Is Omega Healthcare Investors a Buy?

Omega Healthcare Investors (NYSE: OHI) is a real estate investment trust (REIT) with a focus on healthcare. Unlike more diversified peers, however, Omega has chosen to largely specialize on owning nursing homes. Although the baby boomers who are currently entering their senior years are a huge opportunity for healthcare REITs in general, there are other things to consider with Omega before you jump aboard.

A quick overview

Omega owns healthcare properties that focus on providing housing for the elderly. About 18% of its portfolio is dedicated senior housing for residents with lower levels of medical needs. This includes things like assisted living and memory care facilities. The rest of the portfolio, about 82% of what the REIT owns, is focused on skilled nursing assets. These facilities provide 24-hour care generally after a patient is discharged from a hospital.

Image source: Getty Images.

The company's portfolio includes roughly 900 properties across 40 states and the United Kingdom. It leases these assets out to about 70 operators. Looking just at the nursing home assets, Omega is the biggest player in the space, owning twice as many nursing homes as its next closest REIT competitor. That said, management estimates that it has just a 5% market share, meaning there's still plenty of room for acquisition-led growth.

Omega's occupancy was 82.8% at the end of 2018. That sounds like a bad number considering that other REIT sectors often have occupancy levels of 90% or more. However, it's really not bad for a nursing home REIT and, perhaps more important, it's actually an improvement: In 2015, occupancy dipped to 81.9%.

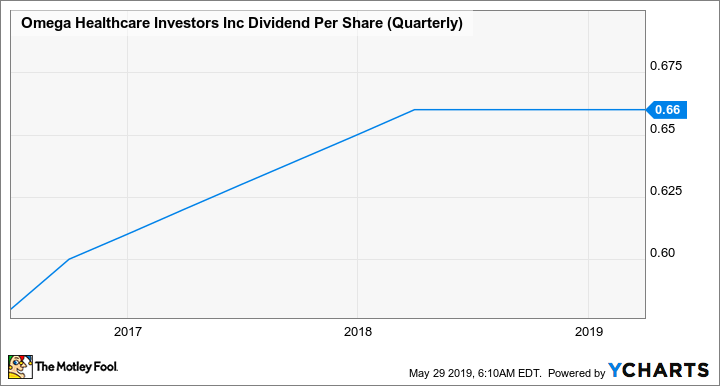

As for dividends, Omega offers investors a lofty 7.4% yield. The REIT's adjusted funds from operations (FFO) payout ratio was 86% in the first quarter, a solid figure. The dividend has been raised for 16 consecutive years, though it hasn't been increased in roughly six quarters. That pause is likely because taking a more stringent look at its payout ratio by using NAREIT's FFO standards (NAREIT is the primary industry association for REITs) brings the payout ratio to a more worrying 98.5% -- which is where the trouble starts.

Maybe nursing homes aren't so great

Although the company clearly prefers adjusted FFO, the number is inflated by adding back certain one-time costs that could easily be seen as material. For example, lease termination fees and stock-based compensation get included in adjusted FFO but excluded from NAREIT FFO. Termination fees could be a sign that properties are being vacated, while stock-based compensation seems like it would be considered a regular expense. There are other factors here, but the main takeaway is that Omega's payout ratio is perhaps not as robust as management would like investors to think it is.

OHI Dividend Per Share (Quarterly) data by YCharts.

Which leads to an even bigger problem: Omega's future isn't exactly in its own hands. The REIT notes that it generally has built-in rent escalators in its leases. The target is around 2.5%. So far, so good. However, the REIT's lessees generally have to live within structured payment schemes run by the U.S. government. Medicare and Medicaid account for 33% and 50% of the rent roll, respectively. Although Omega isn't beholden to the U.S. government, its tenants sure are. And these programs have long histories of financial issues.

Although hyperbole about the coming insolvency of such government programs is probably overkill, the fact is that federal and state governments will need to be careful about spending. And that, in turn, could lead to weak reimbursement rates for Omega's tenants. Rent coverage is currently around 1.3%, down from 1.4% in 2015. Not a dire statistic, but one to watch closely as the baby boomer generation increasingly needs nursing care.

The boomer demographic wave will likely boost occupancy levels, but it will also tax the payment systems that nursing homes rely on to pay Omega its rent. This dynamic is why some of the more diversified healthcare REITs -- notably Ventas (NYSE: VTR) and HCP (NYSE: HCP) -- jettisoned their nursing home properties a few years ago and started to add medical office and research space, which don't suffer from the same government pay headwind. Omega has basically taken the opposite course, using the concern in the nursing home sector to buy assets on the cheap. Doubling down only works, however, if the facilities it buys successfully navigate the industry conditions. If they don't, then even the low price Omega paid may turn out to be too much.

VTR Dividend Yield (TTM) data by YCharts.

Dividend coverage concerns mixed with the exposure to government payment plans should lead most conservative investors to nix Omega as an investment option. Yes, the 7%-plus yield is attractive considering that Ventas and HCP have yields around 5%, but the additional risks here aren't worth the extra yield unless you can stomach a notable amount of uncertainty.

Probably not a great choice

Omega's yield is very attractive but it comes with some notable risks. Most investors, and particularly those with a conservative bent, would likely be better off looking at a more diversified healthcare REIT. And while aggressive investors might be tempted to jump in here because of the high yield, the dual issues of dividend coverage and government pay exposure need to be watched very closely. Omega will likely never be a "set it and forget it" type of investment.

More From The Motley Fool

Reuben Gregg Brewer owns shares of Ventas. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance