Omega Healthcare Investors Inc (OHI) Q1 2024 Earnings: Surpasses Revenue Forecasts

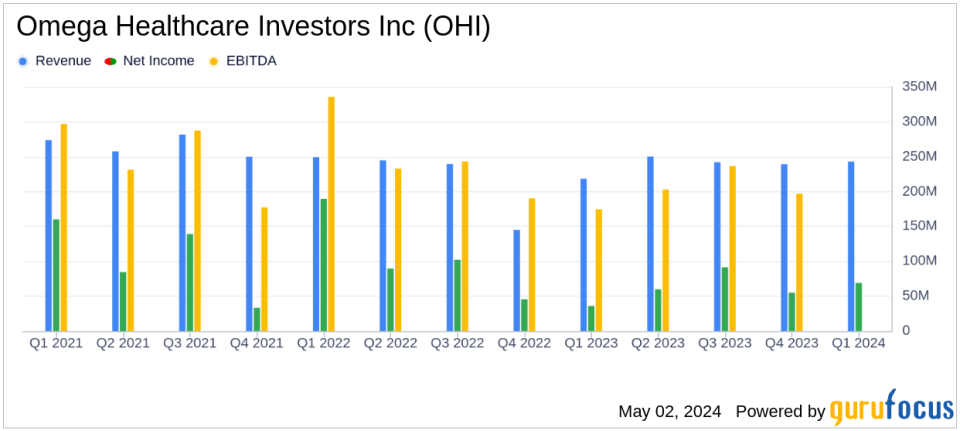

Revenue: Totalled $243.3 million for Q1 2024, up from $218.2 million in Q1 2023, surpassing estimates of $231.64 million.

Net Income: Reached $69.3 million, a significant increase from $36.8 million in the previous year, below estimates of $79.22 million.

Earnings Per Share (EPS): Reported at $0.27, below the estimated $0.32.

Dividends: Maintained a quarterly cash dividend of $0.67 per share, consistent with previous payments.

Investment Activity: Completed $240 million in new investments year-to-date, including significant acquisitions and real estate loans.

Debt Management: Repaid a $400 million debt maturity in April 2024, showcasing strong financial management and commitment to reducing liabilities.

2024 Guidance: Affirmed Adjusted FFO to be between $2.70 and $2.80 per diluted share, indicating stable future earnings expectations.

On May 2, 2024, Omega Healthcare Investors Inc (NYSE:OHI) released its 8-K filing, detailing the company's financial results for the first quarter ended March 31, 2024. Omega, a leading real estate investment trust (REIT) specializing in healthcare facilities, reported a robust increase in revenues and net income, surpassing analyst expectations for the quarter.

Company Overview

Omega Healthcare Investors Inc invests primarily in long-term healthcare facilities in the United States and the United Kingdom. The company's portfolio is diversified across skilled nursing facilities (SNFs), assisted living facilities (ALFs), and other specialty healthcare facilities, operated under triple-net lease agreements.

Financial Highlights

For Q1 2024, Omega reported revenues of $243.3 million, a notable increase from $218.2 million in the same quarter the previous year, and well above the estimated $231.64 million. This growth was primarily driven by the timing and impact of operator restructurings and transitions, along with revenue from new investments made throughout 2023 and 2024. Net income also saw a significant rise to $69.3 million, up from $36.8 million year-over-year, and surpassing the estimated $79.22 million.

Operational and Strategic Developments

During the quarter, Omega completed $240 million in new investments and repaid a $400 million debt maturity, showcasing strong financial management and strategic growth. The company's CEO, Taylor Pickett, highlighted improved operating fundamentals, with increased occupancy and reduced agency labor usage contributing to a standalone EBITDAR coverage of 1.42x. Despite challenges such as the new minimum staffing rule which may impact the industry, Omega's proactive management and solid acquisition pipeline position it well for future growth.

Challenges and Industry Impact

The recently announced minimum staffing rule has been pointed out by CEO Pickett as a potential burden on the industry. However, with most requirements starting in a few years, there is time to adjust to these new regulations. This proactive approach towards industry challenges underscores Omega's resilience and strategic foresight in navigating regulatory landscapes.

Investor Considerations

Omega's performance this quarter reflects its strong operational capabilities and strategic investment acumen, making it a noteworthy consideration for investors interested in healthcare REITs. The company's ability to exceed revenue expectations and manage significant debt repayments effectively demonstrates its robust financial health and operational efficiency.

Conclusion

With a solid start to 2024, Omega Healthcare Investors Inc continues to demonstrate its capability to navigate the complexities of the healthcare real estate market, backed by strategic investments and strong operational adjustments. As the company moves forward with its planned activities for the year, it remains well-positioned to sustain its growth trajectory and deliver value to its shareholders.

For detailed insights and further information, you can access the full earnings report and supplemental data on Omega's investor relations website.

Explore the complete 8-K earnings release (here) from Omega Healthcare Investors Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance