The one trick that will save you $1,416 a year on household bills

People are losing hundreds or thousands of dollars simply by failing to cut themselves a good deal with their power, energy, mobile, or internet providers.

However, most Australians might not know that there’s a right time to strike in negotiating cheaper prices for themselves: when their contract is about to end.

“On average families spend $14,000 a year on mobile phones, car registration and insurances, electricity/gas and internet/streaming TV services,” said GetReminded app co-founder Silje Dreyer.

“This could be slashed by thousands of dollars a year by simply knowing when your service contracts expire – knowing what you are paying and how long for.”

For example, some Aussies are saving $433 on average per year on their electricity bills by switching providers when their contracts end, she said.

Others are receiving just one notice in the mail about their car insurance and registration, and by the time they get round to it, it’s too late to shop for a better deal.

“There are so many competitive offers it’s crazy people don’t shop around. Many just keep paying the same high rate and renew at the last minute,” Dreyer said.

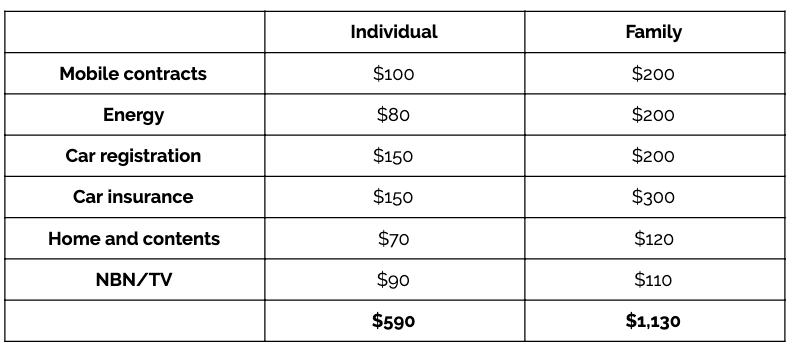

An individual spends $590 a month on their household expenses, whereas a family would fork out $1,130.

By shopping around with other providers, Aussies generally save 20 per cent on each of their providers.

In dollar terms, this means single Australians stand to save $118 a month, or $1,416 a year all up. Families can save $2,712.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Now read: UNVEILED: Australia’s 100 most-loved online retailers of 2019

Now read: The gender pay gap in Australia has hit a new record low

Now read: Woolworths to bring Disney magic to the supermarket war

Yahoo Finance

Yahoo Finance