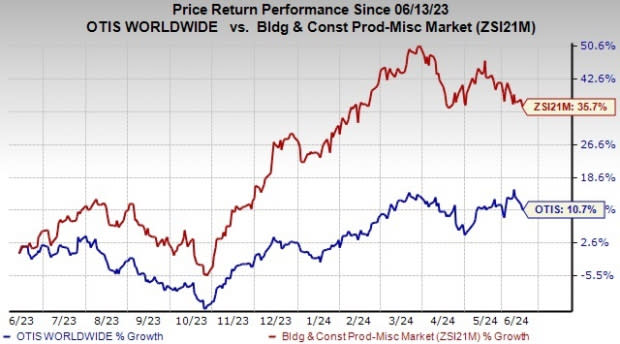

However, the aforementioned tailwinds are partially offset by headwinds in the form of high costs and expenses, along with the high concentration of the company’s business in the international market. Shares of this leading elevator and escalator manufacturing, installation and service company have gained 10.7% in the past year compared with the Zacks Building Products - Miscellaneous industry’s 35.7% growth.

Image Source: Zacks Investment Research

Let us discuss the factors highlighting why investors should retain the stock for now.

What Makes the Stock Appealing

Strong Repair Volumes & Maintenance Pricing: OTIS observes continued strength in maintenance and repair operations. During the first quarter of 2024, the Service unit’s net sales rose 5.8% year over year to $2.16 billion. OTIS reported a 5.8% year-over-year increase in maintenance and repair, driven by portfolio growth and strong repair volumes and maintenance pricing (excluding the impact of mix and churn).

The company has excelled in enhancing productivity, particularly in field operations and driving repairs, effectively reducing the repair backlog, especially in the Americas. For 2024, OTIS expects organic sales to grow between 6% and 7%, in line with previous guidance, including maintenance and repair, with a range of 5.5% to 6.5%.

Solid Modernization Backlog: In the first quarter of 2024, modernization orders were up 12.9% at constant currency, thereby giving a boost to the backlog. Modernization backlog at constant currency increased 15% year over year. The robust performance of the Service business, bolstered by the implementation of a modernization strategy, coupled with productivity initiatives and the uplift program, surpassed the challenges posed by the sluggish New Equipment markets.

For modernization, OTIS foresees organic sales growth between 8% and 9% in 2024, showing an increase from the prior estimate of about 8%, as the company continues to execute on its expanding backlog.

Stable Balance Sheet: Otis has been maintaining a strong liquidity position to navigate through the current environment. The company has been maintaining a strong liquidity position to navigate through the current environment. At first-quarter 2024-end, the company had $884 million in cash and cash equivalents (down from $1.27 billion at 2023-end) along with a $1.5-billion unsecured, unsubordinated five-year revolving credit facility.

At March 2024-end, its long-term debt totaled $6.85 billion, down from $6.87 billion at 2023-end. Although the cash balance has decreased, it has sufficient liquidity level to meet its short-term obligations of $35 million.

Factors Affecting Growth Prospects

High Costs: OTIS faces extensive research and development costs for elevators, escalators and related equipment. Inflation and higher input expenses may dampen overall performance. Although the technology's incremental cost is low, the real cost of installation continues to rise. The company's strong commitment to joint ventures leads to increased costs, putting pressure on margins.

The company does not rely on a single supplier. However, some components or applications require particular specifications or qualifications. In those cases, there may be a single supplier or a limited number of suppliers that can readily provide such components, which could result in supply constraints or cost pressures, including financial or operational difficulties or a contract dispute.

Currency Woes: Otis is exposed to fluctuations in foreign currency exchange rates, owing to international sales, purchases, investments and other transactions. In first-quarter 2024, foreign exchange reduced net sales by 1.2% year over year. For 2024, it expects headwinds from foreign exchange translation to impact sales.

Key Picks

Some better-ranked stocks in the Zacks Construction sector are:

Howmet Aerospace Inc. HWM currently sports a Zacks Rank #1 (Strong Buy). HWM has a trailing four-quarter earnings surprise of 8.5%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for HWM’s 2024 sales and EPS indicates a rise of 10.6% and 29.9%, respectively, from prior-year levels.

M-tron Industries, Inc. MPTI currently carries a Zacks Rank #2 (Buy). It has topped earnings estimates in three of the trailing four quarters and missed once, with an average surprise of 26.7%.

The Zacks Consensus Estimate for MPTI’s 2024 sales and earnings per share (EPS) indicates a rise of 8.8% and 58.6%, respectively, from prior-year levels.

Gates Industrial Corporation plc GTES presently carries a Zacks Rank #2. GTES has a trailing four-quarter earnings surprise of 14.9%, on average.

The Zacks Consensus Estimate for GTES’ 2024 sales indicates a 0.2% decline but EPS growth of 2.9% from the prior-year levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Gates Industrial Corporation PLC (GTES) : Free Stock Analysis Report

Howmet Aerospace Inc. (HWM) : Free Stock Analysis Report

Otis Worldwide Corporation (OTIS) : Free Stock Analysis Report

M-tron Industries, Inc. (MPTI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance