Old Republic International Corp (ORI) Q1 2024 Earnings: Surpasses Analyst Revenue Forecasts

Net Income: $316.7M, significantly increased by 58.5% from $199.8M in Q1 2023, surpassing the estimated $181.4M.

Earnings Per Share (EPS): Reported at $1.15 per diluted share, up from $0.68 year-over-year, exceeding the estimate of $0.65.

Revenue: Total operating revenues reached $1,848.8M, up 6.7% from $1,732.4M in the previous year, slightly above the estimated $1,844.0M.

Combined Ratio: Increased to 94.3% from 92.7% last year, indicating a slight decrease in underwriting profitability.

Net Investment Income: Grew by 19.1% to $164.1M, driven by higher investment yields.

Book Value Per Share: Increased to $23.83, up 2.2% from $23.31 at the end of the previous year.

Shareholder Returns: Total capital returned to shareholders during the quarter was $264M, including dividends and share repurchases.

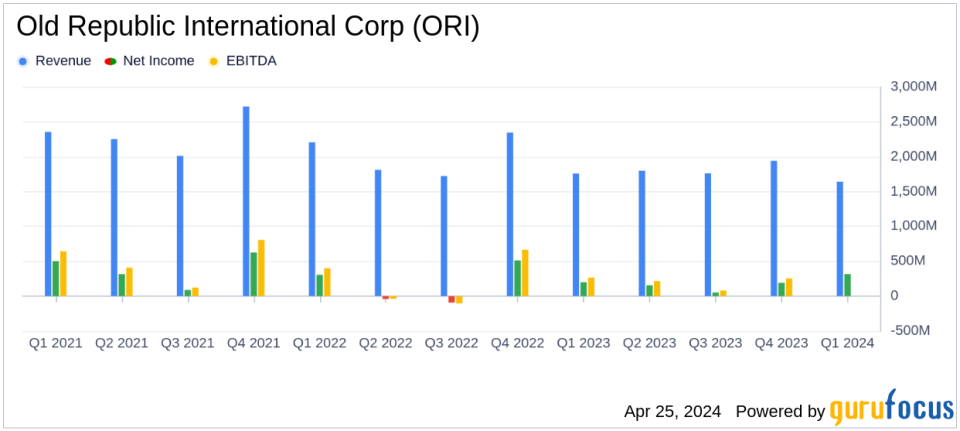

On April 25, 2024, Old Republic International Corp (NYSE:ORI) released its 8-K filing, revealing a robust financial performance for the first quarter of 2024. The company reported a significant increase in pretax income and net income, surpassing analyst expectations, particularly in revenue metrics.

Old Republic International Corp, a major player in the insurance industry, operates through segments including General Insurance, Title Insurance, and the Republic Financial Indemnity Group (RFIG) Run-off. The company's primary operations involve offering diverse insurance products across the United States, focusing on sectors such as automobile, aviation, and workers' compensation, among others.

Financial Highlights and Performance

The company's financial results for Q1 2024 were impressive, with a pretax income of $398.7 million, a substantial increase from $249.2 million in Q1 2023. This growth was driven by a notable rise in pretax investment gains, which surged to $167.1 million from $26.2 million in the previous year. Excluding these gains, the pretax income still showed a healthy increase of 3.9% year-over-year.

Net income also saw a significant rise, reaching $316.7 million compared to $199.8 million in the same quarter last year. This increase was bolstered by net of tax investment gains, which jumped to $132.0 million from $20.6 million. When excluding investment gains, net income grew by 3.1% to $184.7 million.

The diluted net operating income per share increased by 9.8%, standing at $0.67, which aligns closely with the analyst estimate of $0.65 per share for the quarter. Total operating revenues increased by 6.7% to $1,848.8 million, exceeding the estimated $1,844.0 million.

Operational Insights and Challenges

Old Republic's General Insurance segment experienced double-digit growth, particularly in net premiums and fees earned, which rose by 13.1% to $1,091.6 million. This growth was partially offset by a decline in the Title Insurance segment, where net premiums and fees earned decreased by 6.5%. The company's combined ratio deteriorated slightly to 94.3% from 92.7%, indicating increased claims and expenses relative to premiums.

The company also returned significant capital to shareholders, with $264 million distributed through dividends and share repurchases during the quarter. Additional capital returns continued post-quarter with $146 million in share repurchases.

Strategic Financial Management

Old Republic's management emphasizes long-term profitability and balance sheet strength, crucial for meeting insurance underwriting obligations. The focus on excluding investment gains from performance evaluation reflects a strategic approach to present a clearer picture of the operational efficiency.

The company's investment strategy, which avoids high-risk assets, supports stable funding for insurance claims and obligations, ensuring long-term capital stability. This conservative investment philosophy is reflected in the solid growth of book value per share, which increased by 2.2% to $23.83.

Outlook and Forward Guidance

Old Republic's management remains focused on long-term profitability rather than short-term fluctuations, aiming to provide stable returns over insurance and economic cycles. The company plans to continue leveraging its strong market position and diversified product range to navigate potential challenges in the insurance sector.

For detailed financial figures and future projections, interested parties can access the financial supplement on Old Republic's website and join the scheduled conference call to discuss these results further.

This comprehensive performance in Q1 2024 positions Old Republic International Corp as a resilient player in the insurance industry, capable of managing cyclical challenges while driving shareholder value through strategic operations and robust financial health.

Explore the complete 8-K earnings release (here) from Old Republic International Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance