Oracle's (ORCL) Q2 Earnings: Cloud Business in Spotlight

Oracle ORCL is slated to report second-quarter fiscal 2022 results on Dec 9.

The company’s fiscal second-quarter performance is anticipated to have benefited from momentum in its cloud business driven by the robust uptake of the Oracle Cloud Infrastructure (OCI) services and Autonomous Database offerings.

Increased availability of Oracle cloud regions globally is expected to have strengthened its competitive position in the cloud computing market.

In October 2021, Oracle announced that it will open 14 new cloud regions across Europe, the Middle East, Asia Pacific, and Latin America to support its cloud services platform. Oracle expects to have 44 cloud regions by the end of 2022.

In November 2021, Oracle unveiled its first cloud region in France — Oracle Cloud Marseille Region. Following that, the company unveiled Oracle Cloud Singapore Region and also launched its second cloud region in the United Arab Emirates — Cloud Abu Dhabi Region. The company currently has 34 cloud regions in the world.

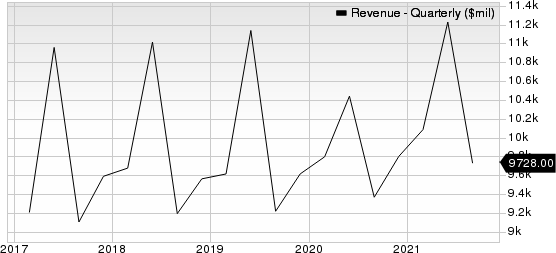

Oracle Corporation Revenue (Quarterly)

Oracle Corporation revenue-quarterly | Oracle Corporation Quote

Higher investments in product development, especially toward cloud platform, is likely to have limited margin expansion. Increasing competition from big and small players in the cloud domain might have acted as a headwind.

Click here to know what the company’s overall fiscal second-quarter performance is expected to be.

Momentum in Cloud Offerings to Drive Performance

Oracle’s cloud solutions, including OCI services and other cloud-based applications, are witnessing healthy adoption amid the continuation of remote work and hybrid work innovation.

Growing clientele is helping the company to maintain its leading position in the cloud domain. In the quarter under review, Oracle’s OCI services were leveraged by SoundHoud as the company accelerates its worldwide-expansion endeavors. OCI platform was also leveraged by Samsung Securities to migrate Derivative Analytics Business to cloud environment.

Oracle teamed up with India-based Bharti Airtel to extend its cloud-native offerings to more than a million enterprise clients, which includes big corporations, start-ups, governments and small and medium enterprises in the country. Oracle also rolled out OCI AI services, which are designed to aid developers in the easy implementation of AI services in applications.

The Zacks Consensus Estimate for Cloud services and license support revenues is pegged at $7.525 billion, indicating an improvement of 5.8% on a year-over-year basis.

Momentum in back-office cloud-based Fusion Human Capital Management (“HCM”) solutions along with NetSuite Enterprise Resource Planning (“ERP”) and Fusion ERP applications is expected to have favored the company’s quarterly performance.

The migration of several large-scale SAP clients to Oracle Fusion ERP cloud and increasing deal wins in several verticals, especially banking and healthcare, might have acted as a tailwind for the company’s ERP business.

NetSuite ERP and Fusion ERP cloud revenues were up 28% and 32%, respectively, in the first quarter of fiscal 2022.

Among deal wins in the Fusion Cloud space, Netherlands-based telecommunications service provider KPN leveraged Oracle Fusion Cloud Applications to revamp the company’s operations. Honda Motor implemented the Oracle Fusion Cloud ERP solution to streamline indirect purchasing activity and lower procurement costs for indirect materials.

Oracle’s latest Exadata Cloud@Customer service offering is gaining traction among on-premises customers. Also, autonomous database in Gen2 public cloud infrastructure is witnessing solid uptake.

The consensus estimate for Cloud license and on-premise license is pegged at $1.1 billion, indicating an improvement of 0.7% on a year-over-year basis.

Increasing clout of Oracle Fusion Cloud Supply Chain & Manufacturing (SCM) solution, integrated with new capabilities that help companies foster innovation and improve decision making, is expected to have contributed to the top line in the about-to-be-reported quarter.

IT Spend Visibility is a Concern

The coronavirus situation remains highly fluid. This uncertainty is likely to have kept IT spending across small- and medium-sized businesses under check. This might have had a negative impact on Oracle’s fiscal second-quarter top line.

The Zacks Consensus Estimate for fiscal second-quarter Hardware revenues is pegged at $814 million, suggesting a drop of 3.6% on a year-over-year basis. The consensus mark for Services revenues is at $787 million, indicating a rise of 4.7% on a year-over-year basis.

At present, Oracle carries a Zacks Rank #3 (Hold). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Strong Cloud Revenues for Major Players

Strong demand for cloud solutions amid the ongoing work-and-learn-from-home and accelerated digitalization trends has led to a great earnings season for cloud companies. Let’s take a quick look at the latest quarterly performance of the major cloud players — Amazon AMZN, Microsoft MSFT and Alphabet GOOGL.

Amazon reported third-quarter 2021 net sales of $110.81 billion, up 15% year over year driven by momentum in Amazon Web Services (“AWS”). AWS revenues (15% of sales) rose 39% year over year to $16.1 billion in the last reported quarter.

Microsoft’s first-quarter fiscal 2022 revenues of $45.3 billion increased 22% from the year-ago quarter’s levels (up 20% at constant currency or cc), driven by Azure cloud offerings. The top line surpassed the Zacks Consensus Estimate by 3.3%.

In the last reported quarter, Azure and other cloud services’ revenues surged 50% year over year (up 48% at cc). The upside was driven by robust growth in consumption-based businesses.

Alphabet’s third-quarter 2021 revenues of $65.1 billion increased 41% year over year (39% at cc). The figure rose 5.2% from the prior quarter’s levels.

Top-line performance was driven by the continued momentum across the company’s search, advertising and cloud businesses. Google Cloud revenues rose 44.9% year over year to $4.9 billion, contributing 7.7% to the quarterly revenues.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance