Option Care Health Inc (OPCH) Surpasses Analyst Revenue Forecasts in Q1 2024

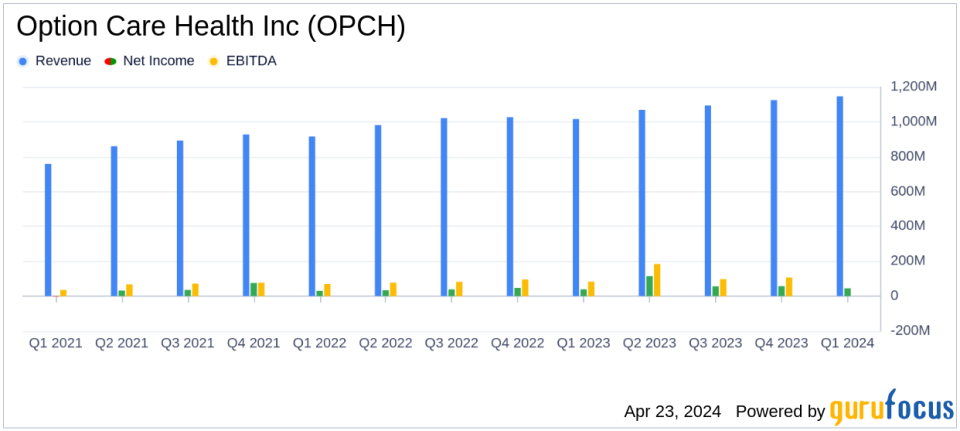

Revenue: Reported $1,146.1 million, up 12.8% year-over-year, surpassing estimates of $1,101.75 million.

Net Income: Reached $44.8 million, a 14.2% increase from the previous year, exceeding the estimated $41.87 million.

Earnings Per Share (EPS): Achieved $0.26, compared to $0.21 in the prior year, surpassing the estimated $0.23.

Gross Profit: Grew to $238.5 million, representing 20.8% of net revenue, though the gross margin percentage decreased from 22.5% last year.

Adjusted EBITDA: Increased by 4.8% to $98.3 million from $93.8 million in the previous year.

Cash Flow from Operations: Reported a negative $68.8 million, a significant shift from a positive $89.8 million in the prior year, primarily due to the Change Healthcare cybersecurity incident.

Stock Repurchases: Completed approximately $40.0 million in stock repurchases during the quarter.

On April 23, 2024, Option Care Health Inc (NASDAQ:OPCH), the nation's largest independent provider of home and alternate site infusion services, announced its financial results for the first quarter ended March 31, 2024. The company reported significant growth, with net revenue reaching $1,146.1 million, a 12.8% increase from $1,015.8 million in the same quarter of the previous year. This performance surpassed the analyst's revenue estimate of $1,101.75 million. Net income also saw a healthy rise to $44.8 million, or $0.26 per share, beating the estimated earnings per share of $0.23 and net income of $41.87 million. The detailed financial results can be accessed through OPCH's 8-K filing.

About Option Care Health

Option Care Health is at the forefront of providing innovative home and alternate-site infusion services across the United States. With a dedicated team of over 7,500, including more than 4,500 clinicians, OPCH offers specialized treatment for a variety of conditions such as bleeding disorders, neurological disorders, and chronic inflammatory disorders, ensuring high-quality care in the comfort of patients' homes or at convenient alternate sites.

Financial Highlights and Operational Challenges

The first quarter of 2024 not only showed a robust increase in revenue and net income but also highlighted a gross profit of $238.5 million, which is 20.8% of net revenue. Despite a slight decrease in gross margin percentage from 22.5% in the previous year, the increase in gross profit by 4.1% indicates strong pricing and operational efficiency. Adjusted EBITDA also improved to $98.3 million, up 4.8% from the prior year's $93.8 million, demonstrating effective cost management and operational leverage.

However, the quarter was not without its challenges. The company experienced a significant negative cash flow from operations amounting to $(68.8) million, primarily due to the Change Healthcare cybersecurity incident, contrasting sharply with the positive cash flow of $89.8 million in Q1 2023. This incident underscores the vulnerabilities in the healthcare sector to cyber threats, highlighting an area of potential improvement for OPCH.

Strategic Moves and Future Outlook

In response to its operational challenges and market opportunities, OPCH has actively managed its capital, evidenced by stock repurchases of approximately $40.0 million during the quarter. Looking forward, the company has updated its full-year 2024 guidance, expecting net revenue between $4.65 billion and $4.8 billion and an adjusted EBITDA of $430 million to $450 million. These projections reflect the company's confidence in its business model and growth trajectory despite external pressures.

CEO John C. Rademacher commented on the results and outlook, stating,

The Option Care Health team delivered solid financial results while navigating a disruptive environment. I am proud of the resilient enterprise we have built and the team's unwavering commitment to providing extraordinary patient care in the post-acute and ambulatory setting."

Conclusion

Option Care Health's Q1 2024 results not only surpassed analyst expectations in terms of revenue and earnings but also demonstrated the company's ability to navigate through operational challenges effectively. The strategic financial management and optimistic outlook for the rest of the year position OPCH well within the competitive landscape of healthcare providers and services, making it a noteworthy entity for investors and industry stakeholders alike.

For further details on OPCH's financial performance and strategic initiatives, interested parties are encouraged to access the replay of the earnings call and additional documents through the company's investor relations website.

Explore the complete 8-K earnings release (here) from Option Care Health Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance